Even after record last day shenanigans 4,142 gold contracts stand for delivery up 170% sequentially and the highest in 2-1/2 years. Wells Fargo is the perp.

And for silver ... HSBC's 10 month dump hits 48.7 million oz.

Aug 30, 2024 19:45 AM

+++++++++++++++ Silver

Last night was first notice day on the September contract as 4,553 contracts (22.8 million oz) stand for delivery. That breaks the string of 5 sequentially increasing active month contracts. See the chart below. The September contract is down 21% sequentially from the previous active month contact of July.

Delivery notices were issued for 3,830 contracts (19.2 million oz) or 84% of the contracts standing for delivery. That fraction is much higher than typical (about 50%). Often a low fraction foretells a large naked short but that doesn’t seem to be the case at this point … although 3.6 million oz remain to be delivered.

First day issues and stops are summarized below:

The biggest buyer, by far, was JP Morgan customers at 2,891 contracts (14.5 million oz) which represents 75% of the first day delivery notices.

There were few contracts sold by JP Morgan customers … only 20 contracts (0.1 million oz) so JP Morgan customers were nearly uniformly bullish. JP Morgan customer accounts are the largest non-bank category in the silver market and this was the largest monthly buy in over 2 years and one of the smallest sells over that period. See their track record below:

The biggest seller was HSBC customer accounts who issued delivery notices on 1,263 contracts (6.3 million oz) accounting for 33% of first day delivery notices. That 6.3 million oz delivered is close to the 6.0 million oz moved into registered this week at Asahi’s vault where this HSBC “customer” typically vaults.

The surge in selling by this entity continues as the cumulative silver sold since December of last year is now 48.7 million oz. Nearly all of that silver was brought into comex soon before issuing delivery notices resulting in a large supply increase at comex. That modus operandi is in contrast to many traders, particularly banks, who buy and sell the same metal repeatedly.

I have speculated that this HSBC “customer” account is dumping metal at comex to contain the price meanwhile buying even more metal at non-price setting markets. This could result in a net gain in position at contained prices. In a post on May 10 I explained this approach calling that the “differential lag theory”.

HSBC trade history is shown below. See anything different starting in December 2023? If you see a kink in those red and blue lines … you’re coming on board.

Reminder … The “H” in HSBC stands for Hong Kong and the “S” stands for Shanghai. Just sayin’.

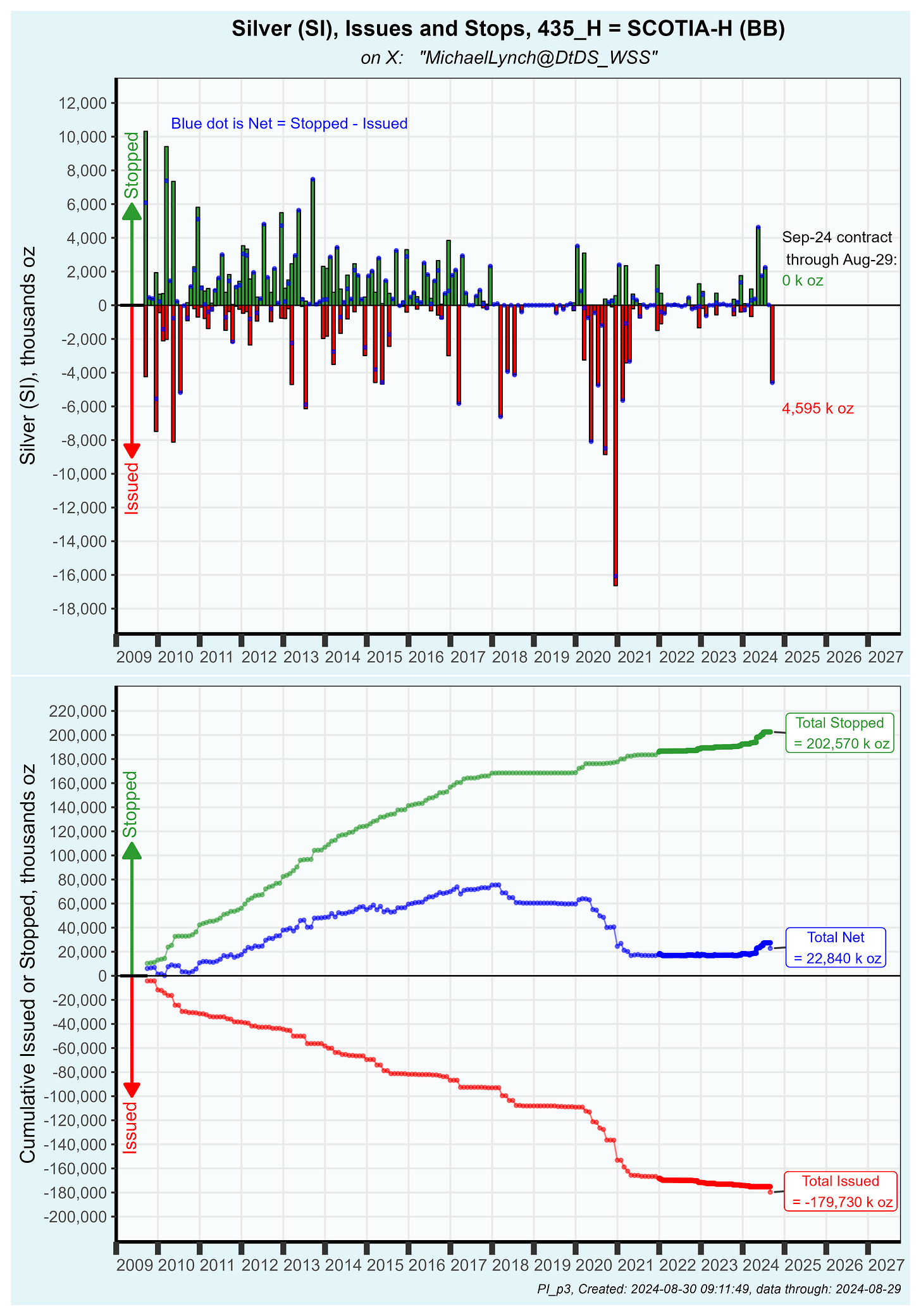

The next biggest seller was Scotia’s house account at 919 contracts (4.6 million oz). That is the biggest sale for a single contract by Scotia for more than 3 years as you can see below. It is possible that this sale completes a flip of metal they bought in May (927 contracts) or June and July (which totaled 801 contracts).

So far this September contract is an odd mix of activity with JP Morgan customers supplying most of the longs and Scotia selling. Formerly Scotia was a big player in precious metals however their activity has diminished over the last few years and they also exited the vault bushiness selling that to MTB.

+++++++++++++++ Gold

There was some potential last minute chicanery on the September gold contract. Nearly 20% of open interest or 959 contracts closed on the last day before first notice.

See any odd last day kinks on the plot below?

That is the largest last day reduction in OI in at least 4 years and the second largest OI reduction of ANY day over the last 4 years.

At least trading volume of 3,966 exceeded contracts closing of 959. Don’t laugh … it sometimes where the OI reduction is less than volume. That is a direct signal that shorts and longs settle off exchange in the dark of the night. On this occasion volume was 3,966 which was also a record for this late in the cycle:

The net of all that is … there’s a chance shorts may have been desperate to close and incentivized longs to settle. An alternative explanation is 20% of longs got spooked and closed at the last minute … far more than any historical norm.

HOWEVER, despite that potential chicanery … 4,142 contracts (12.9 tonne) stood for delivery. That is up 170% sequentially and the highest in 2-1/2 years.

Who was driving this activity? First day delivery notices were 64% of the contracts issued so we have a good read on the buyers and sellers. Wells Fargo’s house account was the largest buyer by far at 164,000 oz. The 2 largest sellers were BofA’s house account at 104,000 oz and Scotia’s house account at 95,000 oz.

I am most interested in 2 things. First, who accumulated that huge 3,500 contract position at day 25 and 26? And second, who closed 959 contracts in the last day. Those 959 are gone and neither the short or long will ever be listed on the issues and stops report. On the first one, it seems like Well’s is the primary suspect on who accumulated the 3,500 contracts over 2 days but with 1,499 contracts undelivered, we’ll have to wait and see if Well’s stops additional contracts.

As a reminder … for gold (and not so much silver) many new contracts are often created and subsequently delivered following first notice day. This can happen in active or inactive months, so we will soon see if this surge in activity continues.

the bottom line is.. I still see, a consistent vault depletion, an attempt to hide the large-scale acquisition by national entities and real attempt to keep the price low until they just can't do it anymore

I like that you generated stops issue charts at the bank level. Useful.

Fear not the physical gold printing machine is going to creat whatever we can't deliver to market out of thin air. Trust me it's going to work.