28.9 million oz stand for delivery on the July silver contract or 39% of the recently inflated registered stocks

HSBC continues operation "Differential Lag Theory"

+++++++++++++ Silver

5,772 contracts (28.9 million oz) stand for deliver on the July contract up 1% sequentially and 77% YoY.

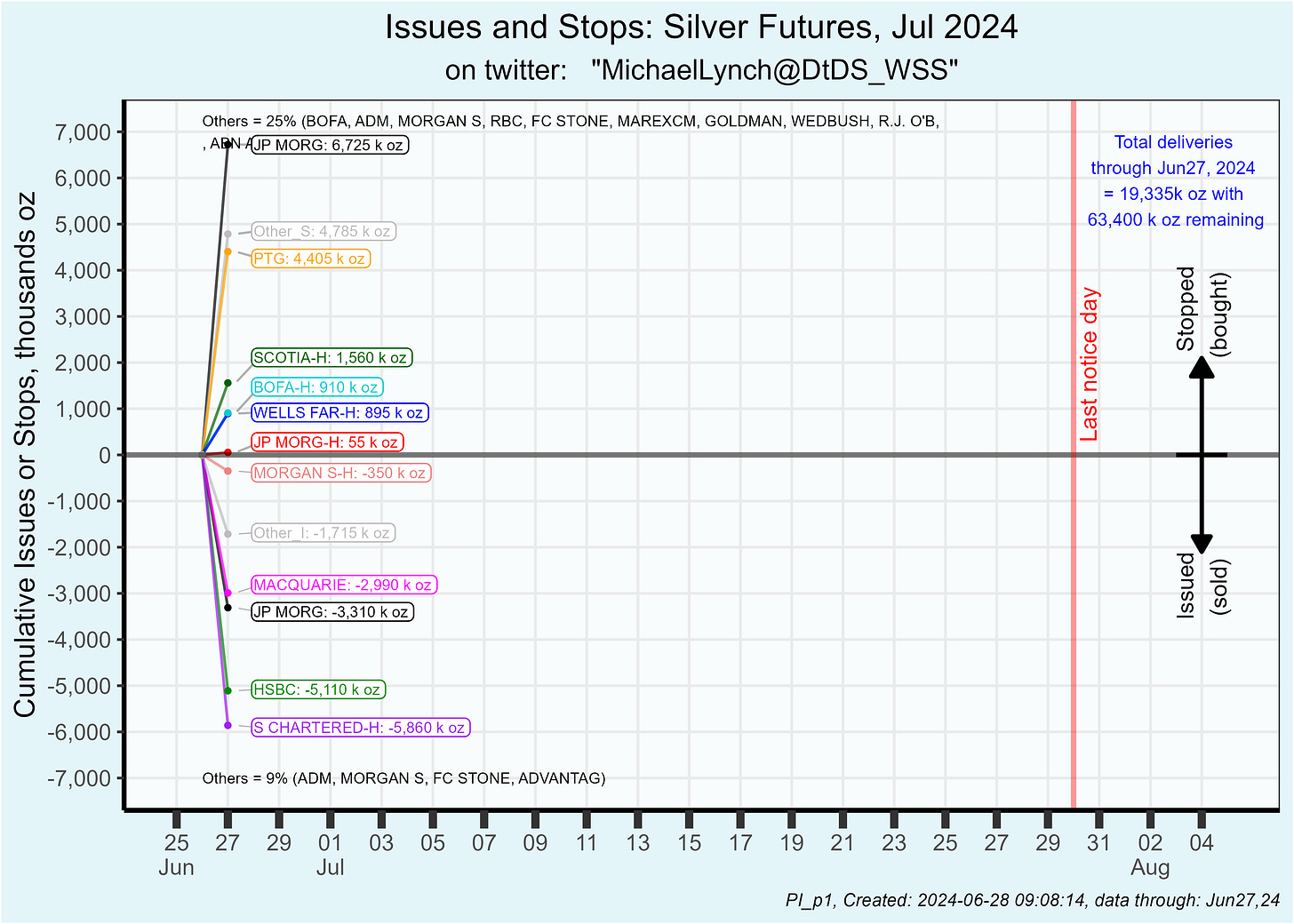

First day delivery notices were issued on 68% of the number of contracts standing for delivery. The first day issues and stops are summarized as follows:

The biggest buyer was JP Morgan customer accounts at 1,345 contracts (6.73 million oz) followed by relatively unknown “PTG DIVISION SG” customers at 881 contracts (4.41 million oz). That was uncharacteristically large for that account as you can see below:

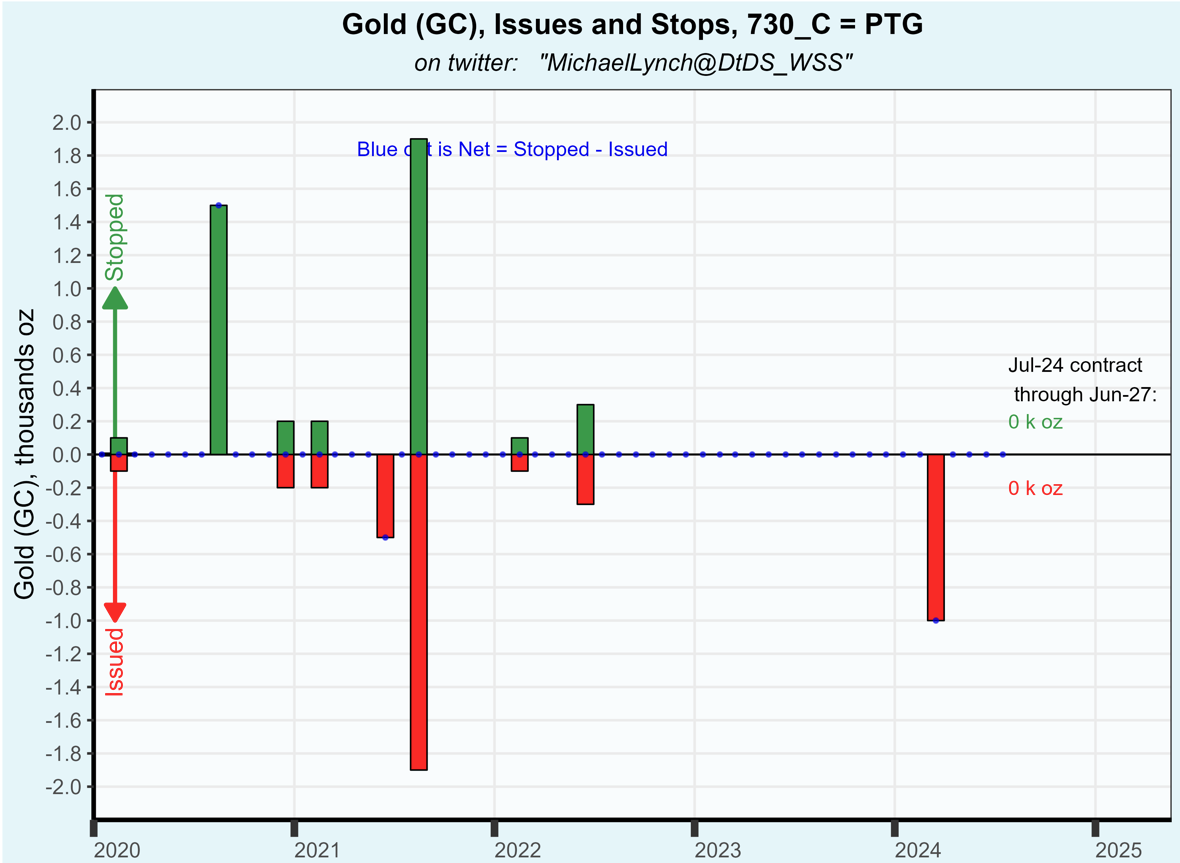

Looking closer at that same account for gold trades … in the past, that account has rarely held gold for more than one contract as seen below. Essentially they usually flip metal in the same month. Is this the same player? There’s no certainty that these trades were done by the same player as all customer accounts are grouped together for reporting purposes. However, if it IS the same player … they usually flip the metal almost immediately so perhaps that will occur for this 4.41 million oz silver buy. So I’m throwing cold water on a bullish signal.

Moving on to the minutia … I have to chuckle at JP Morgan’s house account. The gelded one stopped a whopping 11 contracts. Ol’ JP is a shadow of its former self.

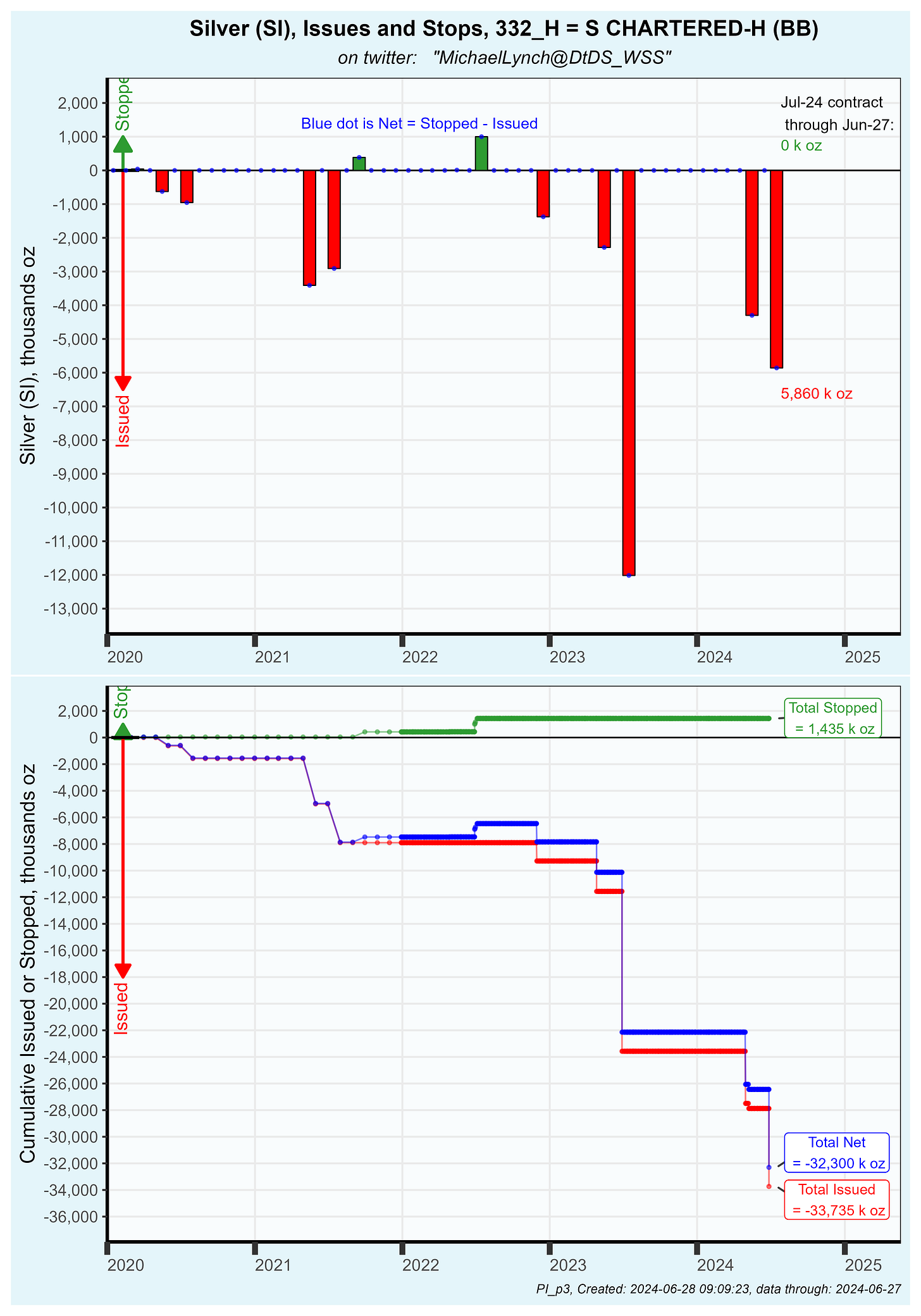

Moving on to the shorts, the biggest seller was Standard Chartered at 1,172 contracts (5.86 million oz). That pairs with the huge vault move into registered at Brinks on June 24. I had thought that vault move could have been BofA preparing to sell … but that isn’t the case. BofA has flipped directions a couple of times recently. However, BofA stopped 182 contracts … a modest amount by BofA standards but it certainly isn’t a 5+ million oz sale.

Back to Standard Chartered … their buy/sale history is shown below. You can see that they have intermittently sold huge amounts of silver … up to 12 million oz in one shot last July:

The second largest seller was the HSBC “customer” account who I have frequently discussed. They issued delivery notices on 1,022 contracts (5.11 million oz). That is likely associated with the 4.5 million oz moves into registered at Asahi’s vault over the prior 2 report days (June 25 and 26). The balance (one even truckload) may arrive on the report for June 27 to be released later today (June 28 at about 3:00 PM).

This first day 5.11 million oz dump runs HSBC’s total silver sales over the last 8 months to 39.7 million oz. If my “Differential Lag Theory” is on target, the game continues. If you’ve missed that …

https://substack.com/home/post/p-144515700

In summary, the amount of physical silver bought and sold is up significantly over the last year but essentially flat from the most recent active month (May). JP Morgan customer accounts were big net buyers and a new player emerged buying 4.41 million oz. BofA bought a modest amount following last month’s absence on the inactive June contract. Selling was dominated by Standard Chartered’s house account and the old familiar HSBC “customer” account.

+++++++++++++++ Gold

The July gold contract, an inactive month, had a last day surge in OI of 417 contracts which resulted in 2,432 contracts standing for delivery. That is equal to the average of inactive contracts over the last year:

BofA was the largest buyer at 843 contracts. While 2.6 tonne isn’t a large buy by BofA standards, it is much more bullish than last months sale of 11,580 contracts:

The next largest buyer was Macquarie customer accounts at 565 contracts.

The biggest sellers were JP Morgan customers at 861 contracts and Scotia Capital at 428 contracts and … (drum roll) HSBC “customer” accounts at 221 contracts. That sale drives HSBC’s 8 month total to a net sale of 691,000 oz or 21.5 tonne.

The vault data arrives later today at 3:00 PM … so I’ll omit the vault reports

Can you give us a summary - is the SGE making any difference in terms of the amount of gold and silver available for traders on the CRIMEX to use to prevent future price discovery? Is that question possible from your data? Thanks, and glad you’re back!