Alert: February gold open interest is far into record territory with 4 days to first notice

Meanwhile January contract deliveries continue to surge

Jan 27, 2025, 12:10 PM

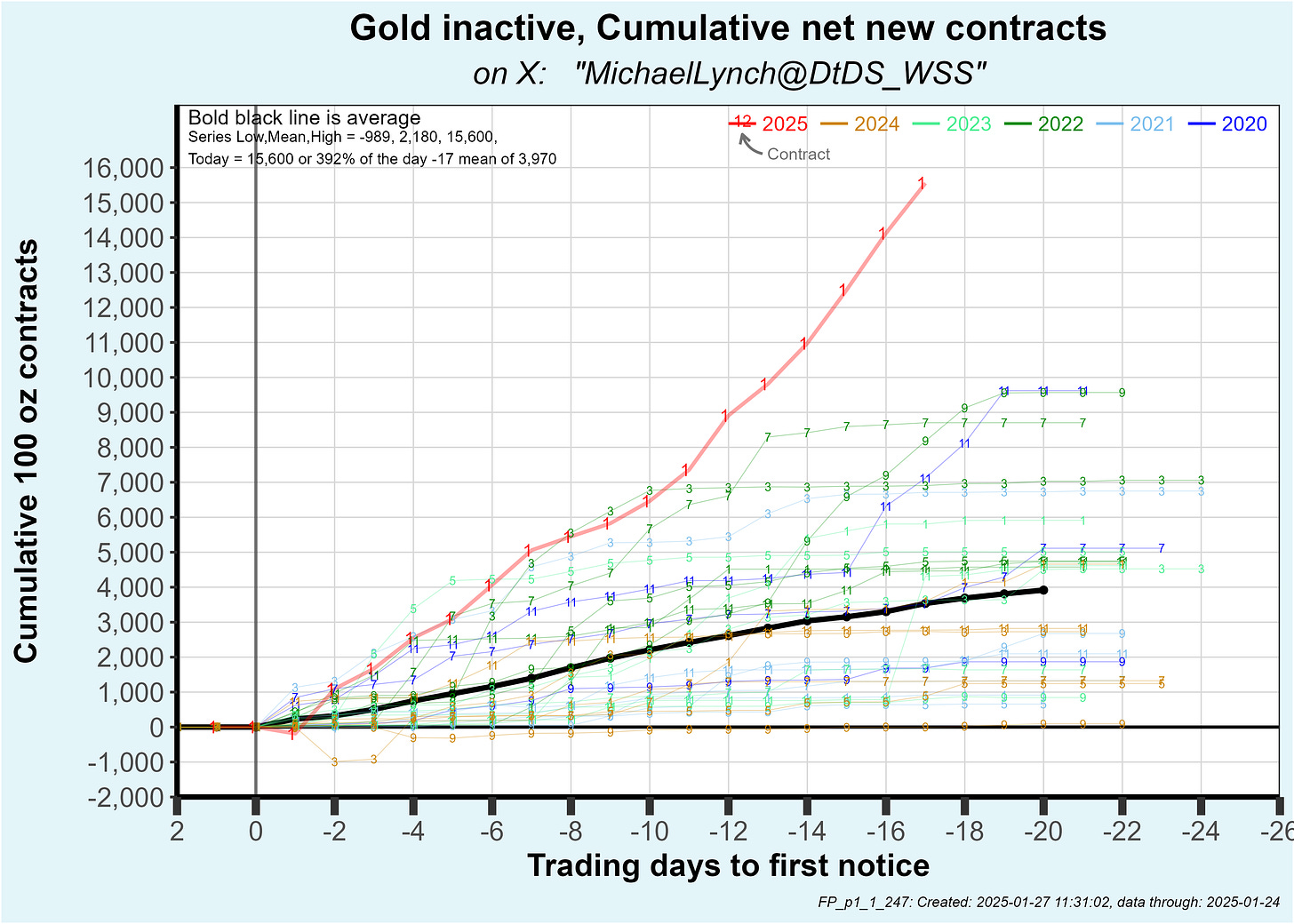

Before I get to the February gold contract let’s catch up on the January specie which I had reviewed this in my last post. January is an inactive month and new contracts each day continue to sizzle with 1,429 created on Friday bringing the cumulative total to 15,600 since first notice day. That is far into record territory:

That brings cumulative delivered contracts so far to 16,700 also far into record territory:

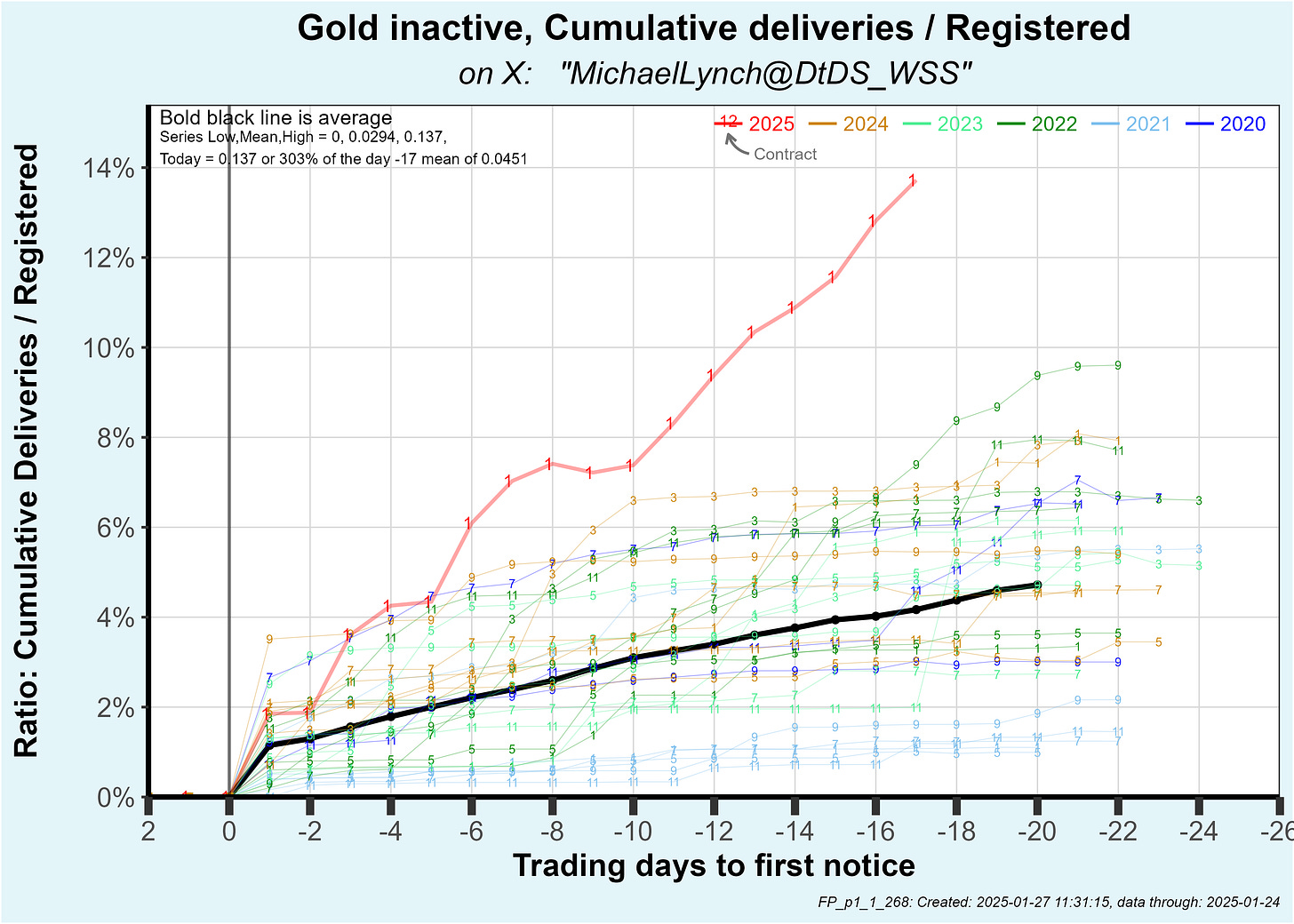

Cumulative deliveries amount to 13.7% of registered gold … also far into record territory despite the recent surge in registered gold in the vaults.

All those superlatives said … it’s possible, we ain’t seen nuttin’ yet. The February contract, an active month, has first notice day on Friday. Open interest is also far into record territory at 4 days to first notice:

OI is now 147% of the day 4 average or 69,000 contracts over the mean. OI is running higher than contracts during 2020 and those contracts resulted in the highest gold deliveres in comex history.

Looking at the OI trajectory on the plot above, note that the reduction from day 20 to day 4 is much less than prior contracts. OI at day 20 was one of the lowest and now, at day 4, it is the highest. That is a clue that the folks holding those contracts are rolling at a very low rate.

And, of course, I have a plot for that. You can see below the daily change in OI has been running far below average. The number of contracts closing (typically by rolling) has been running much less than average until the last 2 days. The $64,000 question: Are those folks that didn’t yet roll going to stand for delivery?

I’ll expect an ugly week. The pattern is that price is hammered in the run up to first notice. Also look for a surge in midnight settlements over the next few days. Friday’s report had 5,048 contracts vanish between the prelim report and the final indicating some midnight deals were cut to close positions.

The thing that is different this time is that the plebs are here. I discussed in my last note that customer accounts have been buying large volumes of gold in the January contract. Those same accounts are likely participating in the February contract. If there are enough of them, we could see a showdown. Get your popcorn.

London is being emptied into the US now….

Long story. Did work in London, Stavanger, Oz in the interim. Sold up completely in the UK 2 years ago - good foresight perhaps. Do a tr[p - KL is a good base.