Gold vault additions slow while physical gold bought for immediate delivery are at record highs

A whiff of a supply demand mismatch

April 11, 2025 1:00 PM

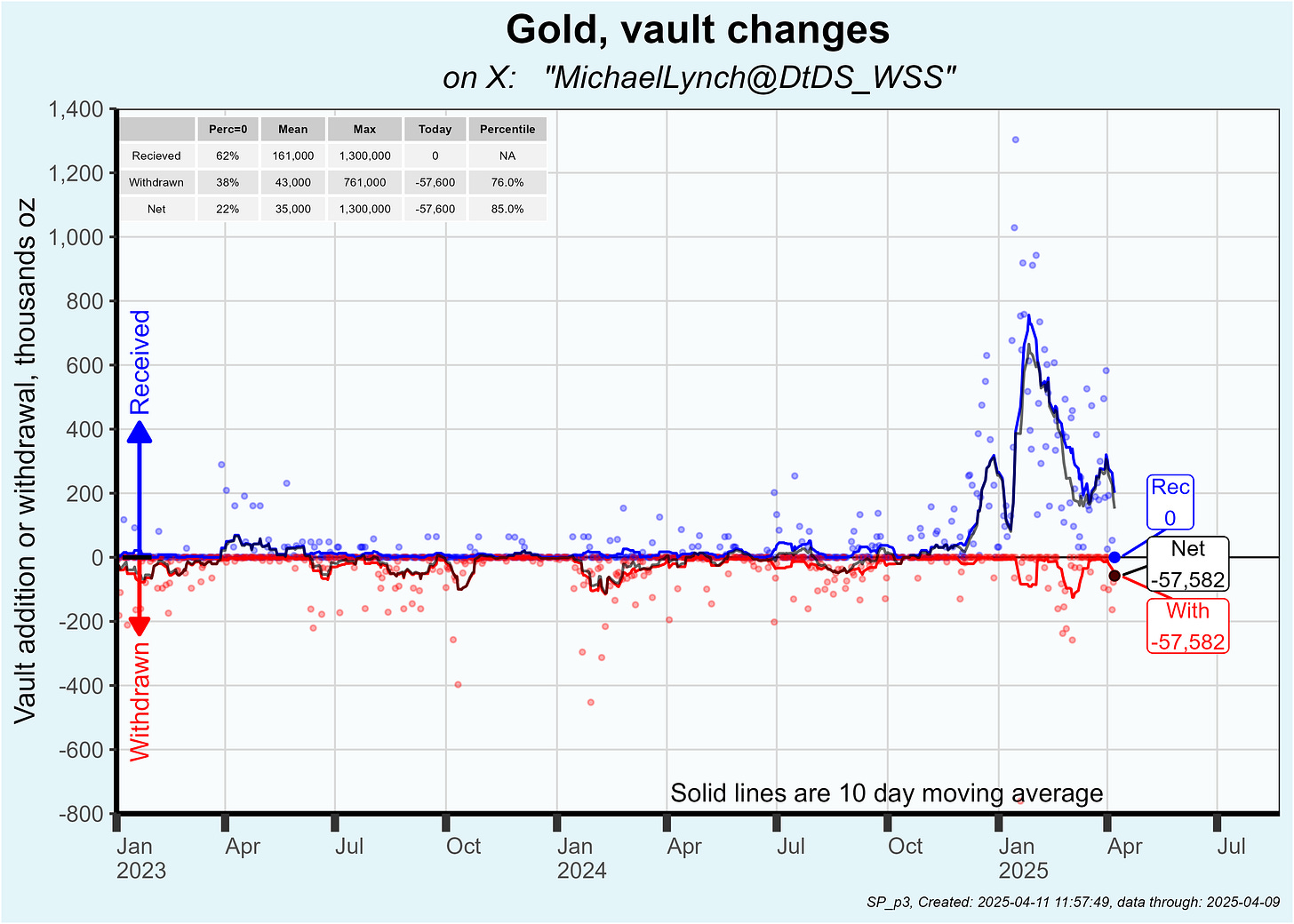

Gold delivered to comex vaults has slowed considerably. The 10 day moving average is now 202,000 oz per day. While that is high on a historical basis, it is well off the peak 10 day average of 700,000 oz per day in late January. Furthermore, the last 2 days have been zero, an event which hasn’t occurred this year.

Daily adds and withdrawals are plotted below along with a 10 (biz) day moving average:

The pivot point for this surge in vault activity was December 9. Since then, 28.0 million oz has been added. Of that, 17.9 million oz was transferred to registered and 18.7 million oz has been sold. Thus, of the gold that has arrived, 9.3 million oz hasn’t yet been sold.

Cumulative changes since December 9 are plotted below:

That remaining 9.3 million oz of unsold gold is roughly the sum of metal delivered for one recent active month and one recent inactive month. In other words, the remaining gold could be played out after the May and June contracts are delivered (May being an inactive month and June being an active contract).

I’m not predicting the vault will be scrubbed clean at that time … just pointing out the math. If the pace of metal arriving remains low AND the torid pace of buying continues there will be a supply demand crunch at some point.

And … the record pace of buying has NOT abated. In fact the number of contracts being written for immediate delivery on the April contract (which is now in the delivery period) are running at record highs. Over the last 6 days an average of 1,705 new contracts have been written each day for a 6 day total of 1,023,100 oz of gold.

See the plot below which illustrates that this rate of new contracts is about 8 times the average pace.

I find it interesting that this record buying over the last 6 days has occured with prices being extremely volital and at or near record highs. Longs want physical metal regardless of price slams or spikes.

If you have your gold … all you need is popcorn.

Hi Michael, Thanks for another great update!

I just posted this on your previous article but will repost again here. We might have a clue about what has been happening with silver.

Alasdair Macleod is telling a story from a mining conference he attended recently. All the silver miners were saying they are selling doré bars to JPM. They suspect that these bars are going to China for refining - which makes sense because the refineries in the West have no capacity at the moment - too busy with gold. So buying low grade silver at the mines becomes your "alternative venue".

At the same time, China is dumping silver on COMEX, to keep the price down. So that is HSBC's "Customer".

If China buys more doré bars than the silver it sells on COMEX, it is adding to its reserves with 'even cheaper' silver.

When China decides to stop playing this game...

Michael, Here is a new interview with Alasdair Macleod.

https://www.youtube.com/watch?v=ombzJqF6EK4

Start at 5:20 for just 1 minute.

Alasdair says he thinks that China is using its strategic reserves to control the market.

I am not going to name any names but I have heard from several people that China is suspected of being the 'whale seller'. All the banks are believed to be long for their own book. China is not 'shorting' silver, it is selling it... to control the price.