Nobody is selling gold and silver as only one seller accounts for 99% of gold and 94% of silver delivery notices on the November contracts.

The path to zero ask?

October 21, 2024, 10:16 AM

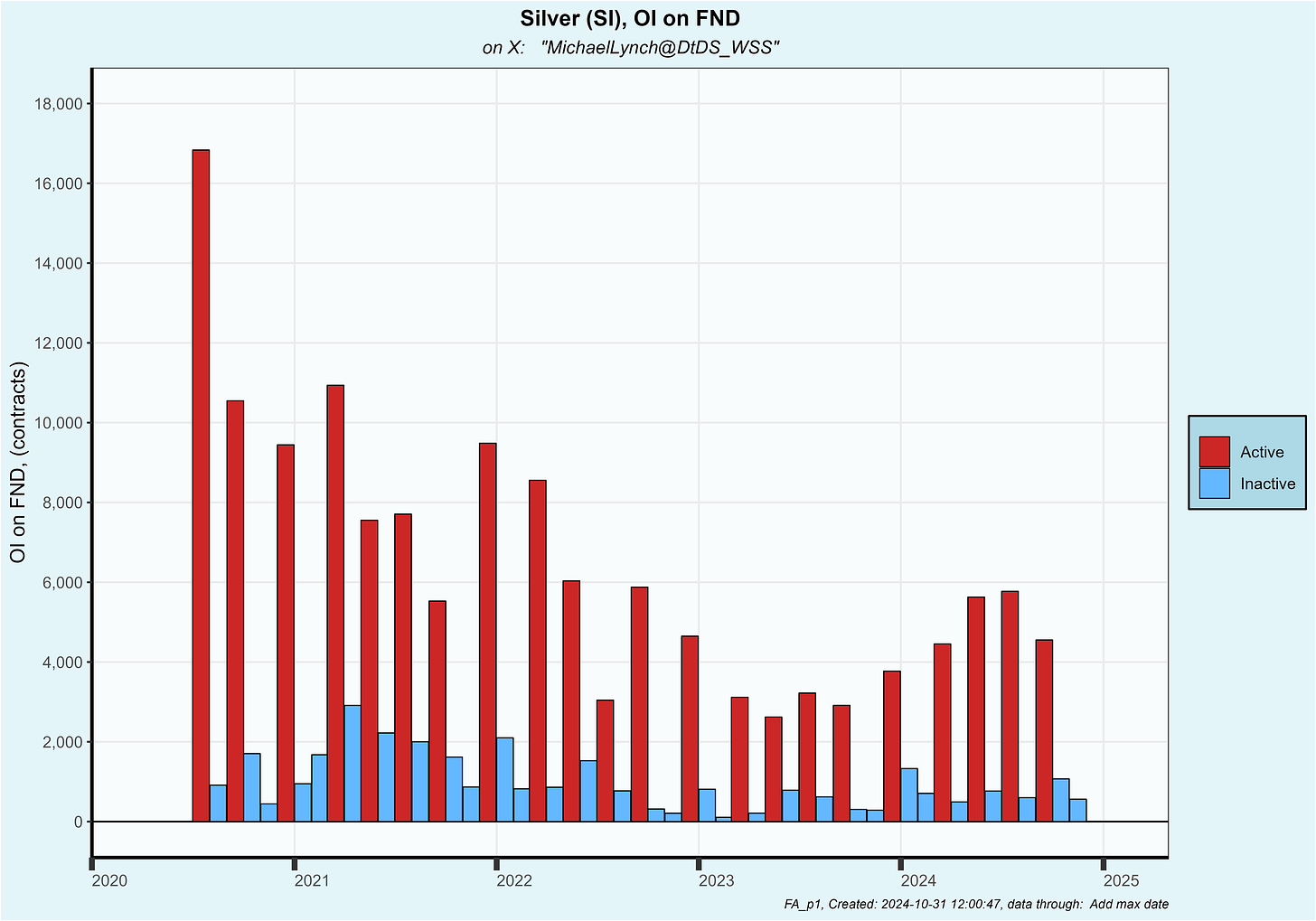

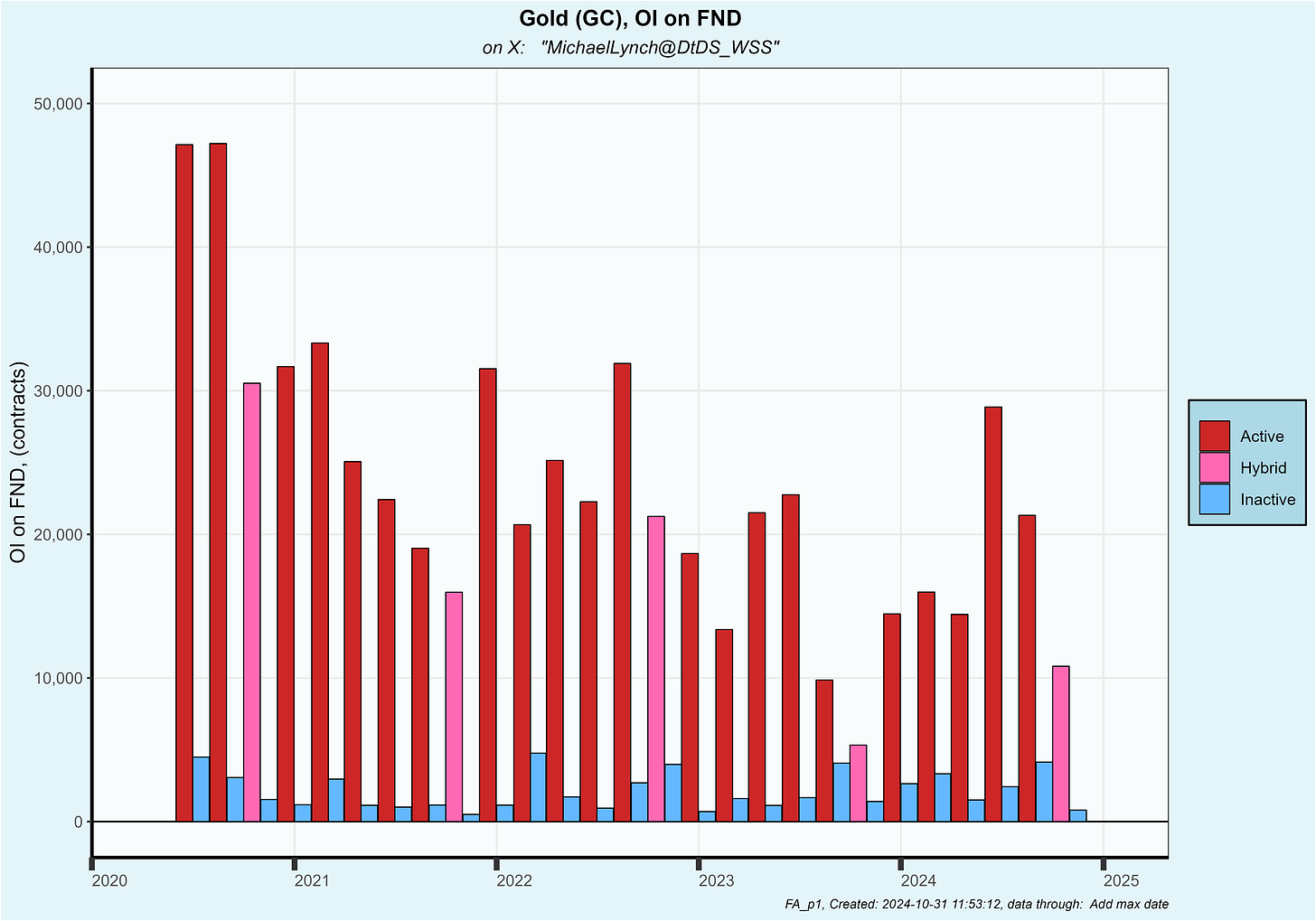

Yesterday was first notice day on the November gold and silver contracts. Both are inactive months an occasion which only occurs in January, October and November of each year. But there’s an asterisk on October … October is officially inactive, but the open interest typically is much greater than an inactive month but less than an active month. Apparently this is due to some traders preferring to roll positions just 2 months instead of 4. If October was skipped, a 4 month gap would exist between the active contracts of Sept and Dec. See the schedule below.

The net of all that is that November are void of an active contract.

++++++++++++++++++ Silver

562 contracts (2.8 million oz) stood for delivery. For inactive contracts that is down 48% sequentially from Oct but almost double last November. OI on first notice day is plotted below.

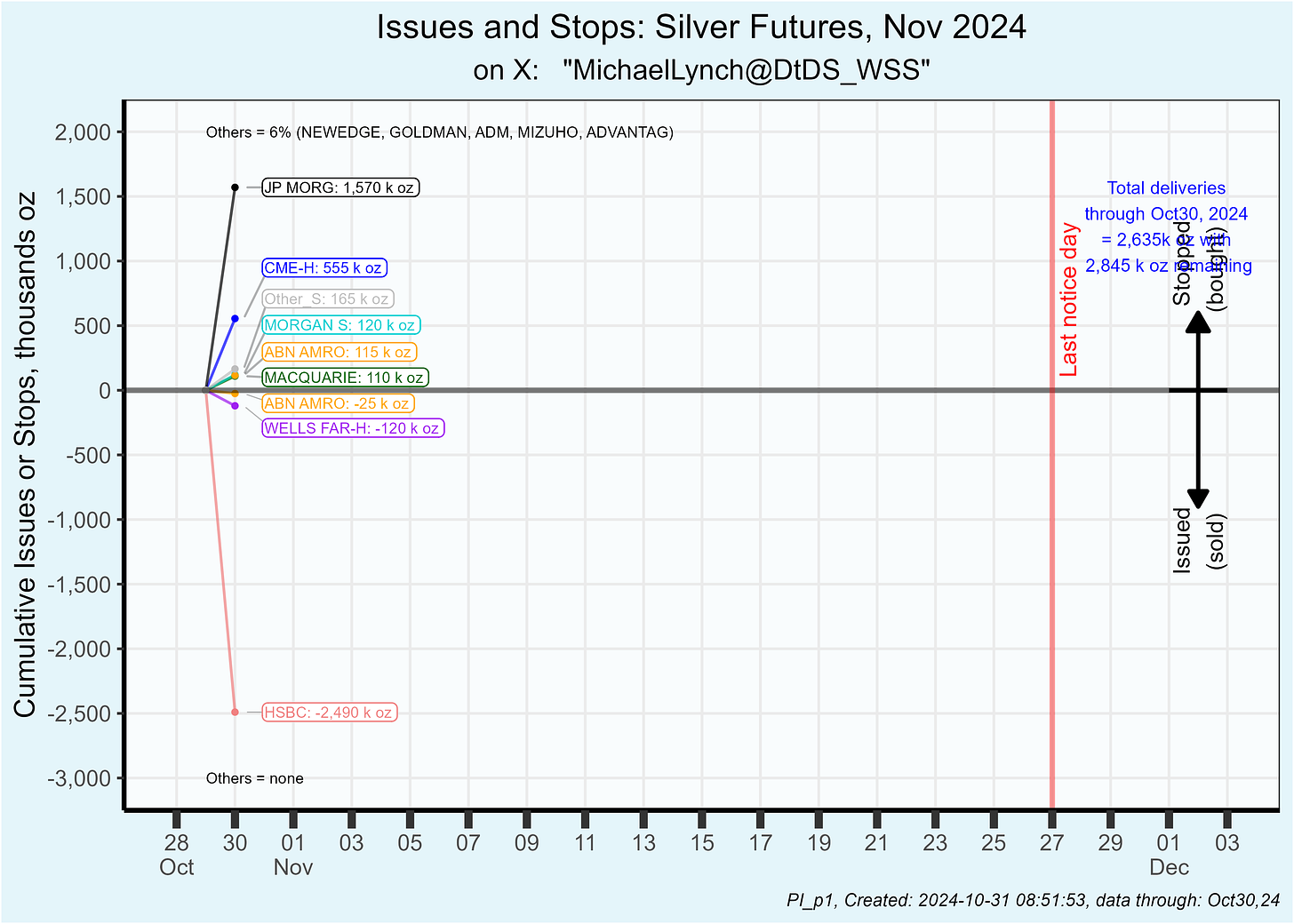

Delivery notices were issued on 527 contracts or 94% of the 562 standing for delivery. Typically first day delivery notices amount to about half of the contracts standing for delivery. With 94% of contracts settling, there probably won’t be any naked short drama.

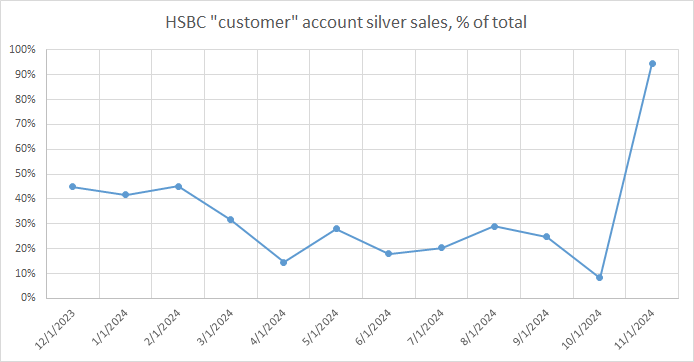

Once again shorts are dominated by one party. And once again that party is the HSBC “customer” account who issued 94% or 498 of the 527 delivery notices on the first day. That percentage is a new record of short sale dominance for this HSBC “customer” account:

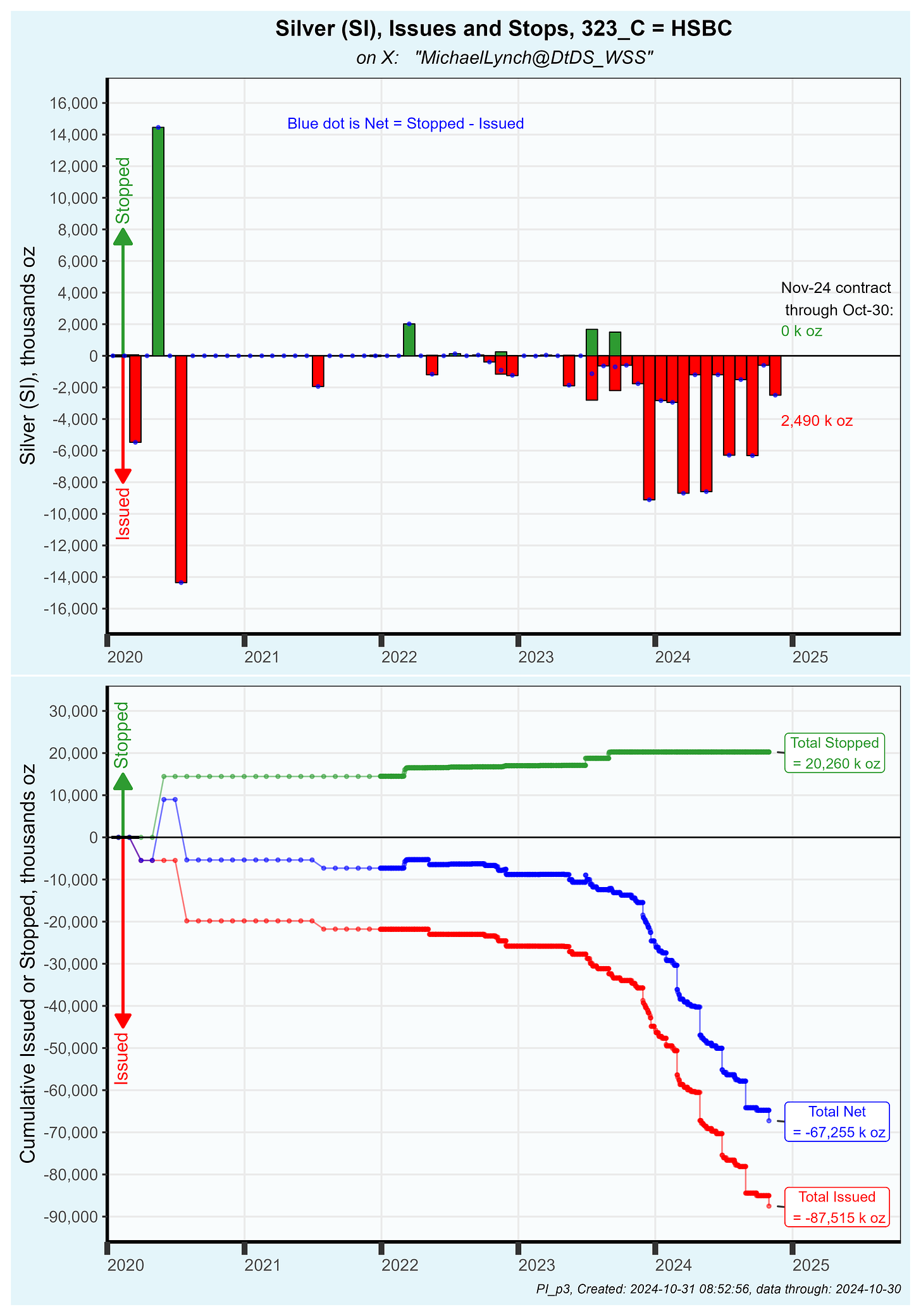

If you haven’t followed the HSBC “customer” drama, you ought to catch up with my prior posts. This HSBC customer account commenced uncharacteristically high sales in December of last year as you can see below:

Since then this HSBC “customer’ has sold 51.7 million oz of silver and not bought one oz. As a reminder, the customer account category is an amalgamation of all customers, so this could theoretically be more than one party, however I am convinced it is one entity as trading and patterns are uniform … no silver purchases, vault moves at mostly Asahi’s vault etc.

Back to the Nov contract … the largest buyer was JP Morgan customers who stopped 313 contracts (1.6 million oz). The cumulative positions issued or stopped for the Nov contract is shown below:

The net from all this is … the rush for physical has yet to occur. I’ve been waiting patiently for physical deliveries to jump and that hasn’t occurred although November isn’t a bellweather month as I discussed above. We will get a better signal on the December contract as both gold and silver are active months.

+++++++++++++++++++ Gold

800 contracts (2.5 tonne) stood for delivery on the November contract. That is far below the 4,142 contracts that stood for delivery on the most recent inactive contract (Sept) and far below last November’s tally of 1,399. This is the lowest number standing for delivery since the 698 in Jan 2023. OI on first notice day plots as follows:

Obviously the rush for physical gold hasn’t begun either. That said … this can be interpreted as nobody buying OR nobody selling. The fact that the gold price IS rallying, one could take the latter interpretation that nobody wants to sell. In that case a higher gold price is required to coax metal out of the hands of existing gold owners. That’s nothing more than describing market equilibrium so big deal on that thought. However … if a reduced number of players are willing to sell, then it would follow that prices will be more sensitive to the quantitiy of buyers. In that case an increase in buyers would have a disproportionate impact on price. So, oddly low physical trading at these much higher prices may be a bullish signal. This could be the path to a zero ask scenario.

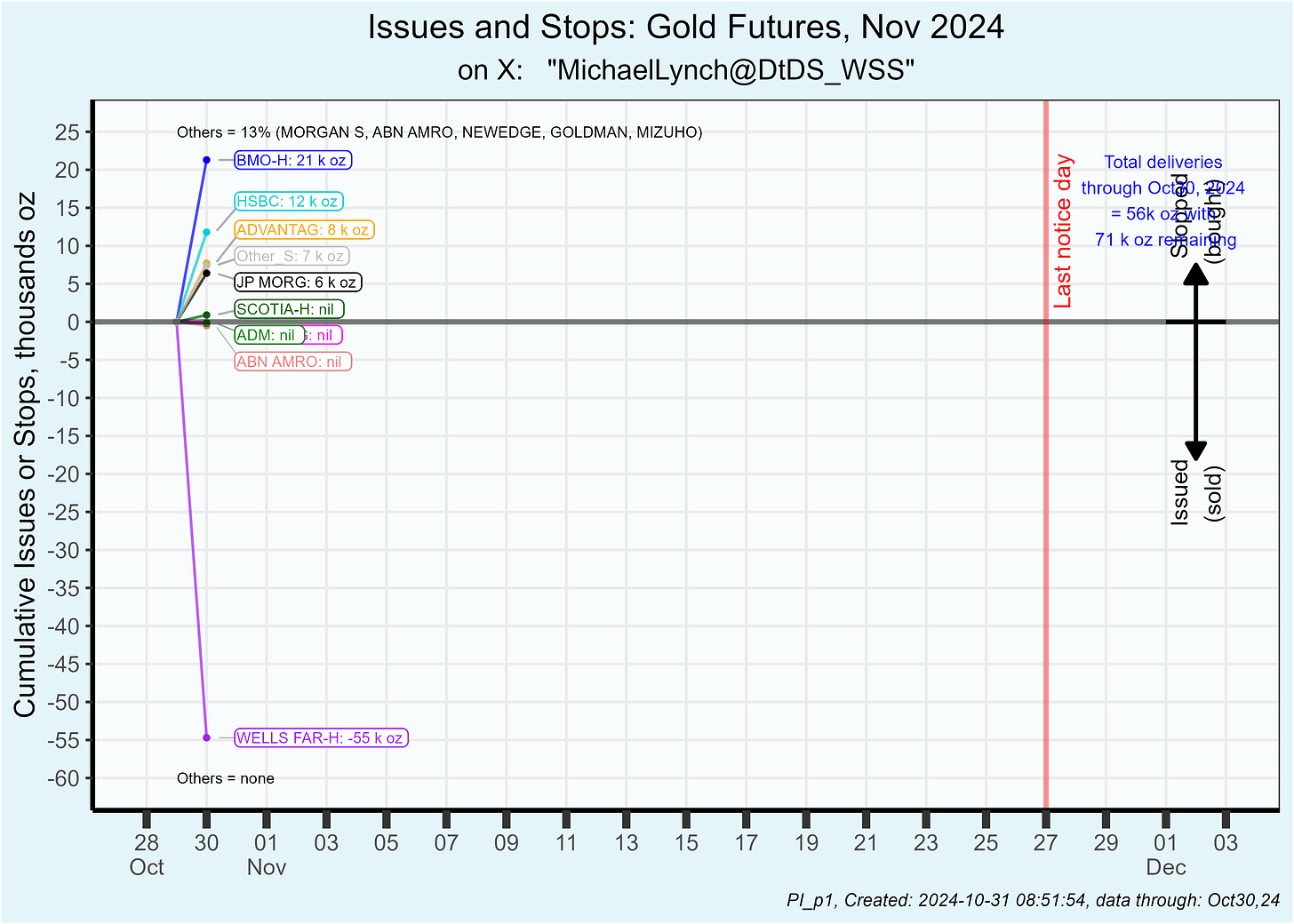

Delivery notices were issued on 555 contracts or 69% of the total standing for delivery. Wells Fargo’s house account issued 547 or 99% of the total issued on the first day. Like silver, physical sales were dominated by one player.

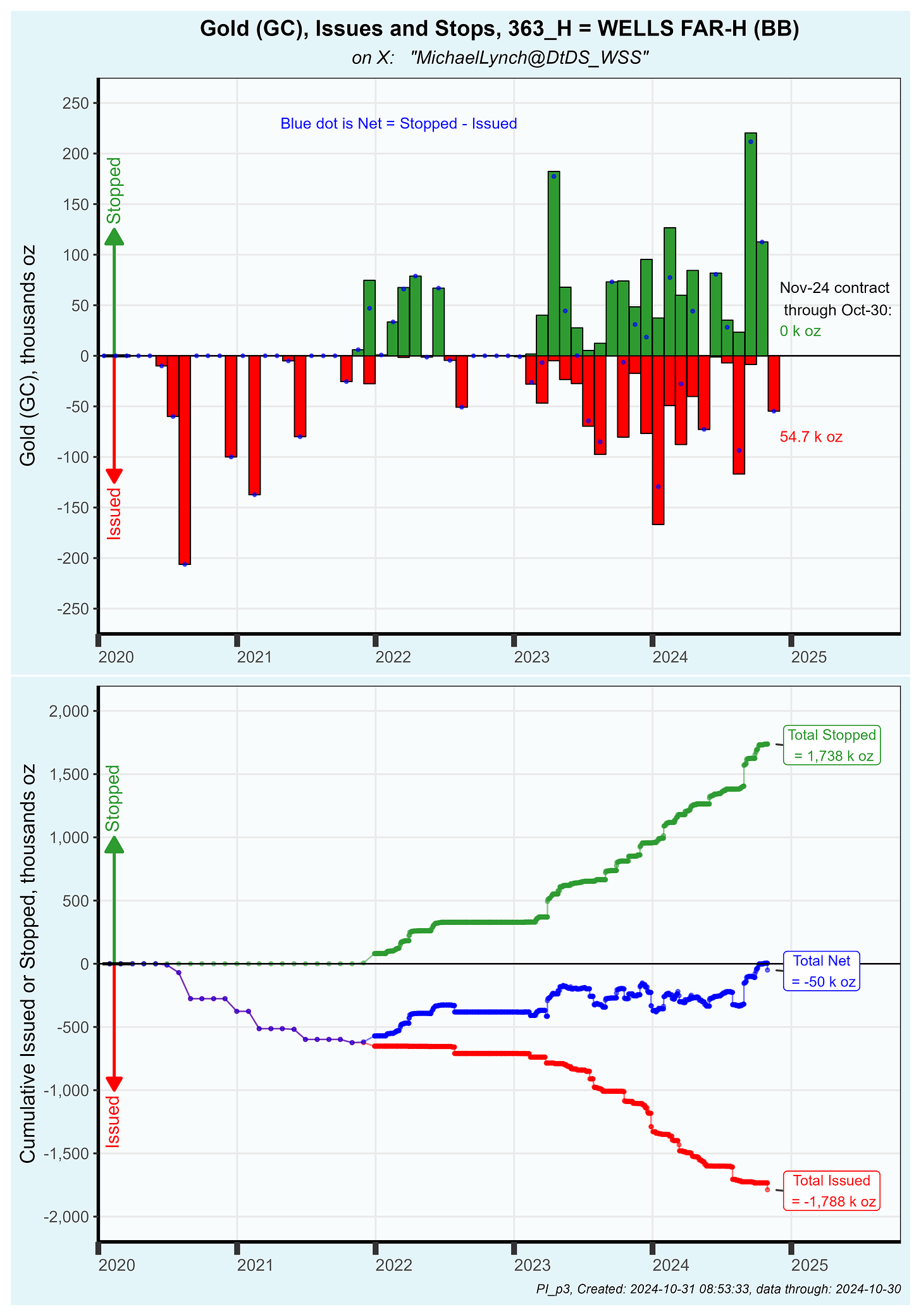

Well’s is generally a gold trader as their cumulative net position hasn’t changed much in recent years. In fact this sale drives their position toward their average holding volume as you can see below. It doesn’t appear that Wells’ activity is a change in philosophy, but just a routine trade.

BMO’s house account (Bank of Montreal) was the largest buyer stopping 213 contracts. The next largest buyer was HSBC customer accounts at 118 contracts. Totals are shown below:

For gold, the HSBC customer accounts do not act as a uniform single customer. In aggregate they have been large sellers this year with a net sale of about 550,000 oz however there have been intermittent purchases as you can see below.

Looking forward to the Dec contact, total OI (all contracts) is running hot at 585,000 which is the second highest OI at this point in the roll cycle over the last 4-1/2 years. Typically, OI increases about 30,000 contracts over the next 2 weeks as you can see in the mean OI trend shown as the bold black line below. It will be an interesting month ahead.

Hey Michael, it is so good to be able to read your words of wisdom again. I have been worried of illness or dodging another hurricane. Please keep it up. Cheers, Scott

I don't want an interesting month ahead.

I want an interesting month NOW.