It's different this time. Very different.

Massive UPWARD revision doubles the number of gold contracts standing for delivery to 2x blowout levels.

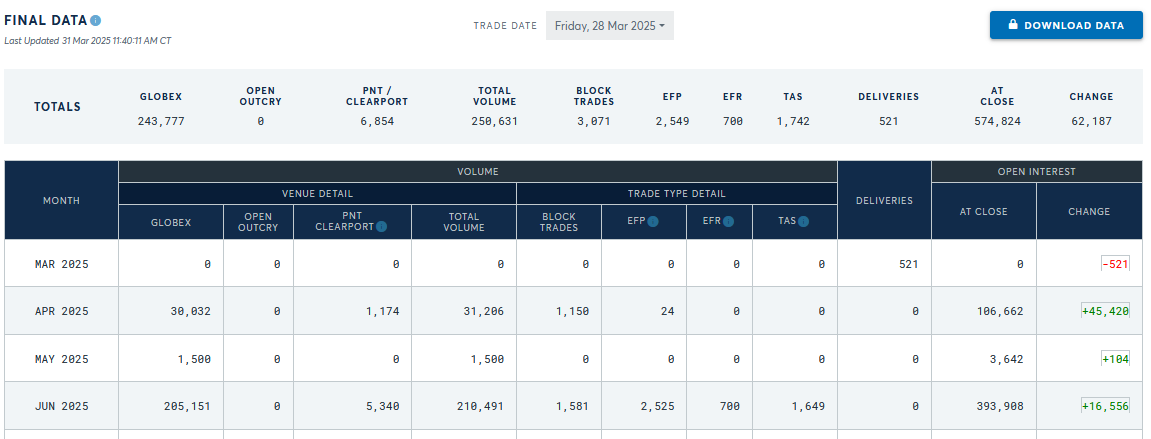

Maybe the final print of today’s CME gold report for trading on March 28 will be revised. The final report shows that the open interest on the April gold contract increased by 45,420 from the preliminary report to 106,662 contracts. March 28 was the last report before first notice, so that is a doubling of metal set for physical delivery.

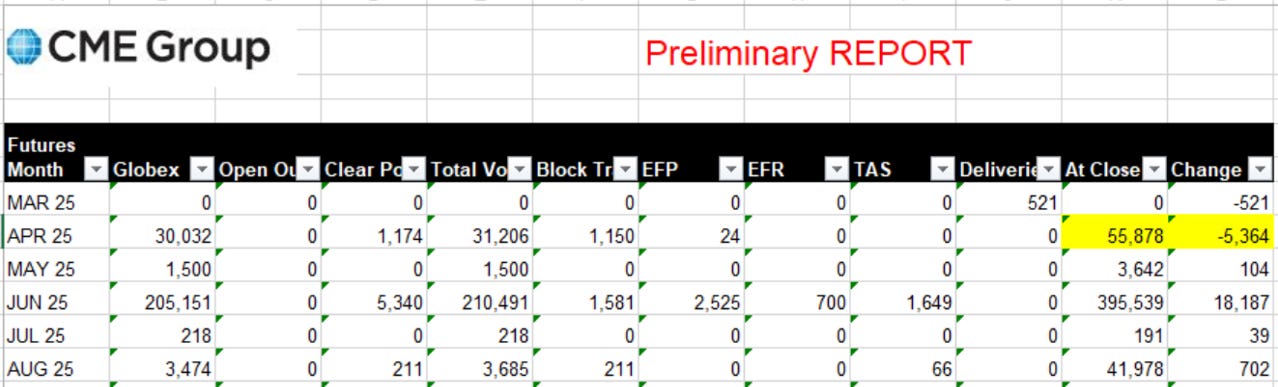

Final and preliminary reports are as follows:

The final data is suspect because total trading volume is shown as 31,206, so an OI increase of 45,420 appears inconsistent. That said … comex reports are often inconsistent. Apparently there is off exchange trading which doesn’t impact reported trade volume but shows up in open interest.

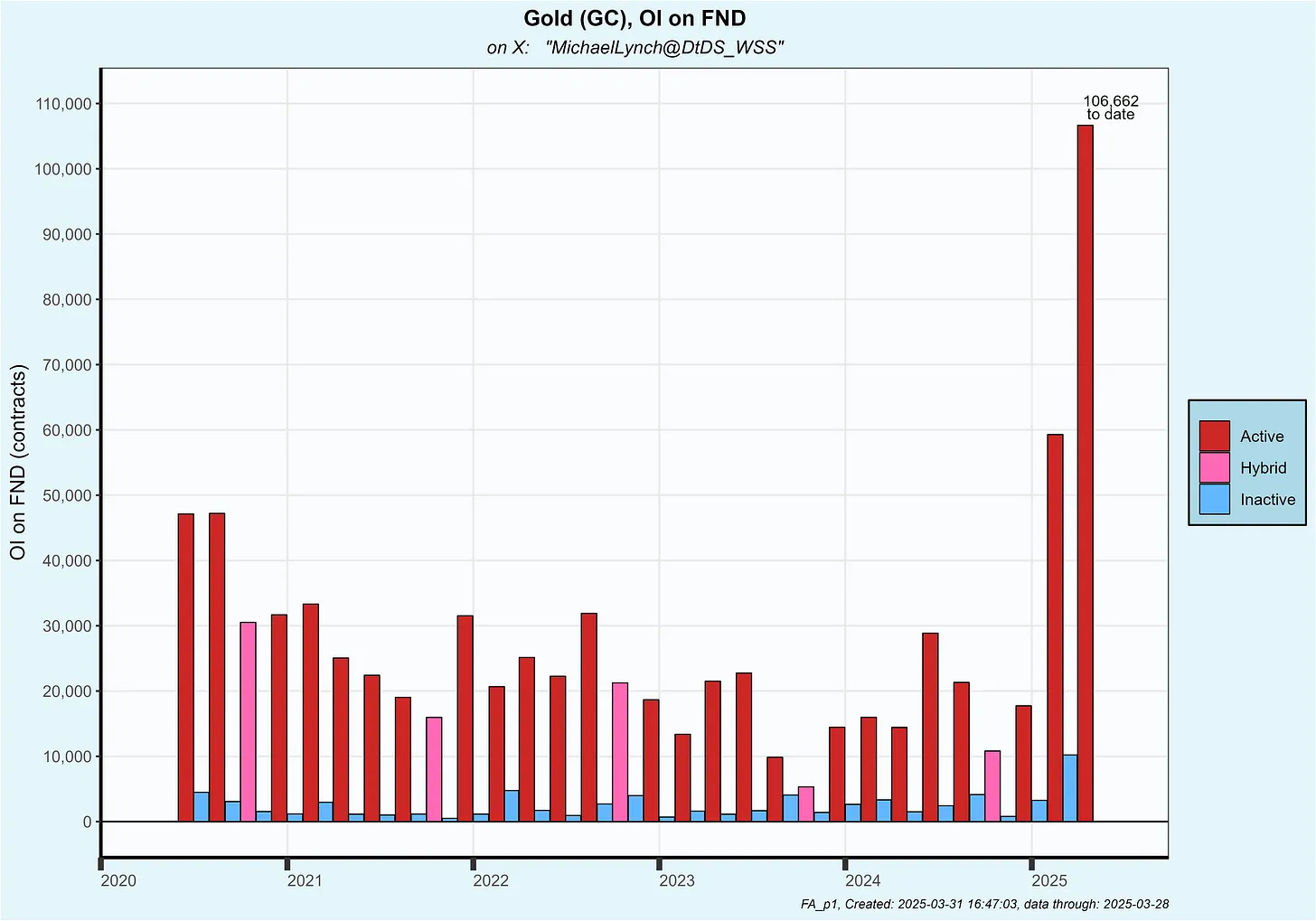

If this report is legitimate, the 106,662 contracts standing for delivery would be nearly double the prior comex record as you can see below:

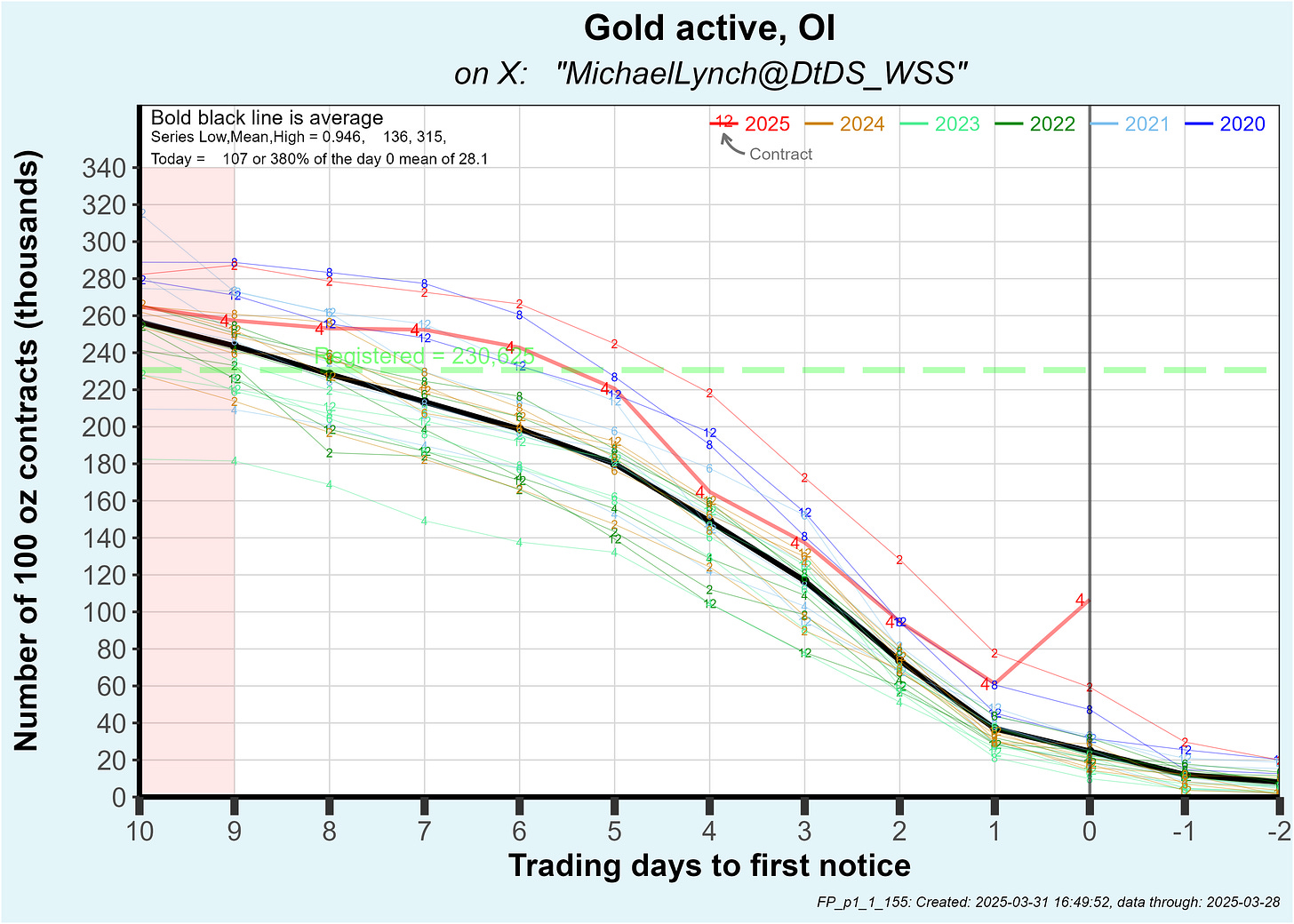

It certainly was a change in direction from prior contracts:

As a reminder, a preliminary report is printed about 10:00 PM each night (Monday through Friday). The final report prints at about 10:00 AM Monday though Friday). So the preliminary report for trading on Friday March 28 was released Friday night and the final on Monday morning.

The preliminary report showed a typical 5,364 contracts closed during the final day and 55,878 contracts, the second highest on record, stood for delivery.

Statistically, the final print has a reduction in contracts standing for delivery compared to the preliminary report. In the days at the start of the Ukrainian war, the March 2022 contract went into delivery and there was a massive DOWNWARD revision which saved comex from default. I called BS on this and did a video with Tom Brodrovich of Palisades Gold Radio regarding this default. In my opinion, longs were sequestered and told to roll position as there wasn’t enough metal.

https://www.youtube.com/watch?v=Kn1epXKqzVY

This situation is completely opposite as the final report shows a huge surge in contracts standing for delivery. The only logical explanation (besides a reporting blunder) is that there was a lot of off exchange dealing over the weekend between the prelim and final reports as longs initiated contracts with shorts. The new contracts arrived on the final report as open interest.

If that’s true … this new group of players is an entirely different kind of buyer. Apparently, these new buyers will not be denied physical gold.

Thanks Ditch! Praying this isn't a typo / mistake but, considering how much focus the gold market has right now and the scrutiny the LBMA was under with their T+40 settlement / default, I don't think this is a mistake at all but, like you say, is a result of the boiler-room deals.

Are you coming around that for such a big buyer “not to be denied physical”, it perhaps is the US Govt?