February gold deliveries are on trajectory for an all time record at comex

And that is on top of the January contract a record inactive month

Jan 30, 2025 10:00 AM

++++++++++++++++++++++++++++ Gold

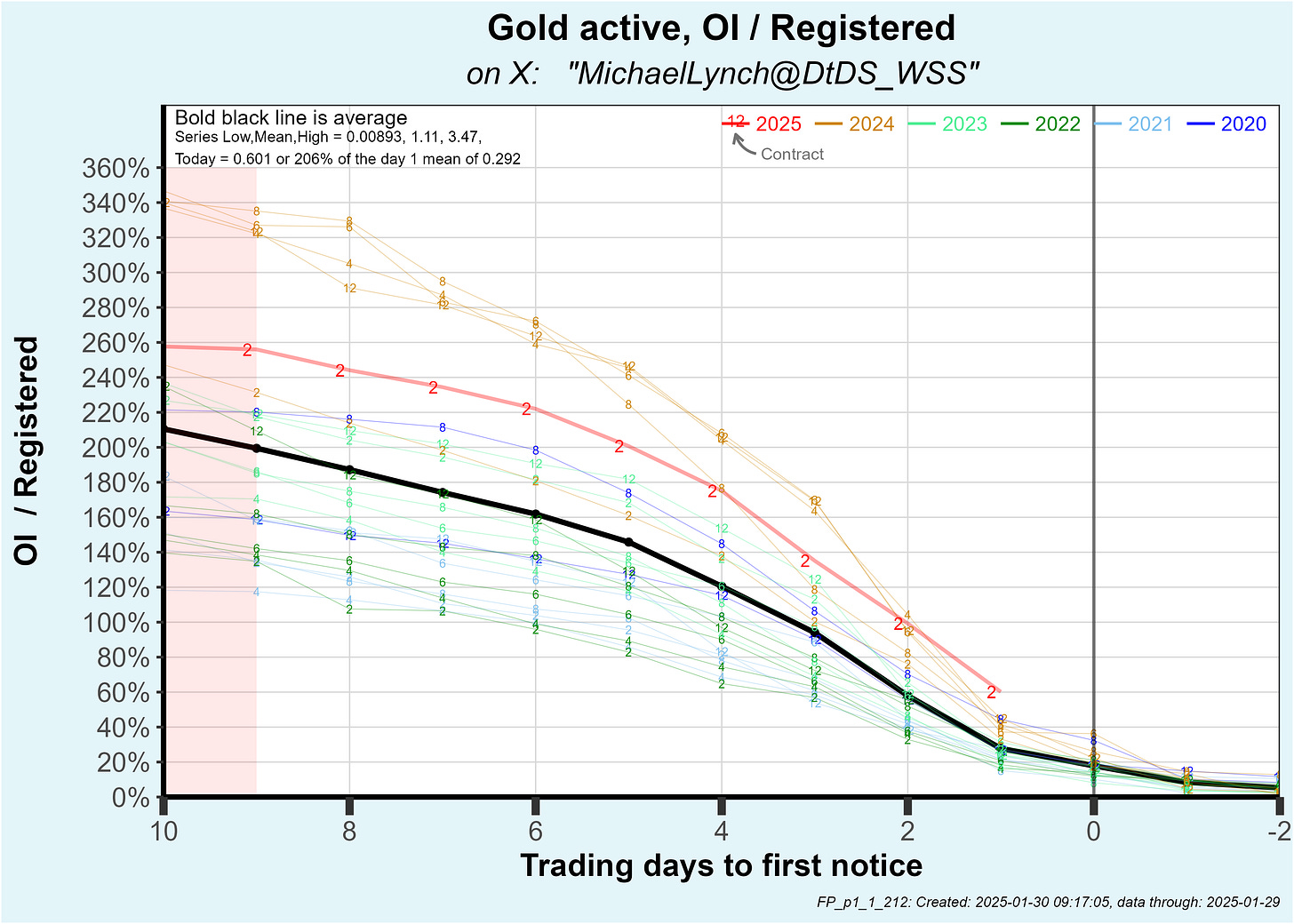

Today’s trading (Jan 30) is the last before first notice on the February gold contract. The preliminary report shows open interest with one day to go is 77,750 … more than twice the mean, the highest in my 4-1/2 year data set and almost certainly the highest ever. See the open interest trajectory below compared to prior active contracts:

Let’s count the chickens before they’ve hatched. The average number of contracts that closed on the last day is about 12,000 as you can see below.

If that were to occur, 65,750 contracts would be standing for delivery. That would exceed the comex record of 55,000 delivered contracts which occurred in June 2020. As a reminder after first notice some contracts may close and new ones could be initiated. On average, the net new contracts during the delivery period is 2,600. The summary here is there is a high likelihood that the February contract will see the highest oz of gold transferred in comex history.

Despite the huge surge of gold in comex vaults, the open interest on the January contract before today’s trading is 60% of registered gold. That is also a record and twice the average of 29%. See below:

All this stress will arrive on top of the inactive January contract which has turned into a blowout month by inactive contract metrics. New contracts continue to be written and delivered as last notice day approaches. Interesting that buying on the January contract now will get you physical gold in hand in a few days. Good luck doing that in London as the FT reports there is weeks long wait for load out.

The January contract has now knocked out 17% of registered gold, far over the norm of 5%. See below:

Thus, between January and February, we could see more than half of comex gold transfer ownership.

++++++++++++++++++++++++++ Silver

The February contract is an inactive month. OI with one day to first notice stands at 1,846 contracts. That isn’t the highest ever, but is 168% of the mean:

Stay tuned. Tomorrow I’ll see who’s been driving this buying spree and who is selling into it.

So, does this mean that those currently holding physical can collect mad vig?

Now & in the future. Future being those whoos holding and making all the rules.

Not lease rates, mind you. Real Vig. Tier One. Right?

JPM and Scotia smoke cigars and drink fine cordials together. Maybe even share the same gals.

Mr Sprott understands the importance of friendliness toward Uncle Sam.

It's also in the best interest of all parties to include Mexico. A myriad of reasons there.

" London Caught Looting"...future headline?

What will they call the Signal Failure Mister? That'd be a great Bingo Card