It is blowout demand by comex customer accounts driving gold and silver ... nothing else

And EFP spreads are caused by comex demand, explained herein

February 7, 2025 10:30 AM

A lot has been said about gold and silver leaving London, arriving at comex vaults, EFP spreads increasing and “shortages” of metal. I believe that the cause and effect hasn’t been understood and the root cause hasn’t been stated. Well, well … allow me to weigh in on all that! My interpretation of events is as follows:

1) In early December Comex short position holders, generally bullion banks, recognized a sharp increase in customer accounts readying to stand for delivery on the gold and silver contracts. Since many of those banks are also brokers and insiders, this information could be discerned from non-public data such as details on those customer accounts readying cash for delivery and requests for exceptions to position limits.

2) Instead of bullion banks just exiting short positions to protect their short position, bullion banks prepared to deliver metal. Why didn’t they just close to avoid the buying deluge? That’s an answer for another day. Covering shorts would certainly have resulted in a price spike.

3) Typically much physical settlement activity has been banks tossing metal back and forth to each other. That results in much of settlement activity over time being the same metal passing from bank to bank. With the upcoming deluge of customer accounts prepping to stand for delivery, banks did not have enough bullion in comex vaults to handle the upcoming deluge. Furthermore, banks know that customer accounts are much less prone to re-selling newly bought physical. Non-banks don’t flip metal as banks do.

4) Banks began sourcing metal from their London vault holdings either moving metal they already owned or buying metal in London and then transporting it to comex vaults in the NYC area.

5) Comex vault reports show that metal began arriving in the second week of December.

6) Delivery activity to customer accounts came to fruition. New contracts written for the December silver contract soared as 1,700 contracts were written over the last 3 weeks, one of the highest ever. The same happened to gold. The buying wave continued into the January contract with delivered gold contracts topping the prior record by nearly a factor of 2X. Silver also had one of the strongest delivery periods on record.

7) The buying wave continued into the February contract where the number of gold contracts standing for delivery exceeded comex’s prior record by 25%. Furthermore, new contracts written since first notice day are also into record territory. The February silver contract is also on target for a record.

The amount of gold delivered in the last month would have nearly wiped out registered gold at comex had metal not arrived at comex:

8) Most importantly, the rush to buy metal is driven by non-bullion banks. So far just one week into the February gold contract, over 2 million oz has transferred from bullion banks to customer accounts. That exceeds the entire total for any prior contract by more than a factor of 3.

This is a record wave of buying by non-bullion banks.

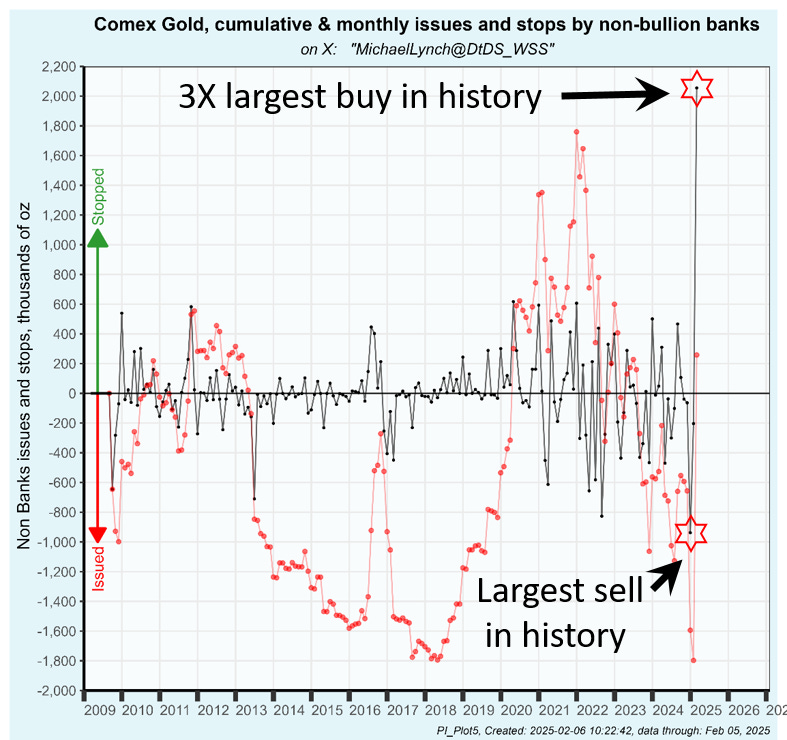

Much of what I discuss above I’ve shown in recent posts at my substack account. See those posts for the backstory. To illustrate the rapid change in non-bank demand (point 8 above), which is the key to understanding the market right now, see the plot below:

For each contract I’m showing the non-bank net buying (black line). This is the total metal bought less metal sold. To clarify, this is physical metal as shown in the issues and stops report (not the commitment of trader report). Since the monthly net buying has some chatter, I calc’d the cumulative net gold bought by the non-bullion banks (red line) which illustrates the buying/selling trend.

Things to point out … the net buying by customer accounts on the February contract at over 2.0 million oz has exceeded any other contract in comex history by more than 3X. In addition, the largest net sell by non-bullion banks was only 2 contracts prior. This 2 month change is enormous.

Next plot … I identify the periods where non-banks were strong net buyers (green shaded areas) and sellers (yellow shaded) and correlate that to gold price. As you can see it is apparent that net buying or selling by customers accounts often correlate to gold price. I’d suggest that the customer account buying caused the price increases.

So, we’ve just seen the largest change in direction of customer moving from a strong sell to a record buy. This plot suggests a huge buy signal. As of yesterday’s comex reports, the buying deluge continues. I’ll bring you updates in the days to come.

Forgot to mention … tariffs have nothing to do with this. This is all about customer accounts at comex thirsty for metal.

I should just stop there, but I want to address the EFP spread situation. I see this as a mix up of cause and effect. EFP is not causing the market turmoil, nor is the inability of the Bank of England to move metal. The core reason is the surge in customer accounts buying metal at comex.

Cause and effect. The EFP spread blew out because of the surge in buying in NYC AND there isn’t enough metal to settle those longs. If there was enough metal at comex, there would be no price disengagement with London spot.

A deeper dig into the EFP spread … it is “normal” only during a stable market. See the plot below which shows spot price and 4 futures contract. In a stable market at equilibrium the relationship of those prices will be driven by short term treasury rates, spreads and trading costs.

In this example an EFP spread between spot and the futures contract 67 days to delivery was $21.30 (illustrated below). However, comex and London are 2 separate markets. In the event of a disequilibrium they will not trade in an orderly fashion.

If a surge in physical demand occurs in NYC, comex futures prices will increase … see below:

In this example the EFP spread increases to $31.50 … more than treasury yields, spreads and trading costs would predict. It’s only because London and NYC are, in teh short term, 2 separate markets.

An EFP increase:

1) Illustrates that in the short term comex and London are 2 separate markets.

2) Does not indicate a shortage of total metal, just a shortage in comex vaults. In this case that is due to the surge in demand by customer accounts. The same thing happened in early 2020 in the aftermath of QE infinity. There was a surge of buying at comex, although banks participated in that demand surge.

3) The increased spread incentivizes someone to move metal from London to comex vaults.

My key point about EFP spreads is … the main driver in the market right now is the surge in buying by customer accounts. That is what is causing EFP spreads to increase. Cause and effect.

I was thinking last week it might be the FED and/or the US gov that wants the gold back on US soil.

And just two days ago a guest at some YT channel i watch frequently, was saying that same thing.

Listening to the new administration's occasional comments this looks to have some merit. And it would be wise too.

What do you think?

When you say customer accounts, can you just clarify that for me with an example?