March 18, 2025 2:10 PM

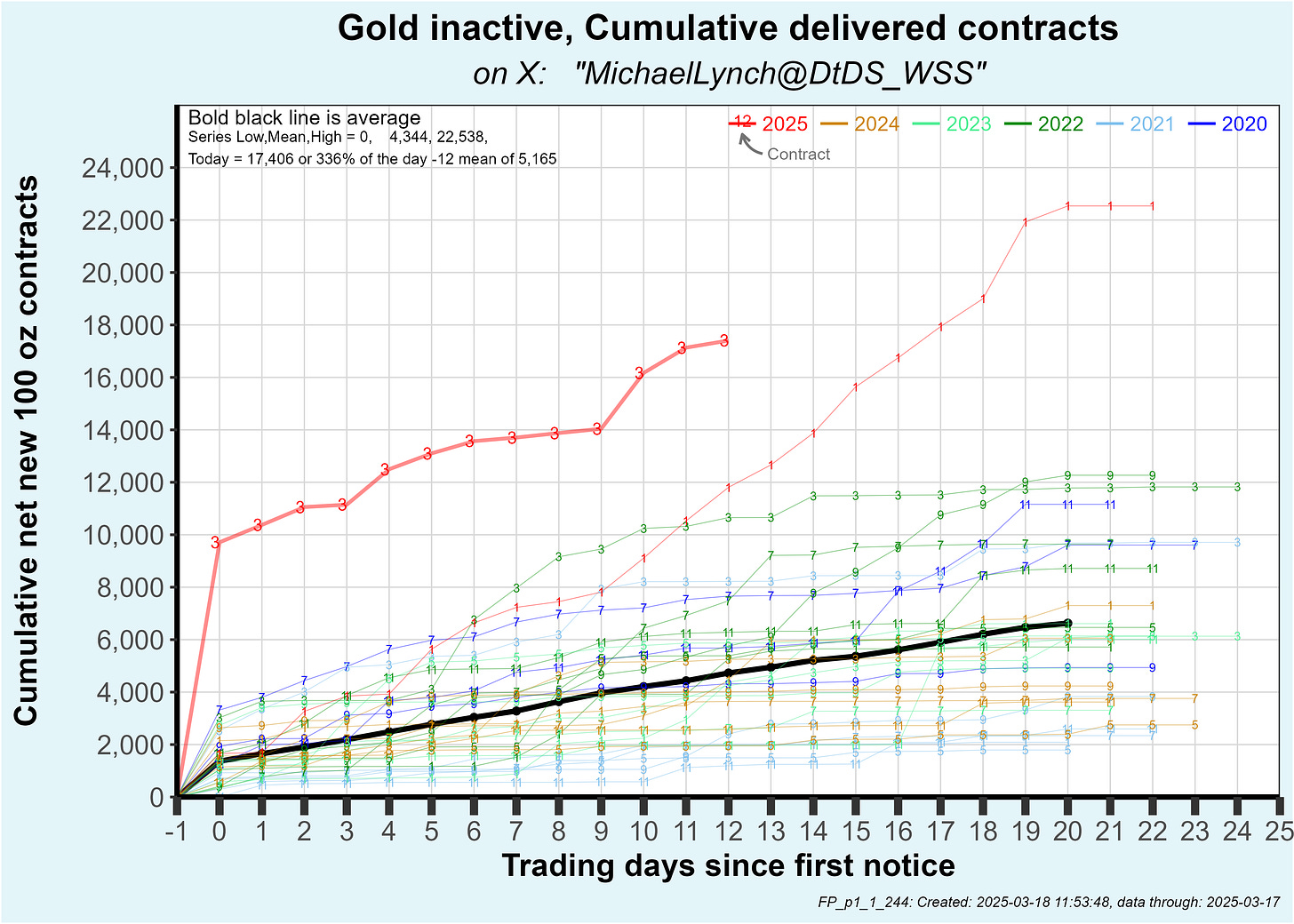

The March gold contract delivered metal is well into record territory at this point in the cycle with cumulative deliveries now at 17,406 contracts (1,740,600 oz). Even with another 10 days remaining, this contract has already bested total deliveries of every prior contract … except the January, 2025 contract.

And it’s still running hot as net new contracts written since first notice day now stand at 7,842, the second highest ever, only bested by that same January contract. See below.

It is definitely a new era for physical gold trading at comex and the buying onslaught hasn’t slowed. The next 10 days will be pivotal as first notice day on the upcoming April contract, an active month, is only 10 calendar days out.

There is no way to tell how many contracts will stand for delivery as the vast majority of the current OI of 257,000 contracts will roll. I’d only be guessing the residual who stand for delivery. Regardless, the current trend is shown below.

If I assume eventual deliveries on the April contract will match the prior active contract of February, then 7.65 million oz would be delivered. In that case, a metal supply crunch could occur.

To illustrate that … let’s talk vaults. Since Dec 9 of last year, 23.7 million oz has been added to comex gold vaults. See the plot below which shows the cumulative change since the pivot point … December 9 of last year.

Sidebar … I’m only tallying the 100 oz bars which are deliverable on the GC and MGC contracts. The comex vault report also includes 400 oz bars which are delivered on the the 4GC contract (one which doesn’t have ANY open interest or trading volume).

Since Dec 9, 12.5 million oz has already been sold … so 53% of the gold added has already transferred. As I said above, if April deliveries match February deliveries of 7.65 million oz, that would spike cumulative deliveries since Dec 9 to 20 million oz. I sketched that on the plot above with an arrow. In that scenario, 84% of the 23.7 million oz move into the vaults would have transferred.

My point is … if this rate of gold buying continues, the flow into comex vaults cannot abate. But it is …

My BS detector went off watching the LBMA folks telling us that the ability to move metal out of London was restricted by logistics. Something else is going on there. Whatever the reason, the dark blue line, cumulative total additions, IS rolling over as the rate of adds IS declining.

Also note on the plot above, two weeks before first notice day on the February contract there was a huge surge in vault additions. If that doesn’t occur soon, supply may soon be tight.

The black line, cumulative delivered gold, includes a period with 2 inactive contracts and only 1 active. You can see the impact of the February contract entering the delivery period in late January as the deliveries spiked and another spike will occur for the April contract.

So … after an epic move of gold from London to comex vaults, it’s almost already sold. If these last 3 record breaking contracts are the new norm, it appears that a supply crunch may be ahead.

A few points I’ll add:

Some bullion banks and some traders are prone to flipping metal and rarely hold it for more than a couple of months, so some of that newly transferred gold will be resold.

On the other hand, some bullion banks (like BofA) are prone to holding metal for long periods

Also, I have written that this buying onslaught has been driven by customer accounts as over 3 million oz has transferred from banks to non-bullion banks.

The key question: Are the new buyers who are driving this physical frenzy entering the market just to be metal flippers? Or, are they staking out a longer term position? I’d guess the latter. The net of all this is … this buying frenzy is moving fast. If that pace continues, it is difficult to imagine supply keeping pace.

Spot $3,035.

++++++++++++++++ Silver

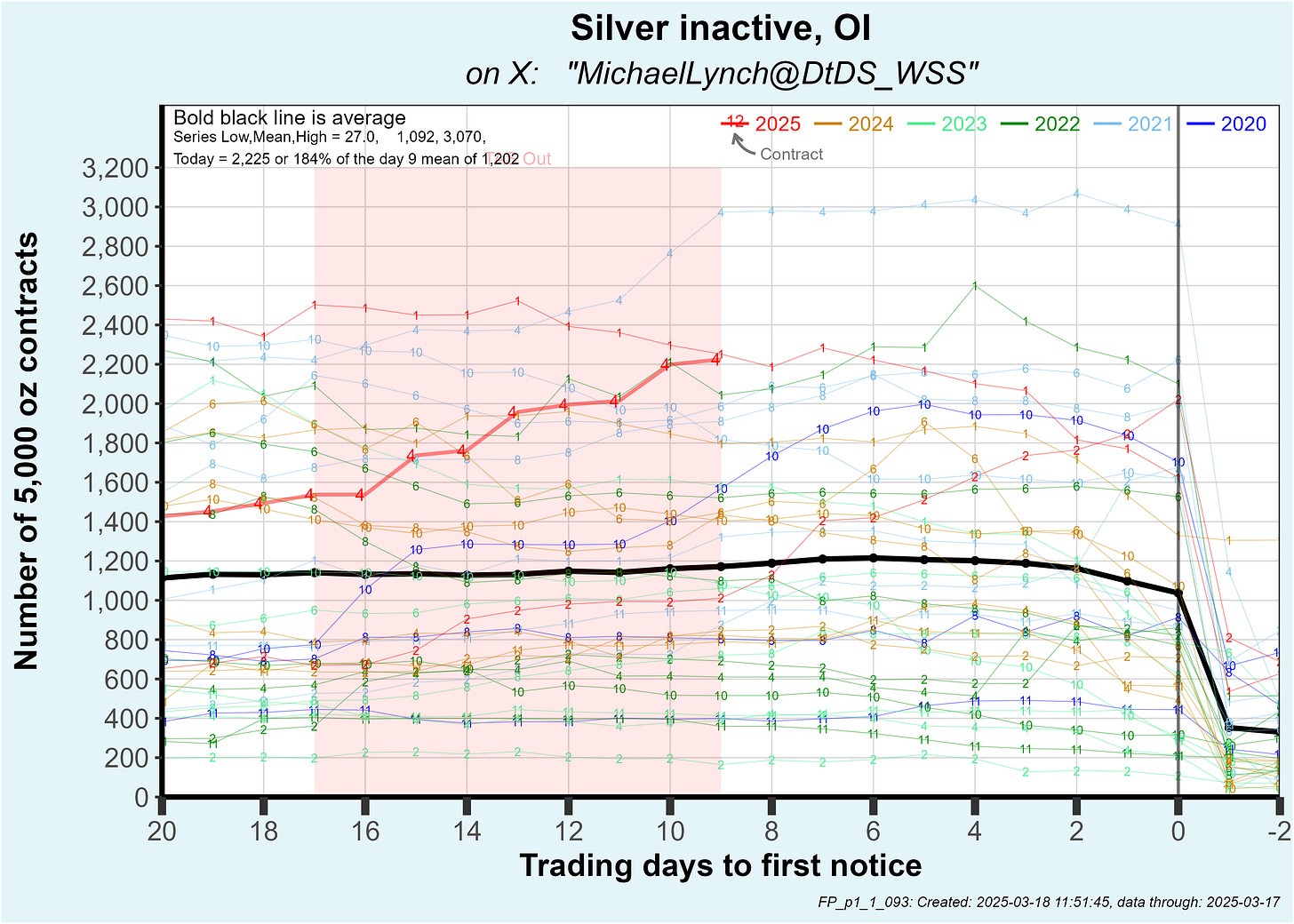

More later on silver … but OI on the upcoming inactive April contract is increasing rapidly:

Michael, great article as usual. Thanks. A few snippets:

1) there is almost no gold or silver left in London that can be sold. LBMA is waiting for new stock from miners/refineries - which is why delivery is now being pushed out to 12 weeks.

2) COMEX has delisted several LBMA options. I suspect COMEX is trying to stop anyone shorting London gold/silver in infrequently traded options. These contracts would 'moonshot' in the event of an LBMA default. See this: https://www.cmegroup.com/notices/ser/2025/03/ser-9515.html

3) the US Treasury has called in the IOUs on 'Greenspan's' gold leases from the 1990s. The buyers are the bullion banks, who are being forced to buyback in the market. They need around 4,000 tones to buy back their IOUs.

4) huge problems in the silver market - see massive short on PSLV. They are utterly desperate to hold the price down. Expect some really odd things in the next few weeks.