28.1 million oz stand for delivery on the May silver contract. HSBC issues 93% of the delivery notices?

A new endgame hypothesis emerges ...

++++++++++++++++++++ Silver

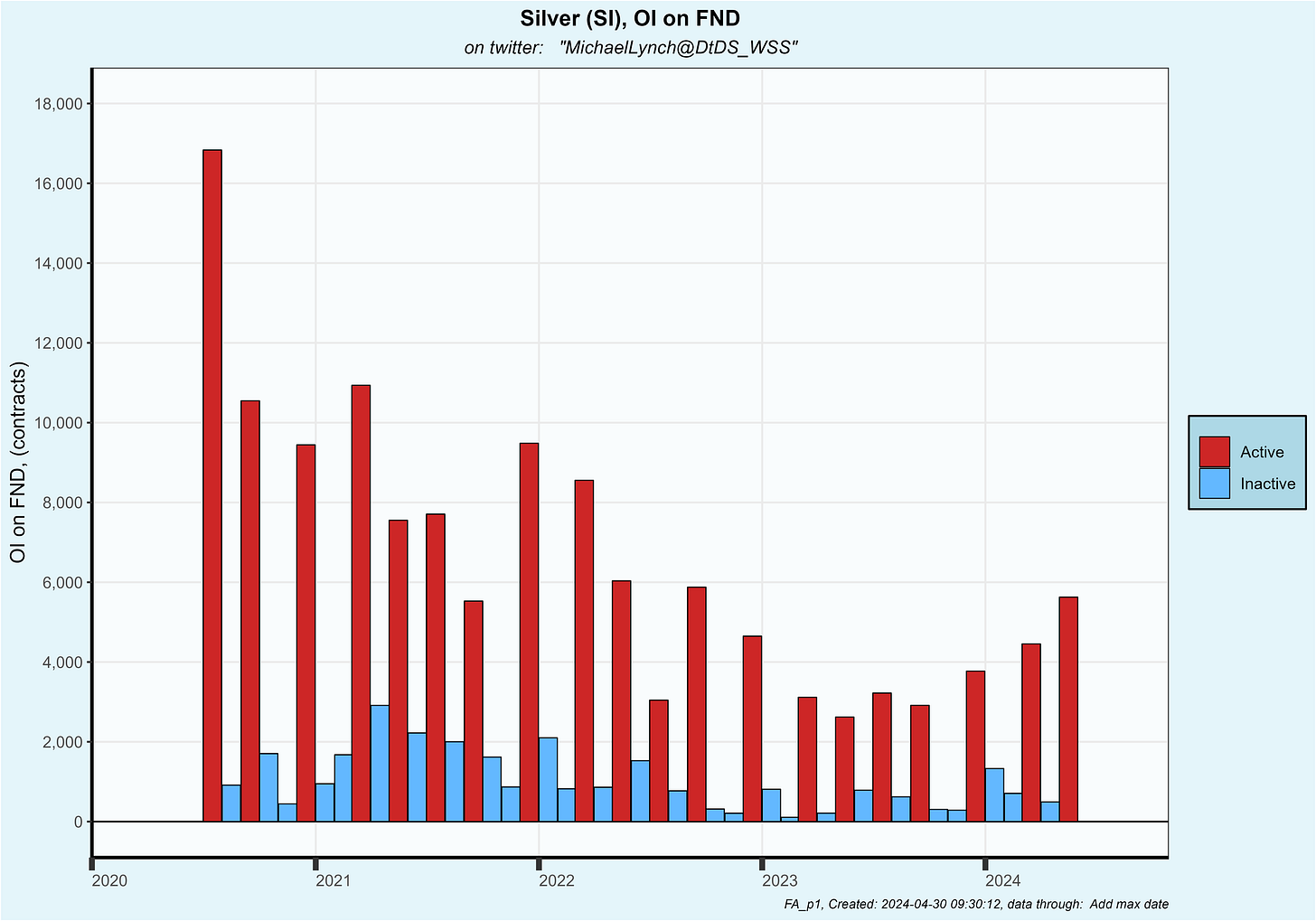

5,626 contracts (28.1 million oz) stood for delivery on the May silver contract. May is one of only 5 active month contracts each year. That is the 26% higher than the prior active month of March and the highest number standing for delivery since September 2022:

Yesterday there was a 6.1 million oz transfer from eligible to registered which increased registered silver to 51.4 million oz. Even after that increase, the contracts standing for delivery amount to 55% of registered.

The prior month contract of April (an inactive month) amounted to 16% of registered so the inference is that 71% of registered silver will flip ownership over these 2 contracts (April and May).

Furthermore, the last 2 contracts (March and April) both had over 1,000 net new contracts written during the delivery period. Those buys were driven by BofA who is absent from the first day Issues and Stops report. I’ll get to that in a minute. The point is … it’s possible BofA will buy silver during the delivery period.

Let’s count the chickens before they’ve hatched and assume that the 1,000 new contracts trend continued (see chart below). In that case another 9.7% of registered would transfer in May driving the 2 most recent contracts (April and May) ownership flip to 81% of registered.

There are players who only flip metal by buying and re-selling. Two examples of those players are Scotia Bank and Wells Fargo (both house accounts). If everybody just flipped metal this high of a transfer rate wouldn’t be a concern.

However much metal in the vault is owned by BofA (and others) who have been accumulating silver. Once they buy, the metal isn’t likely to be resold and, in fact, some is removed from comex vaults. My point is … not all of registered is owned by parties wishing to sell. This 71% to 81% transfer number is a good illustration of the tenuous situation in the silver market.

Moving on to the Issues and Stops report … delivery notices were issued for 2,514 contracts or 45% of the contracts standing for delivery which is only slightly less than average. In the past, a low issuance of delivery notices foretold the presence of a naked short.

That HSBC “customer” account I’ve been discussing for 5 months issued 1,338 delivery notices (6.7 million oz) which is a close enough match to the 6.1 million oz transferred to registered the same day. They likely already had the 0.6 million oz balance in registered. This is now 6 straight months where this HSBC account will be the dominant short. You gotta wonder what the silver market would be like without that seller.

The jolt to me was that HSBC’s house account (the bank itself) sold 998 contracts (5.0 million oz). That is one of the largest sales by HSBC’s house account in the post-QE Infinity period:

Together, the HSBC “customer” account and house account composed 93% of the delivery notices. Ho Lee Fk.

A long time back I suspected that this HSBC “customer” account was a ruse to obfuscate the true seller. That account has now dumped over 30 million oz over the last 6 months.

Recently I hypothesized that HSBC the bank (which also is called Hong Kong Shanghai Bank Corporation) may be trying to suppress prices at comex where world price is set, while accumulating even more metal elsewhere. That may be wild speculation, but if so … it could be the latter phase of the Chinese endgame.

Many analysts argue that the Chinese government has accumulated a huge stack of metal. Recently they encouraged their citizens to stack metal. Perhaps they are running cover so their citizens can accumulate the maximum kilo per yuan.

That may sound like wild conjecture, but if you make the assumption that BRICS intends to reprice gold and silver (not wild conjecture), you’d KNOW they would do a final grab in the period before the repricing … for themselves or their citizens. It isn’t much of a leap to think they’d suppress comex’s status as the price setter so metal can be bought elsewhere on the cheap.

Back to issues and stops … plot below. The largest buyer was JP Morgan customer accounts at 1,128 contracts followed by Scotia’s house at 408 and Wells Fargo at 392. BofA, as I mentioned, was absent from either side of the ledger.

+++++++++++++ Gold

I’ll cover the activity in gold on tomorrow’s report. It’s an inactive month and not as important as silver’s May contract.

Just a few notes though … an HSBC’s customer account sold 2 tonne of gold. HSBC’s house account was not present however, as a reminder, HSBC’s house account hasn’t bought one single oz of gold for 8 months and in the meantime have sold 22 tonne. Just sayin’.

+++++++++++++ More

When I get banned again on social media, you can still get this info if you subscribe:

And hsbc ceo axed. Connection?

HSBC provide custodial (vaulting) for the largest Silver ETF in the UK, PHAG. I have long suspected they rehypothecate this metal including shorting Comex while telling regulators they have "physical in storage" which is lies of course as the PHAG metal does not belong to HSBC. The regulators are corrupt to the core, likely following instructions from US govt/ESF/Fed. A good regulator would look at inflows to PHAG and cross reference with HSBC Comex activity for any correlation.