Massive vault moves from London to the USA could expose the gold and silver paper charade

All because of a rumor about tarriffs

Jan 29, 2025 2:00 PM

The comex / LBMA paper charade could soon be exposed by the vault moves triggered by the possibility of tariffs. This could expose the dearth of physical metal underpinning gold and silver at ETF’s and the price setting venues.

Tarriffs vs Vaults

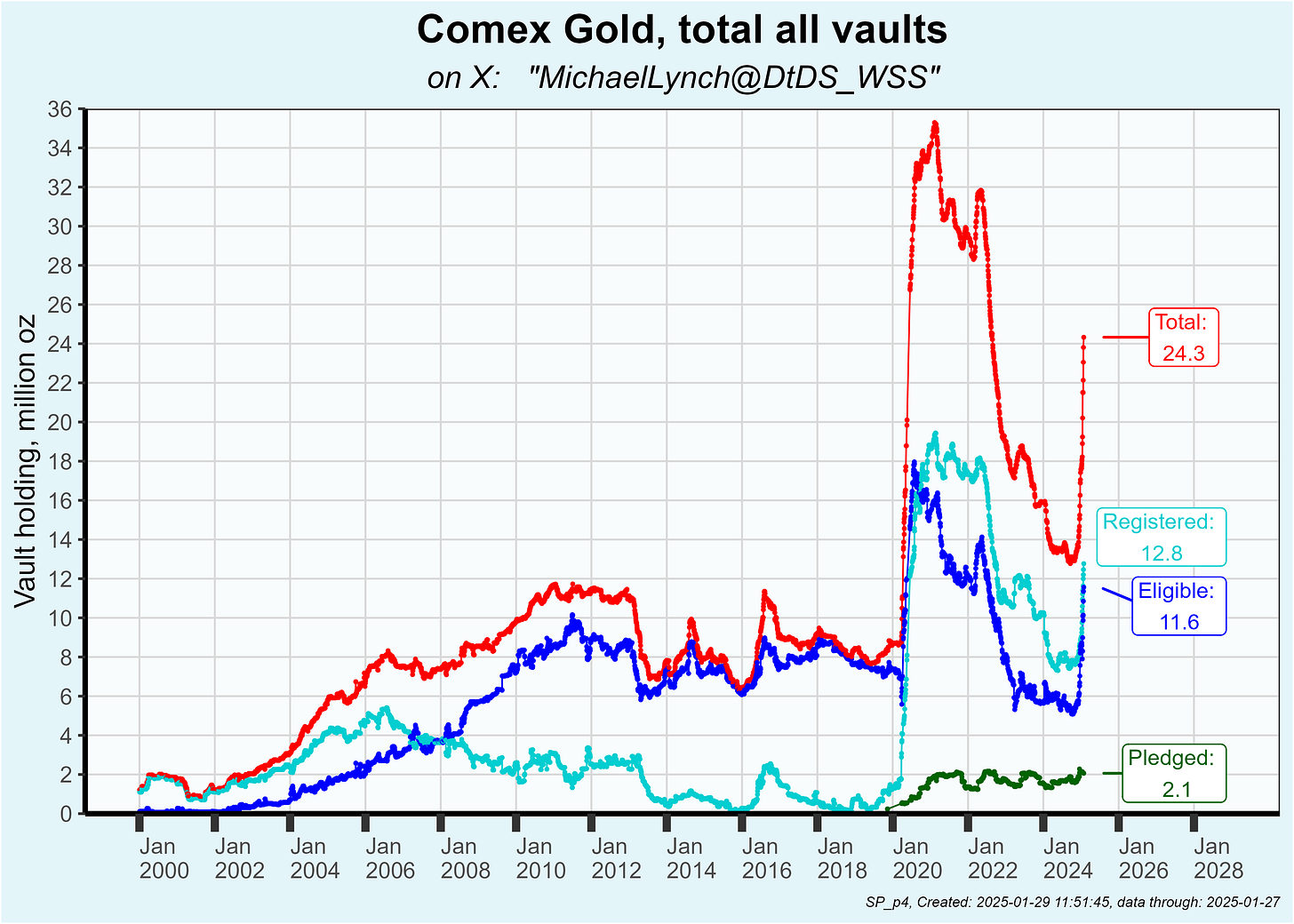

The threat of tariffs is apparently causing metal movement from London’s vaults to vaults within the USA. Comex publishes vault holdings daily on a one day lag thus it is readily apparent that a metal surge into comex vaults is now occurring. As shown below over 11 million oz of gold has entered comex vaults in the last few weeks:

And silver is up about 40 million oz:

Where is it coming from? Almost certainly LBMA vaults. Unfortunately LBMA vault totals are published only monthly and on a 5 week lag. It won’t be until early March when the January data is published.

Hours ago The Financial Times published a piece saying the wait to withdraw bullion from the Bank of England has risen from a few days to between four and eight weeks.

https://www.ft.com/content/86a5fafd-603e-4ee1-9620-39b5f4465f53

So what you may say? Most metal for ETF’s are vaulted in London … at least that’s what they report. Metal for those funds is assumed to be present and owned by the funds. For example, BlackRock’s SLV trust publishes a 5000+ page list daily of each bar associated with the fund. FYI 77% of that total is in a single JP Morgan vault in London with the balance being in a single vault in NYC. One entity controls all that information.

Back to the SLV 5000 page bar report … why do they do publish that? It’s smoke and mirrors. The funds prospectus CLEARLY states that the fund is not an investment in silver.

SLV is only a silver tracking stock. It’s a paper investment. There is no way for an investor to get metal out of SLV. Someday SLV holders will be cashed out with fiat bucks at Friday’s close. Meanwhile gold and silver were repriced on Monday AM.

The SLV bar report? It’s almost certainly rehypothecated metal either leased or sold to other parties. Does the metal exist in the specified vaults? Probably, but that metal is likely owned by others. I suspect that the terms of the lease or sale were likely conditioned that the metal would remain at the specified vault. That way, the charade could continue. Would the buyer care? No … it’s gotta be vaulted somewhere. The net is … the metal does not, in essence, back the trust. The bar report is a pacifier.

Want more on that … my analysis on SLV:

https://www.reddit.com/r/Wallstreetsilver/comments/mhc7s5/ishares_slv_trust_is_toxic_to_all_silver/

Continuing on … if London’s vaults continue to drain, the remaining vault total could diminishe to the sum of the ETF’s stated metal. As the LBMA market continues to function it will become apparent that the ETF’s are not backed by metal. That will trigger an exodus of ETF holders selling their shares. Charade is over. Physical is all that matters as paper holders get burned.

This nearly occurred during 2021. You may recall that during the silver squeeze an incremental, new 120 million oz of silver was identified as being part of SLV. I’m avoiding say that 120 million oz was bought by the “Authorized Participants” and moved into the trust because it was just a spreadsheet entry. Yes, new paper SLV units were created but 200 trucks of silver did not arrive at LBMA vaults delivering physical metal as that would be impossible. BlackRock modified the prospectus to say:

It is possible that Authorized Participants may be unable to acquire sufficient silver that is acceptable for delivery to the Trust for the issuance of new Baskets due to a limited then-available supply coupled with a surge in demand for the Shares.

In such circumstances, the Trust may suspend or restrict the issuance of Baskets. Such occurrence may lead to further volatility in Share price and deviations, which may be significant, in the market price of the Shares relative to the NAV.”

See Ronan Manly’s piece at BullionStar for more info:

https://www.bullionstar.com/blogs/ronan-manly/silversqueeze-hits-london-as-slv-warns-of-limited-available-silver-supply/

What was actually going on was that the metal shown to be owned by SLV was on the brink of exceeding LBMA vault totals. That would have exposed the charade so BlackRock had to issue the statement.

What is happening now is the same situation except from the opposite direction. Instead of ETF “holdings” increasing, the non-ETF metal is vacating LBMA vaults. If this were allow to occurr, a functioning LBMA market would expose that the ETF’s are not backed by metal. All paper metal products would plunge and physical metal would soar.

For that reason … this won’t be allowed to occurr. However, just like during the silver squeeze, we will see the behind-the-scenes action as the curtain is pulled aside.

Fantastic analysis. Looks like a lot of gold is moving just like it did before they released Covid.

BoE, the "Bank of Empty"