Is HSBC depressing comex price while accumulating gold and silver at non-price setting venues? It could work ... The Differential Lag theory explained.

And for whose benefit?

Summary:

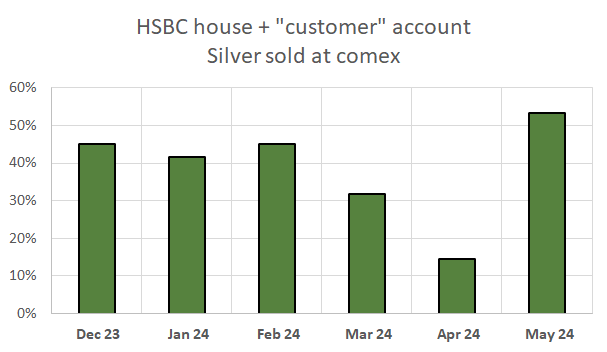

In numerous posts I’ve documented the anomalous and extreme selling by HSBC (Hong Kong Shanghai Bank Corp) accounts at comex over the last 5 months. Here is a recent post:

https://econanalytics.substack.com/p/that-hsbc-customer-account-issues

And chart:

It seems natural to couple that fact with the idea that the Chinese government and public are buying substantial gold and silver. I’m proposing a theory … I’ll call The Differential Lag Theory … on how and why these events could be connected.

I believe a savvy player can acquire gold and silver around the globe while suppressing prices at comex, the price setting exchange, as a way to minimize the price paid and acquire the most gold and silver. If this is occurring, this would be a signal that a repricing of gold and silver is not far off as the incremental demand will eventually impact the price setting market.

Differential Lag Theory

In this theory a participant (in this case HSBC) would buy metal from dealers and exchanges around the world while simultaneously selling some fraction of that metal at comex. I’ll assert that a savvy participant can accumulate a substantial metal position AND contain price increases within a lagged time period.

Comex has been, and currently is, the only price setting market. The key element is that sales at comex cause immediate downward price pressure while buying at other venues (all of which are currently price takers) would eventually induce upward price pressure but at reduced impact and with a time lag.

Exploiting this lag mechanism would allow a participant to acquire metal at a reduced price for a period of time. At some point the overall net increase in demand will impact the price setting market (comex) and the price equilibration would occur.

Another key concept is that comex’s physical market is much smaller than the sum total of transactions around the globe (non-price setting venues). All trades at comex aren’t the same. I could write a chapter of a book elaborating on that but for the moment … I’ll assert that trades on the contract within the delivery period are much more significant than paper trades on contracts outside the delivery period. Paper trades dwarf physical trades by about 1000 to 1.

Consider this … typically spot prices and futures prices follow a precise relationship based on treasury rates, spreads and transaction costs. See the plot below which illustrates this for a moment in time. It would be another chapter of a book to explain, but this is a typical futures trajectory.

The points on that plot are only based on market equilibrium for each contract. In that sense they are independently priced by trading in each specific contract. However, if any one of those futures contracts move off the curve, arbs have an opportunity for profit. Arbs can then trade combinations of futures contracts to achieve a (nearly) risk free profit when equilibrium is re-established … and equilibrium IS established by the arbs because they can write an infinite number of contracts.

The net result of all that trading by the arbs is that futures contracts follow a precise, predictable relationship dependent on each other. The prices of each contract is essentially tied at the hip with other contracts.

One thing to point out … arbs do not concern themselves with the ambient price level but only the tendency of each contract to align on the slope.

So which contract controls the ambient price level? In math jargon this would be called the y intercept on the above plot. In comex jargon that is the spot price. I believe that in normal market conditions control varies through time. However, (drum roll) the contract in the delivery period (and the spot market) are the ultimate controller of the ambient price level. A savvy player can ensure that.

The reason is that infinite futures contracts can be written, but the contract in the delivery period can only be settled between 1) a short with registered metal in a comex vault (or metal that can be moved to registered before contract expiry) and 2) a long who is able and willing to pay in full for physical. Thus, the size of that physical sub-market is much smaller than the paper market … the paper market being all the paper traders, hedgers, arbs etc. in the contracts not in the delivery period.

To restate all that in plain language … a savvy player can control the comex price with transactions of spot and the contract in the delivery period as the physical market has ultimate control over the ambient level. That flies in the face of comments by others who believe the paper traders have ultimate control. However, in the case of a large persistent physical seller or buyer … those trades will control the market. Why? If the prices of futures contracts outside the delivery period do not subsequently align with a specific price trajectory (based on treasury rates, spreads and transaction costs) those contracts will be met by an army of arbs which can then make risk free profit with a series of trades.

Not sure that’s plain language, but it’s the best I can do. It ain’t simple.

The pertinent point is that ultimate control of comex pricing can be determined by this much smaller physical market.

And that sets up my ultimate point … the key element of my Differential Lag Theory is that a savvy player can control the price setting market at comex by a modest scale of physical metal transactions. All other venues around the globe (which are all currently price takers) are much larger than this comex physical submarket. Thus a savvy player can sell physical at comex while accumulating metal at a depressed price around the globe (at the price taking venues). The procedure will work for some time period until the overall increase in net demand eventually impacts comex’s physical market.

Some economist likely wrote about this a half century ago … so if you know of a proper name for it, let me know. Otherwise, I’m going with the “Differential Lag Theory” tag. It is all based on the time lag between the price setter and the price takers … really not that difficult of a concept.

Conjecture

OK, so now what? I don’t know … but I can guess. I’m speculating that some entity operating through an HSBC “customer” account (and most recently HSBC’s house account) is running this plan. While I know the firm name and number from the comex Issues and stops report, I don’t know who the planned beneficiary is … who is buying metal from the price taking venues at the reduced price? I’d suspect that it is the same HSBC account (of course). But other intended beneficiaries could be the Chinese government and citizens.

In addition, since this scheme has a time limit … that could infer that a planned repricing is imminent.

Just throwing this out there … consider the scenario where the Chinese would swap treasuries for gold. If they did it in a day, they wouldn’t get much gold because in the first 5 minutes of the day the dollar would collapse and gold would shoot the moon. Obviously they are going to do it slowly to maximize the net gold acquired. In addition there will be manipulation and obfuscation involved. This Differential Lag Theory could be one of several strategies they could deploy before the repricing event.

Hi, you might be familiar with " Bai" from China. He's a metals guy followed by many in the community. About six months ago, he said that " agents" on behalf of a humongous Chinese company, Chengtagh ( spelling) has been shorting the Conex for the purpose of buying physical as cheaply as possible. That company accumulates for both the government and private investors. They could very well be doing what you suggested at this point if they felt it more efficient. Hell, maybe they're doing a hodgepodge of things to gather as much metal as possible.

Imminent being a week, a month,a quarter?

I read it as next 1st day notice