11 tonne of gold remains undelivered on the August contract. Could be a naked short about to get fleeced.

August 15, 2024 3:00 PM

+++++++++++++ Gold

In my last note, before I departed for the Swiss alps a couple of weeks ago, I discussed how 21,300 contracts stood for delivery on the August contract which is 27% of registered stocks. Since then 379 net new contracts have been written which is less than the average of 1,270 at this point in the delivery period. See that on the plot below. Any dash for physical gold at comex remains on hold.

There is a supply distress signal though … after the first few days into the delivery period, issuance of delivery notices was typical however has since slowed considerably as you can see below.

As of this morning’s open (Aug 15) open interest was 3,573 contracts or 11.1 tonne. That’s not a record high at this point in the delivery period, but it is more than triple the average:

Usually at this point in the delivery period 99% of delivery notices have been issued, however for the August contract that fraction is 85%:

So what’s the delay mean? On some prior occasions, this delivery delay preceded bail outs where a short transfers his position to another player who then issues delivery notices using his registered metal. No doubt the naked short pays a fiat bonus to the rescuer otherwise why would the player with registered metal step in to save the naked short? That bonus will be paid off exchange and wouldn’t directly influence the market price.

Sometimes this could happen with no indication based on public data. However on some occasions I’ve been able to identify the rescuing party and in those occasions it has been BofA or Citi’s house accounts. This isn’t ever a certainty, but it is based on patterns … big banks rarely hold short positions late in the delivery period. So when deliveries are low to trend and then Citi or BofA suddenly issued delivery notices, it was likely a bail out.

The net of this is … a gold short of up to 11.1 tonne may be without metal with 2 weeks to last notice. We’ll see what happens. Personally, I like seeing naked shorts get their ass kicked.

++++++++++++++++++ Silver

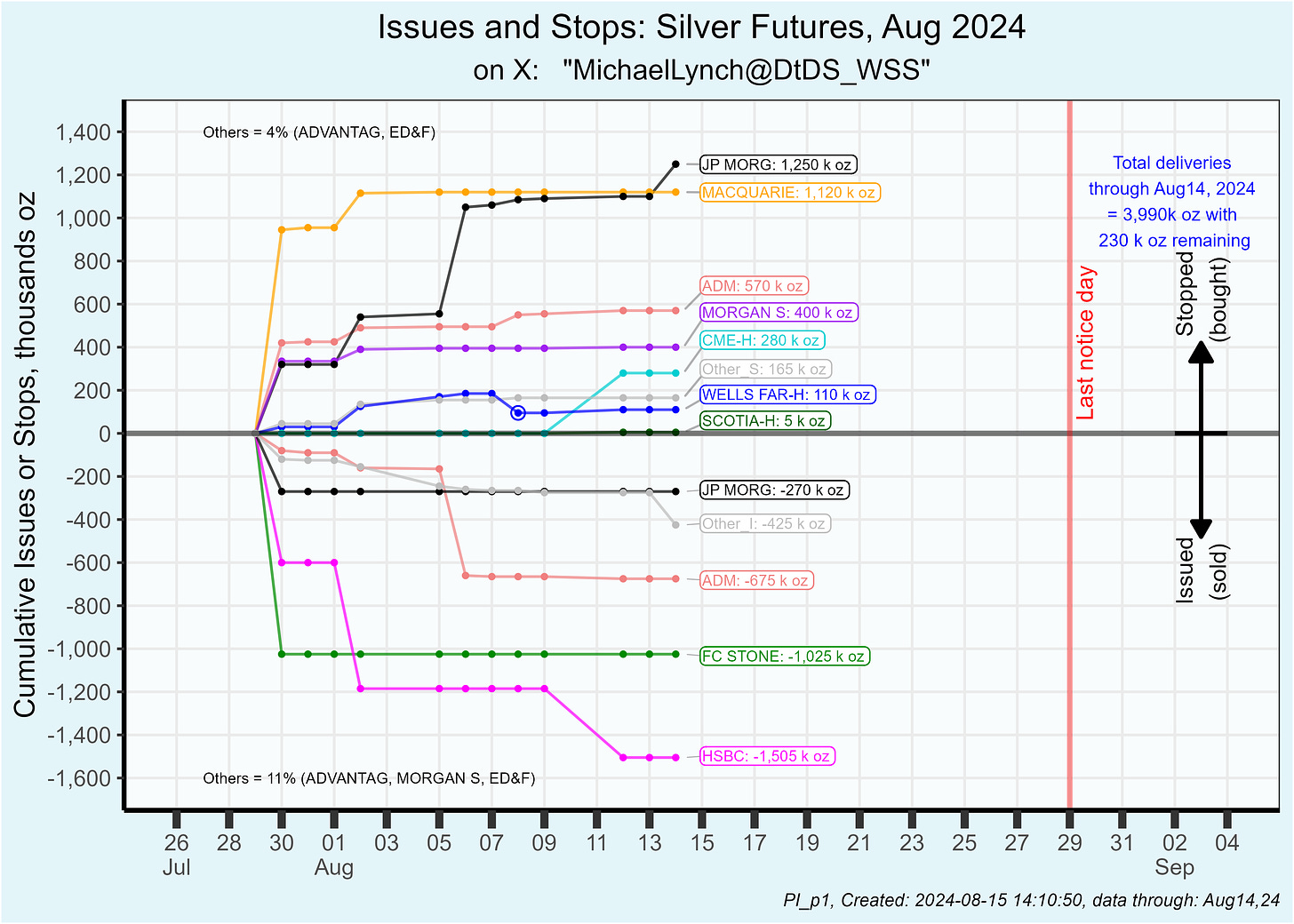

The HSBC “customer” account continues to dump silver and once again is the largest seller. The total silver sold by HSBC on the August contract (an inactive month) is 1.5 million oz:

That brings HSBC’s total silver sold since Dec 2023 to 42.4 million oz or 5.3 million oz per month. The average on the previous 4 inactive months was 2.0 million oz per month, so this August contract so far is a little less than average.

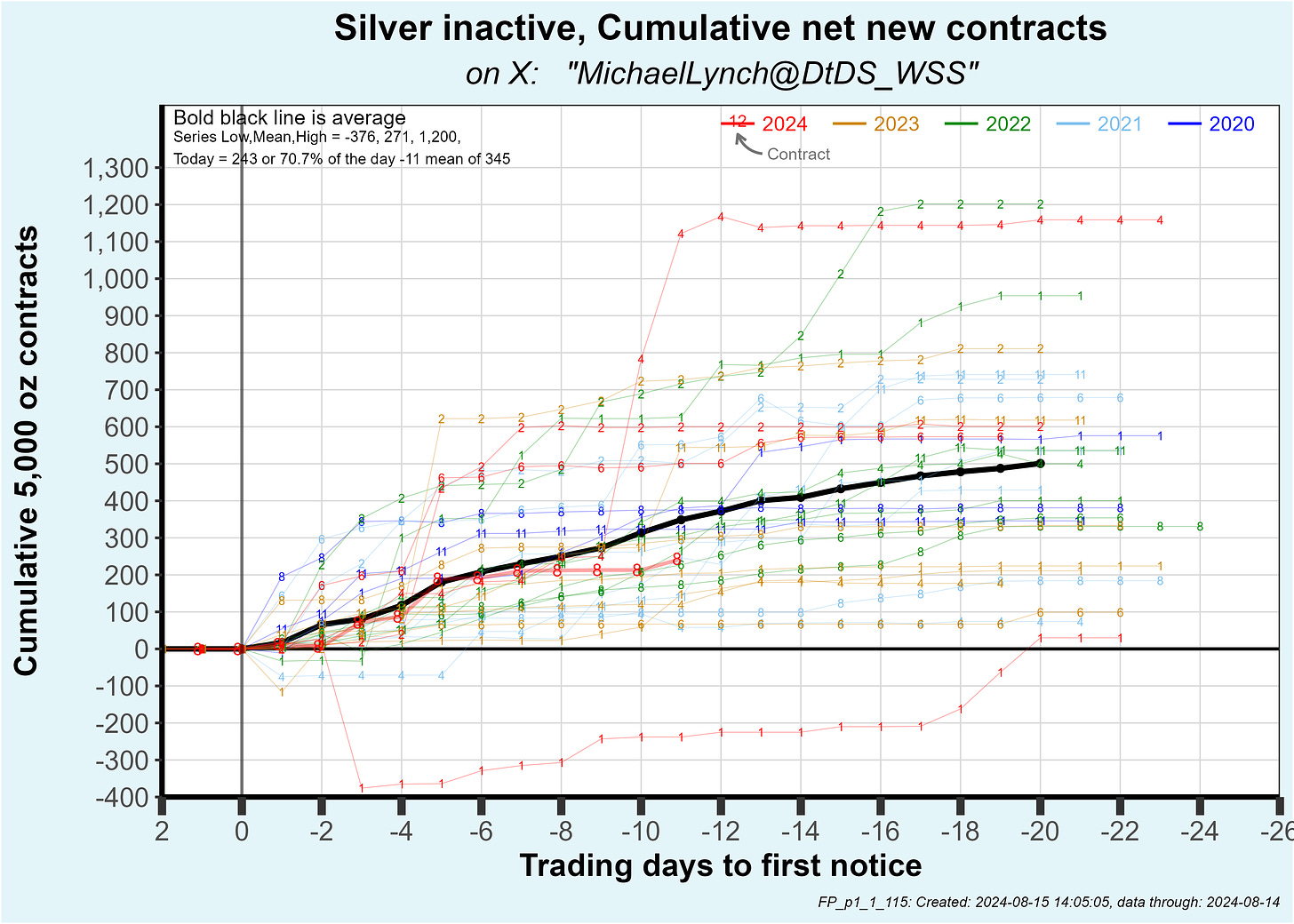

Net new contracts on the August contract are running about 30% below average. I suspect the recent market volatility has been suppressing activity:

That’s it for now. I’m still jet lagged.

Welcome back. Things have been quiet. Now that you are back, time for fireworks!