Gold revaluation? Go big or go home. Which would Donald J Trump choose?

Revaluation to $40,000 saves fiat and the money changers.

February 18, 2025 10:15 AM

The power of printing fiat is greatly underappreciated by society and also among many of us so called “gold bugs”. You and I direct extraordinary time and energy to earn fiat bucks printed by the money changers. From your first day of kindergarten to your day of retirement, you hone skills and work for the paper printed by the money changers. This is not questioned because it is all we have seen our entire life … which is short by historical standards.

I’ll use the phrase “money changers” to connect with the historic reference of those who initially swapped redeemable notes for physical gold and later evolved to modern day banks printing fiat.

Anyone aware of the history of money knows gold is money. Unfortunately, if you own gold it never grows. To grow wealth gold has to be sold, the proceeds invested (think treasuries) and later converted back into gold. Hopefully this swap returns more gold than originally owned, otherwise the swap failed. Call this the “big swap”. Gold is money so all that matters is return in gold terms.

Based on that simple premise, the masters of fiat need marketplace stability for long periods … decades … as they issue debt. Why? If “the big swap” doesn’t achieve a return (in gold terms) ... debt will NOT be bought as an investor will be better off just holding gold.

Last year’s 27% increase in gold compared to treasuries 4.5% yield is a flag. If it was believed that negative return would continue in the future … the fiat game is over.

For that reason the money changers have to create long lasting stable periods …. Decades. That requires money changers containing gold’s value in fiat.

The quandary is … running the world’s fiat system has zero power unless you create fiat. That’s how they exploit their system … by printing fiat.

You can see the dynamic. They want to print fiat, but convince all that their fiat isn’t devaluing. Gold is the most important metric of fiat’s value.

After compounding for decades, printing fiat eventually, and always, catches up with them. Thousands of years of history proves that. Regardless of that fact, 99.9% of people fall for the money changers trick. Charles de Gaulle is a good example of the 0.1% when he demanded gold for his fiat bucks. Soon thereafter there was a devaluation by a factor of 20.

My point is … revaluation of gold / fiat cannot be done frequently otherwise it undermines stability.

And now we can move on …

Apparently Trump’s motto is: Go big or go home. Gold at $2,900 values the US’s 8,100 tonne at a measly $0.8 T. Do you really think he’s going to tweak the monetary system to put a lousy $0.8 trillion onto the balance sheet?

Not long ago that 8,100 tonne of gold backed the entire financial system of the West. That gold backed the $US directly and Europe’s currencies indirectly as they pegged to $US.

That $0.8 T is peanuts compared to debt of $36 T and annual spending budgets of $4.8 T. That $0.8 would be enough to run the government for 2 months.

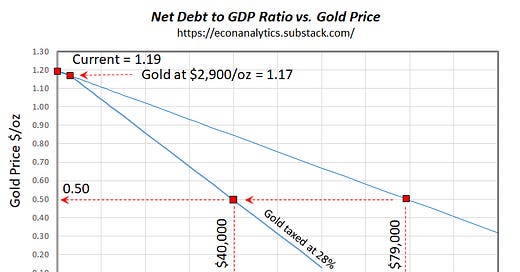

Revaluing gold to $2,900 would change the debt to GDP ratio from 1.19 to 1.17. It’s the same number!

Most importantly, a small patch just begs for gold to continue its accent (or more accurately, fiat’s decline) to further save the system. I explained above why that instability is fatal to the fiat system. This is happening now as central bank sell dollars and guy gold.

A revaluation to $2,900 per oz would be a tiny patch on a fatal wound of excessive spending and debt. If you’re thinking a revaluation to $2900 … go home. Trump will stay.

Gold will be revalued to something much higher. The goal will be to kick the fiat can DECADES down the road. Why? So fiat can function for another long stable period.

What price could that be? One target could be to get the debt to GDP ratio into a zone where the fiat system can function for decades longer. If I assume that target is 0.50, a gold price of $79,000 per oz will accomplish that.

How can Trump change gold to $79,000 per oz? Easy, he announces that the Treasury will buy any gold offered for sale at $79,000. This is just a devaluation of the dollar. He can create fiat and buy your gold. As soon as the market realizes that, there is no need to rush to Trump’s gold window to sell your gold. Trump’s price will be the price everywhere.

The loser is bond holders … and the money changers need them for the following decades. Furthermore, after this revaluation there is no incremental increase in the ability to service debt, so the stressed debt service metrics will continue.

So … amend the plan. Tax gold at, say 28%. After the revaluation, all gold has a new cost basis of $2,900 regardless of what you originally paid. When you sell your gold, tax will be due at the new price less $2,900 times 0.28.

How much gold is in the hands of US taxable entities? I don’t know. If I assume 1.0 billion oz (12.7% of the world’s total), that will be a huge windfall to the treasury.

In that 28% tax scenario, what gold price is required to drive the debt to GDP to 0.50? A gold price of $40,000 would revalue the 8,100 tonne gold owned by the government to $10.4 T and also raise $10.4 T in tax revenue. That drives debt to GDP to 0.50.

Proceeds from the tax can be used to buy treasuries and make bondholders less sad.

Proceed onward for decades with peace and prosperity! Gold holders get a lot more of the latter, but they deserve it for understanding history.

Error ... I mislabeled the y axis. That is net debt to GDP (as it is stated in the title).

Sorry, one more thing. It is known, factually, that each major nation has been balancing its gold reserves to equal 4% of gdp. I think Poland is the last to equalise. Anyway, this would lead one to surmise that the gold revaluation will be a x25 move. Thereby allowing all gold / gdp balanced countries with a sub 1.0x debt to gdp ratio to clear their deficits. Everywhere (except Canada and the U.K. who have almost nothing thanks to incompetent leadership). 3k x 25 = $75,000. You say $79k through another lens. Add in the trump go big factor and the 1.20 debt to gbp in the USA and it doesn’t take much to get to $100,000 an Oz of gold. Oh what a surprise Bitcoin is there too. Oh why don’t we just link them up. July. Basel 3. Less than 4.5 months away. Silver, even at 50:1 (which won’t work for long with a massive shortage and ground reserves at 9:1 gold) but even just at 50:1 that’s $2,000 silver. That’s a x60 move. Interested in your opinion 🙏🏻