Extreme midnight settlements prevent a June silver contract open interest blowout.

Shorts sweating it out 3 weeks to first notice?

+++++++++++++++++++ Silver

The upcoming June silver contract is over 3 weeks to first notice but it appears that a midnight battle is occurring where contracts for more than 3.6 million oz have already settled off exchange.

For inactive contract’s this is the point in the cycle where open interest builds. The reason is that the prior contract (in this case, May) has entered the delivery period. If a trader wants physical delivery they often open a contract for the next delivery month whereas paper traders will open a contract in the next active month (in this case July).

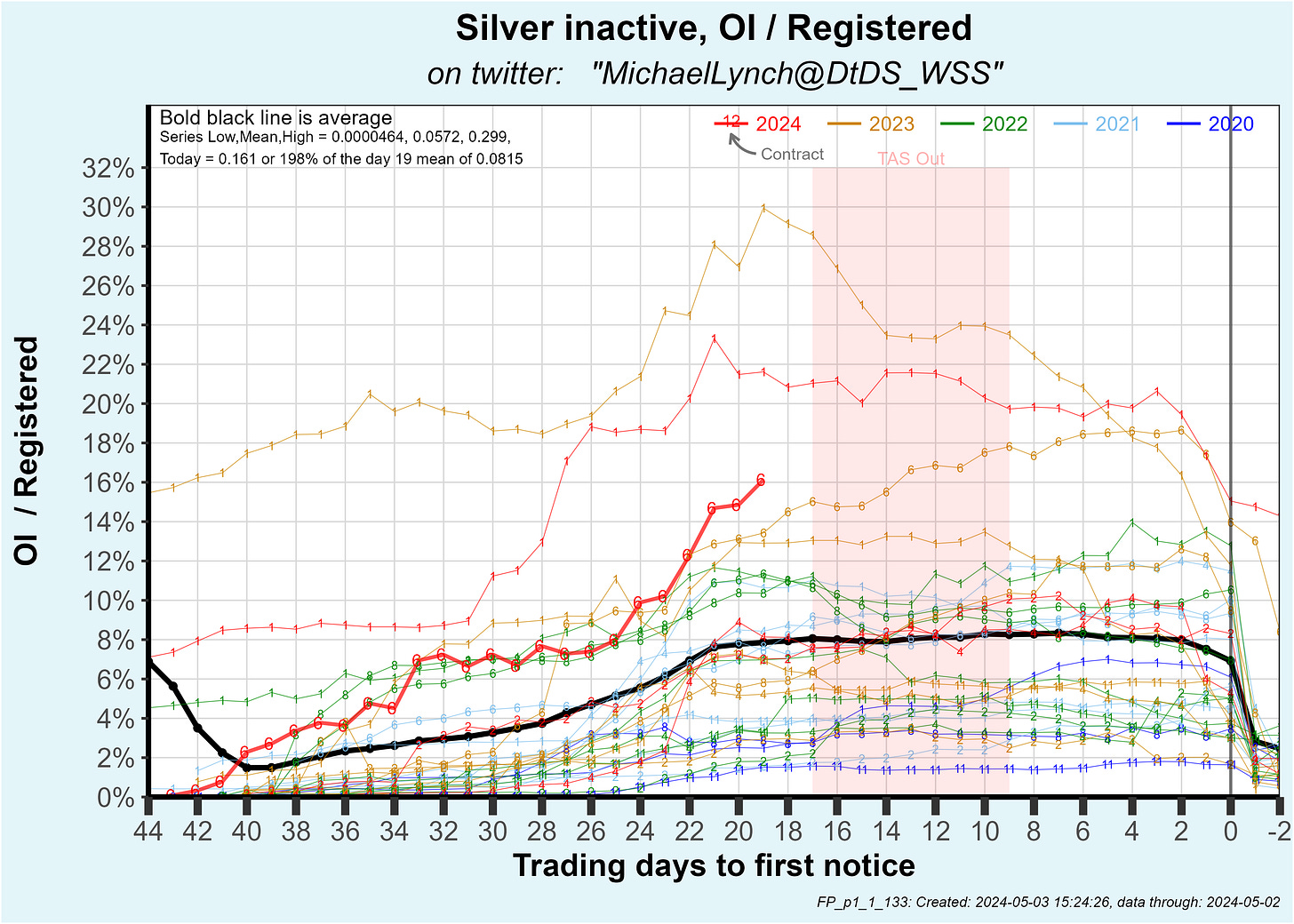

The plot below shows that the June contract’s OI is now 1,999 nearly double the average at this point in the cycle.

It’s worth pointing out that traders that open positions on inactive contracts typically stand for delivery. You can see how the OI doesn’t plunge into first notice day like the active month contracts.

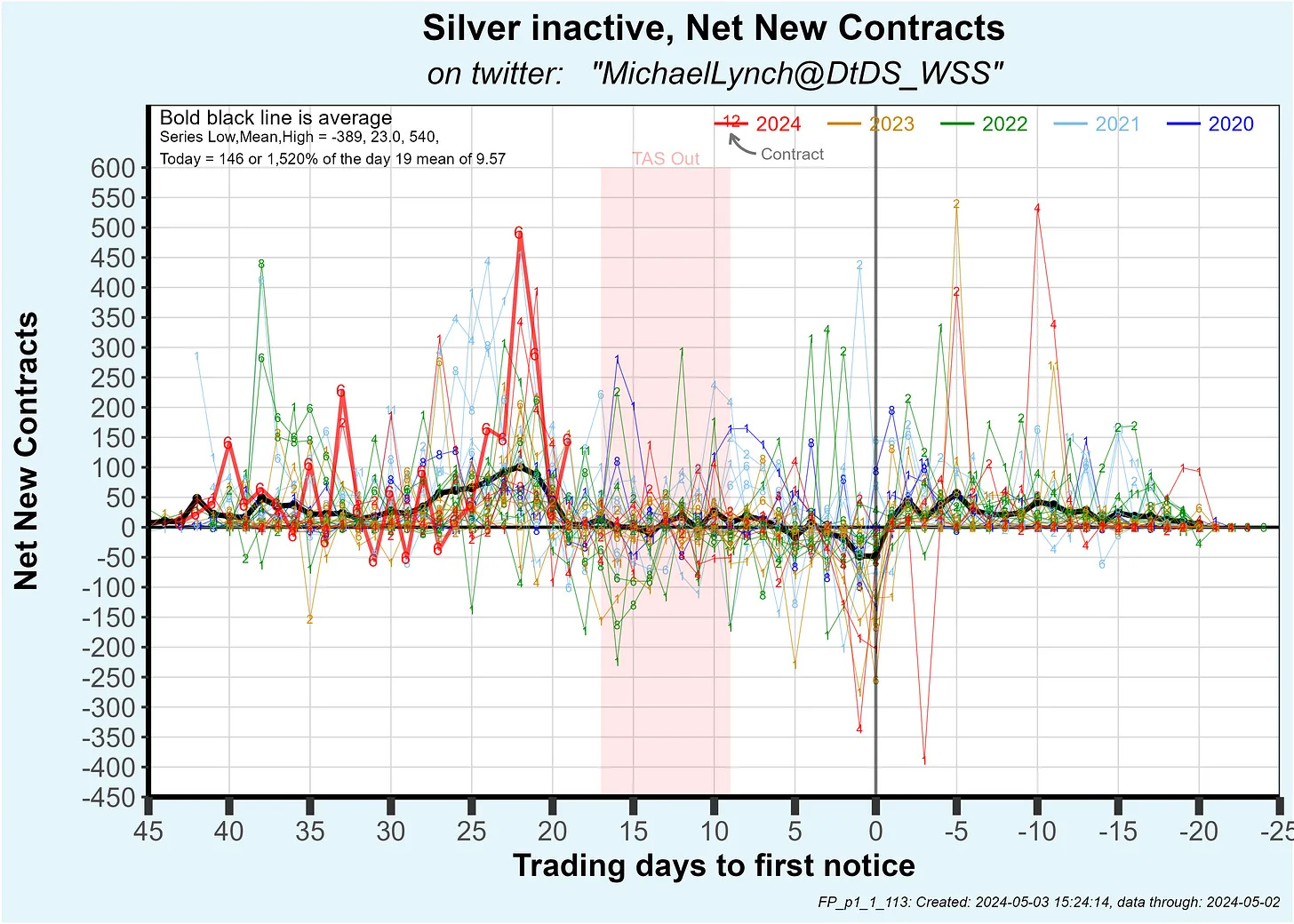

On March 30, 500 new contracts were tacked onto OI. Furthermore 6 of the last 7 days added many more contracts than average:

As a fraction of registered, OI is now 16%, one if the higher contracts over the last 4 years:

Also, trading volume is near highs, indicating high interest in the June contract:

So … that looks interesting, but that is just part of the story.

Recall that the CME folks print a prelim report of activity about 10:30 PM (NYC time) and then a final print about 10 hours later. Usually the change in OI is nominal … it averages just a 0.31% reduction.

In the past, large changes are associated with market stress. This guy documented one huge example. If you haven’t yet listened, we can’t be friends anymore:

Apparently there is some stress on the June contract even though it is more than 3 weeks to first notice. Why? The June contract had 50 contracts (2.6% of OI) close on April 30, 425 close (18.7%) on May 1, and 237 close (10.6%) on May 2. The total is 712 contracts or the equivalent of 3.6 million oz.

Raw numbers:

Each of those reductions are large deviations from the mean and statistically improbable based on prior data.

See the plot below which show the fractional change for each day of each contract. There area a lot of zeros (or near zeros) in this data set which plot on the axis and are not visible. Basically, you only see the big adjustments.

So far, June 2024 has had the second largest tally of midnight shenanigans. Only Feb 2023 had more. That contract was soon after the great vault drain where registered silver was knocked down to only 32 million oz. In that case I believe shorts didn’t have metal to deliver and chose to settle under the midnight moon in off exchange deals. It appears we are seeing that again.

Had those 712 OI reductions on the upcoming June contract not occurred, OI would be 2,711 and would be far higher than any other contract. Well, that’s worth a picture …

This is on top of the 26% sequential increase in contracts standing for delivery on the active month of May. Perhaps the rush for physical is starting … and the shorts don’t have it.

+++++++++++++++++++++ Silver Vaults

579 koz arrived at MTB’s vault, 118 koz departed Asahi and 404 koz transferred from registered to eligible at Brinks:

+++++++++++++++++++++ Gold Vaults

Comatose:

Have a good weekend!

Subscribe now while supplies last:

Thanks Ditch!! I would love to watch shorts get squeeeeeeeezed!!

How does this end? I am uncertain, but my hefty stack of physical silver will still be there.