A single day record of gold buying drives delivered gold at comex further into record territory

Settlements over the last 6 weeks exceeds comex YE24 registered gold

Feb 14, 2025 11:30 AM

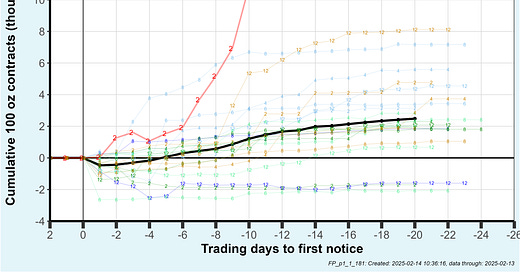

Gold buying on the February contract was sizzling and now it is shooting the moon. The February contract is now in the delivery period so new contracts written at this time almost always result in delivery. Just yesterday (Feb 13) a net 3,897 contracts were initiated (12 tonne). That is almost twice the previous single day record.

The cumulative new contracts written since first notice day is now 10,821 … far over the mean of 1,630 at this point in the delivery period and far more than the prior top contract.

In fact, the cumulative new contracts written so far has already topped the max of any prior contract for the entire delivery period and we’re only half way through the delivery period. See the plot below.

Recall that a record number of contracts had stood for delivery (59,296). See my piece on Jan 31. Adding these 10,821 new contracts will push the eventual total into the stratosphere.

Contracts delivered to date amount to 67,921. I’ll help you put that in perspective with the plot below.

At this morning’s open the open interest was 2,196, so that metal will almost certainly be delivered later this month. That implies eventual deliveries of 70,117 contracts or about 7 million oz.

As I mentioned above, the pace of new contracts is shooting the moon and 2 more weeks remain on the contract. Regardless of the possibility of many more new contracts being written, let’s assume that stalls and eventual total February deliveries are 7 million oz. That would be consistent with the theory that all this buying is related to valentines day.

Also recall that 2.2 million oz was delivered on the January contract which was a record for inactive months (see my Jan 23 piece for that). So 9.2 million oz have been (or are set to be) delivered over the last 6 weeks.

Not changing the subject … as you can see below, registered gold was less than 8.0 million oz in early December.

This ought to make it obvious that the primary driver of gold flowing into comex vaults is increased demand. Furthermore, I’ll add that it is non-bullion banks buying the metal. See my article on Feb 7 for those details.

What is going on is … America’s wealthy class, those who buy bullion at comex, are buying gold like never before. That is what is driving this entire phenomena. That simple concept is lost in explanations in the chattersphere as distracting talk of EFP spread blowouts, tariffs and London vault problems dominate the discussion. Those are all resulting from this surge in demand.

And … the buying spree continues. The first plot above illustrates that along with the OI plot of the upcoming March gold contract below. Open interest continues into uncharted territory:

++++++++++++++++++++++++ Silver

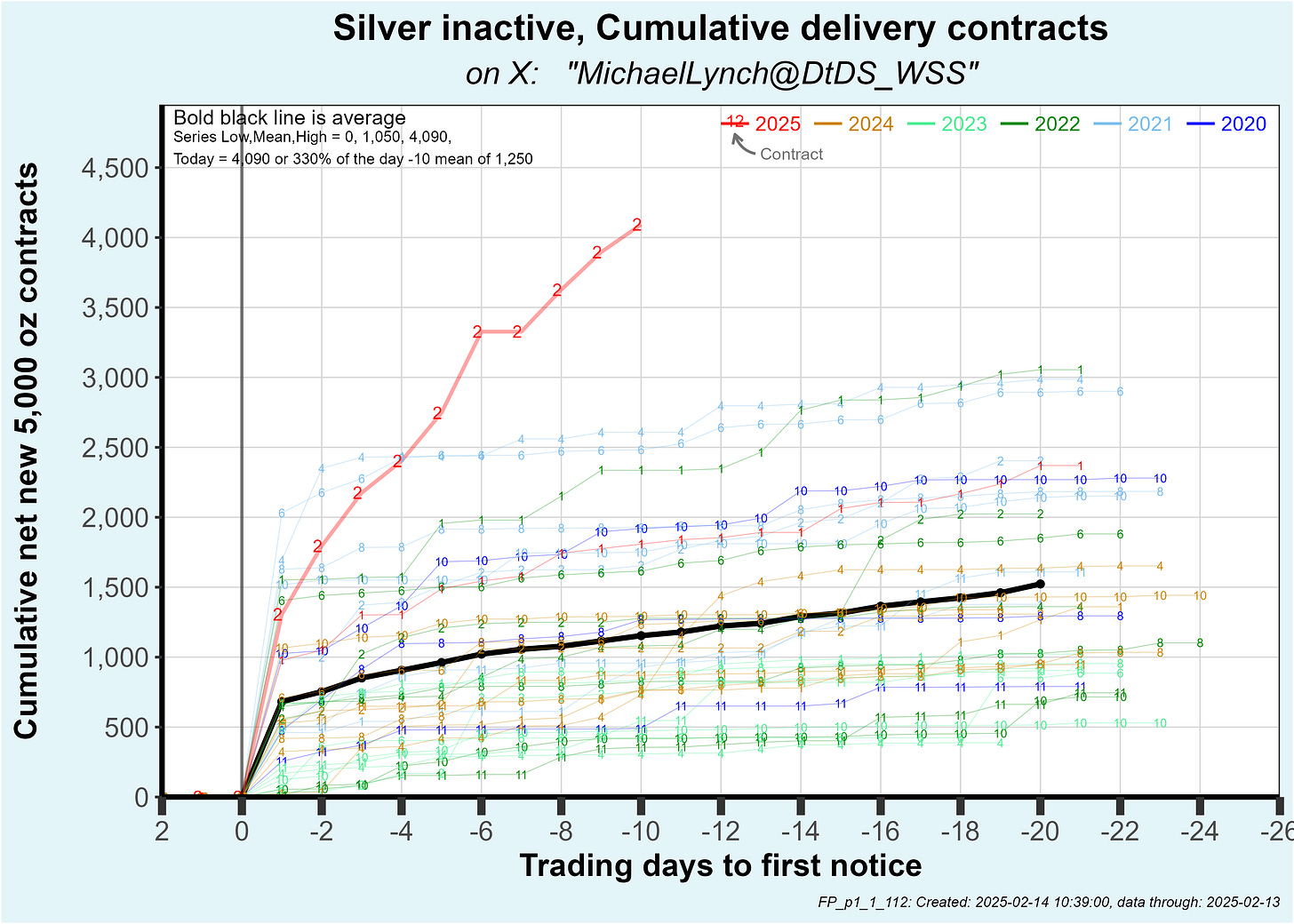

I’ll sum up the silver activity with a chart of the February contract’s cumulative delivered metal shown below. It’s an inactive contract. Cumulative delivered silver is more than triple the mean at this point in the contract and continues to surge:

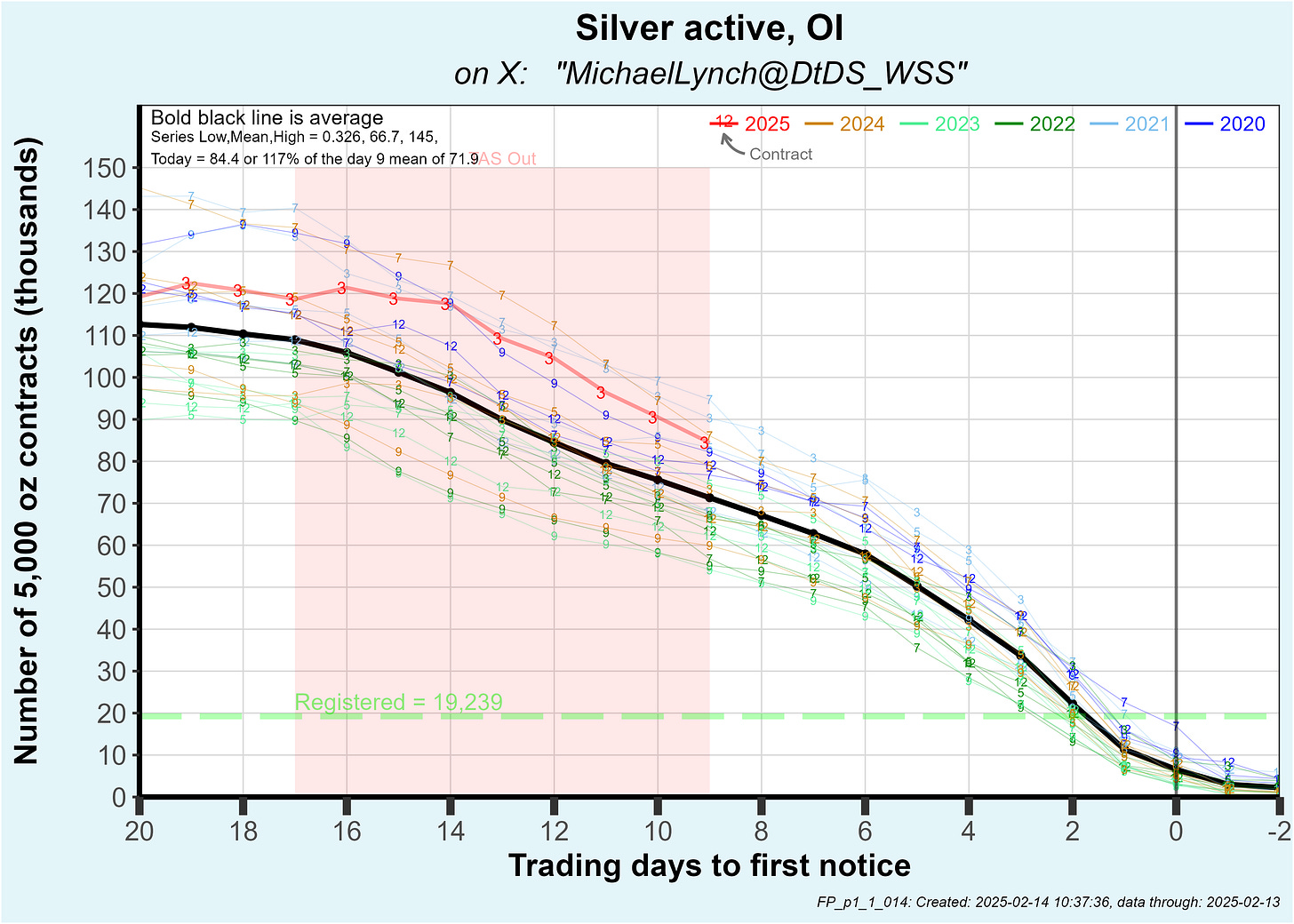

The upcoming March silver contract is the one to watch. At 9 days to first notice, the majority of OI will roll or close, so there’s not yet much yet to discern:

FYI … my prior substack pieces:

https://econanalytics.substack.com/archive?sort=new

🚀 Getting closer to ignition and then blast off.

It is certainly not just Americans buying.