Contracts standing for delivery is up 78% sequentially for silver and 100% for gold. BofA is the biggest gold buyer. HSBC's massive silver dump wanes.

I successfully evacuated from the carnage in the Blue Ridge Mountains which were in the path of Hurricane Helene … so on with the analysis of first notice day on the October contracts.

Oct 1 10:00 AM, 2024

+++++++++++++++++++ Gold

First notice day was Friday Sept 27. As I’m writing this, two reports have posted for delivery notices (Sept 27 and 30).

10,818 contracts stood for delivery representing 14% of registered gold. It is difficult to put that in perspective since October is somewhere between an active month contract and inactive so the only direct comparison is to prior October contracts … not exactly high resolution data. Regardless, this contract’s 10,818 standing for delivery is double October 2023 count of 5,325 and half of October 2022 count of 21,251 contracts. Plot below:

Delivery notices over the first 2 days amount to 89% of those standing for delivery, so there probably won’t be any naked short drama on this contract.

Who were the big sellers and buyers?

Surprisingly the Bank of Montreal (BMO) was the largest seller by far as they issued delivery notices for 553,000 oz (17.2 tonne). Standard Chartered was the next largest seller at 221,000 oz (6.9 tonne). Those top two sellers account for 80% of gold delivery notices so far on the October contract and 72% of the contracts which stood for delivery. Two entities had a huge impact on this market.

BofA was the largest buyer, by far, at 433,000 oz (13.5 tonne) accounting for 45% of the total so far on the October contract and 40% of the contracts which stood for delivery.

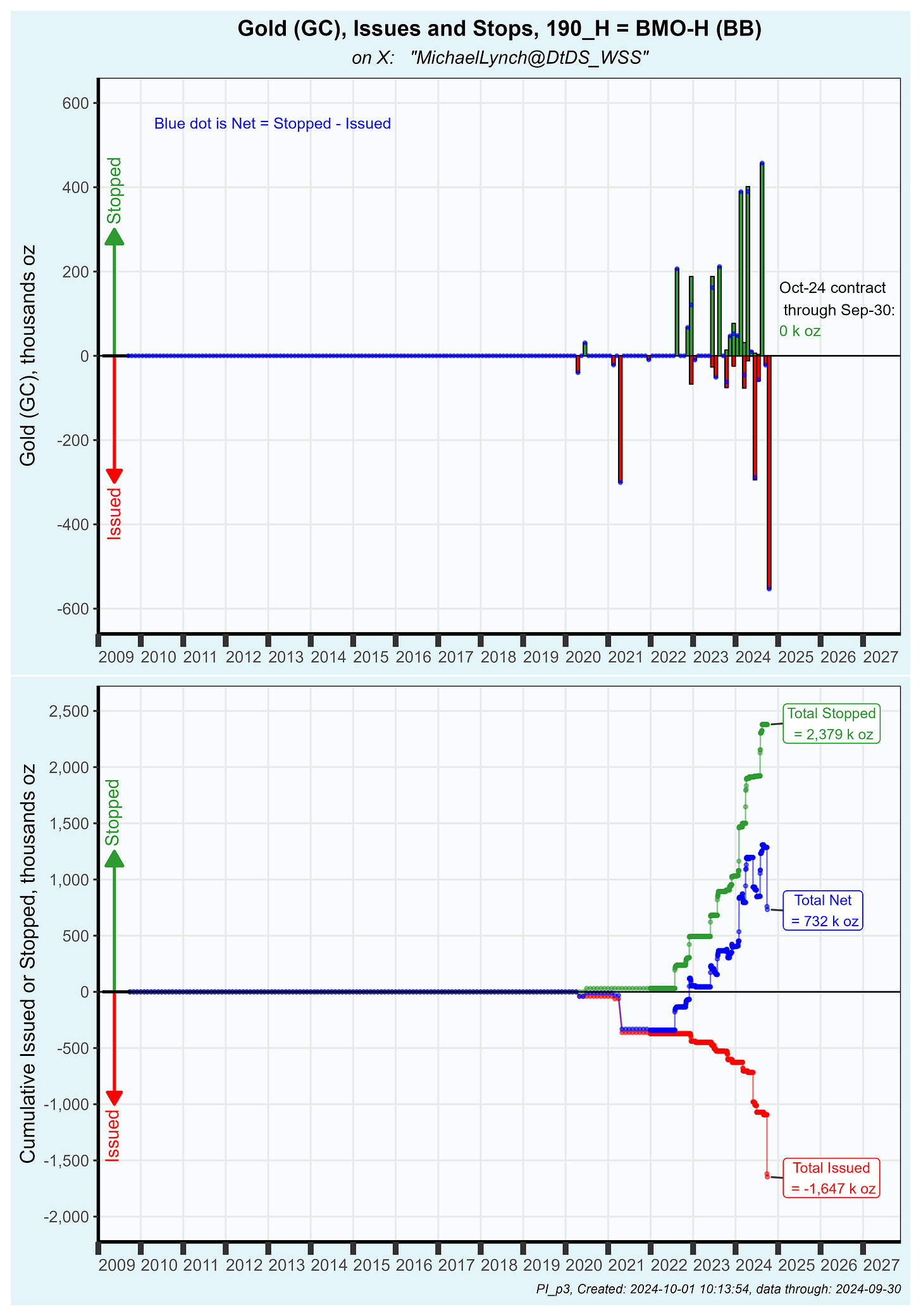

See the plot below of cumulative issues or stops for each account. A trailing “-H” indicates house account.

Back to BMO … their sale is twice the size of the any prior sale in BMO’s history as you can see on the plot below. BMO wasn’t a gold player until the covid scare. Even after this huge sale representing 43% of their stack, BMO’s cumulative net position is 732,000 oz (22.8 tonne). The sale is so large on a notional value basis ($1.5 billion) that it may not be a play on gold but is liquidity driven. I’ll get into this below, but they were also the largest silver seller although that was only $43 million on a notional basis.

Moving to the second largest seller … Standard Chartered sold 221,400 oz which is the fourth large sale over the last 2 years. During that period Standard Chartered hasn’t bought any gold as you can see below. Their net accumulation is rapidly approaching zero.

BofA, the largest buyer on the October contract and the most important player at comex, stopped the most gold contracts since early 2023 implying they are bullish on gold at $2600+. BofA’s cumulative net buy is now 3.95 million oz or 123 tonne.

+++++++++++++++++++ Silver

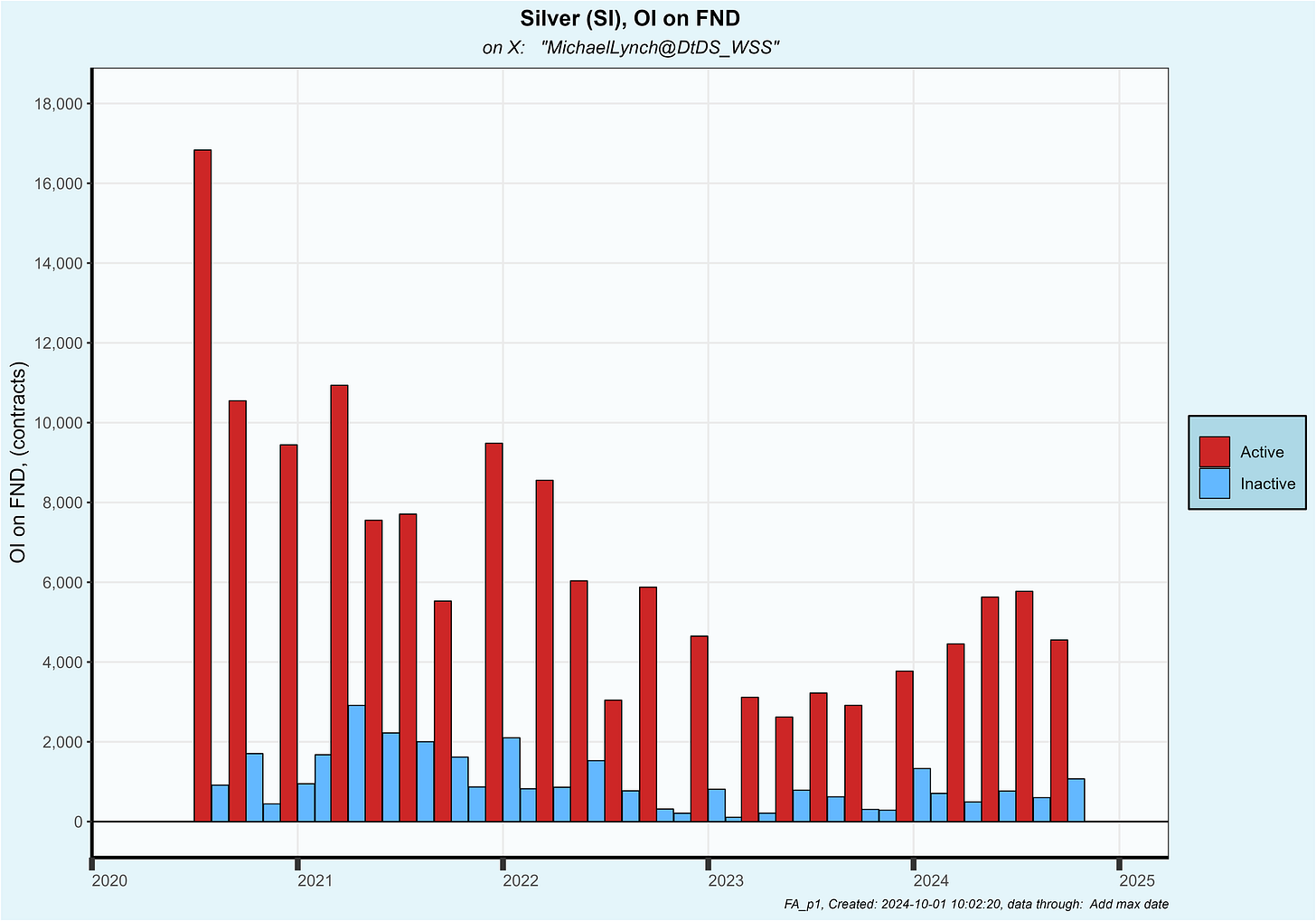

The October silver contract is an inactive contract. 1,071 contracts stood for delivery representing 7.6% of registered silver. That is up 78% sequentially and 67% higher than the trailing year average of inactive contracts:

1,029 delivery notices were issued the first day or 96% of those standing for delivery … so again no naked short drama on silver either. Good to see shorts are selling what they actually own! With a fraction that high, we essentially know exactly who went into first notice day holding contracts.

The largest buyer, buy far, was JP Morgan customers stopping 3,590 koz over the first 2 days or 65% of the total. BofA was a distant fourth highest at 355 koz.

The largest seller was BMO’s house account at 1,355 koz. Interesting that BMO was also the largest gold seller, however this notional value (for silver) of $43 million pales in comparison to their gold sale of $1.5 B. The second largest seller was Stonex Financial (or FC Stone) customer accounts at 1,215 koz.

JP Morgan customers in aggregate have bought a net 48 million oz this calendar year so their 2.59 million oz net buy for this October contract (3.59 bought less 1.02 sold) is a continuation of that trend:

BMO’s house account sale nearly zero outs their net cumulative silver. That doesn’t necessarily mean they haven’t, or can’t, move metal into the vaults from the outside, but it could mean their stack is nearly gone.

The biggest surprise is that the HSBC so called “customer” account only sold one even truckload (600 koz). If you follow my thread, you know that they have been the largest seller since December of last year as they have dumped 49.3 million oz (including this token 600 koz). Even though this is the smallest sale since Dec of last year, I’m reluctant to say HSBC’s dump is over because I know they moved several million oz into the vault recently. Regardless, this is an interesting change of course.

More later. This was a quick note as I’m just getting back up to speed after escaping the storm’s path. Some of those mountain towns are decimated …literally wiped out. I left my generator with friends as I evacuated in my 4x4 armed with chainsaws, extra gasoline and various protection devices. A reminder … at any moment it can be hours to chaos.

Glad you’re safe with prayers and best wishes on the recovery process.

Many thanks for your updates amid difficult times 🙏