May 28, 2025 14:00

+++++++++++ GOLD

The May gold contract will go into the books as the highest physical delivery for an inactive contract in comex history. 25,401 contracts have been delivered so far and an additional 526 are open and undelivered with one day to last notice. This tops the prior record set on the Jan contract earlier this year and the prior inactive contract of March 25. You can see the plot below which illustrates the surge in deliveries starting in Jan of this year:

Those 526 undelivered contracts are one of the highest ever with one day to last notice as you can see on the plot below. This is an indication that a short does not have metal to deliver as usually there’s only a few contracts remaining at this point. I’m not predicting a default as the short will almost certainly come up with some metal. However this is an indication of shorts selling metal they do not have.

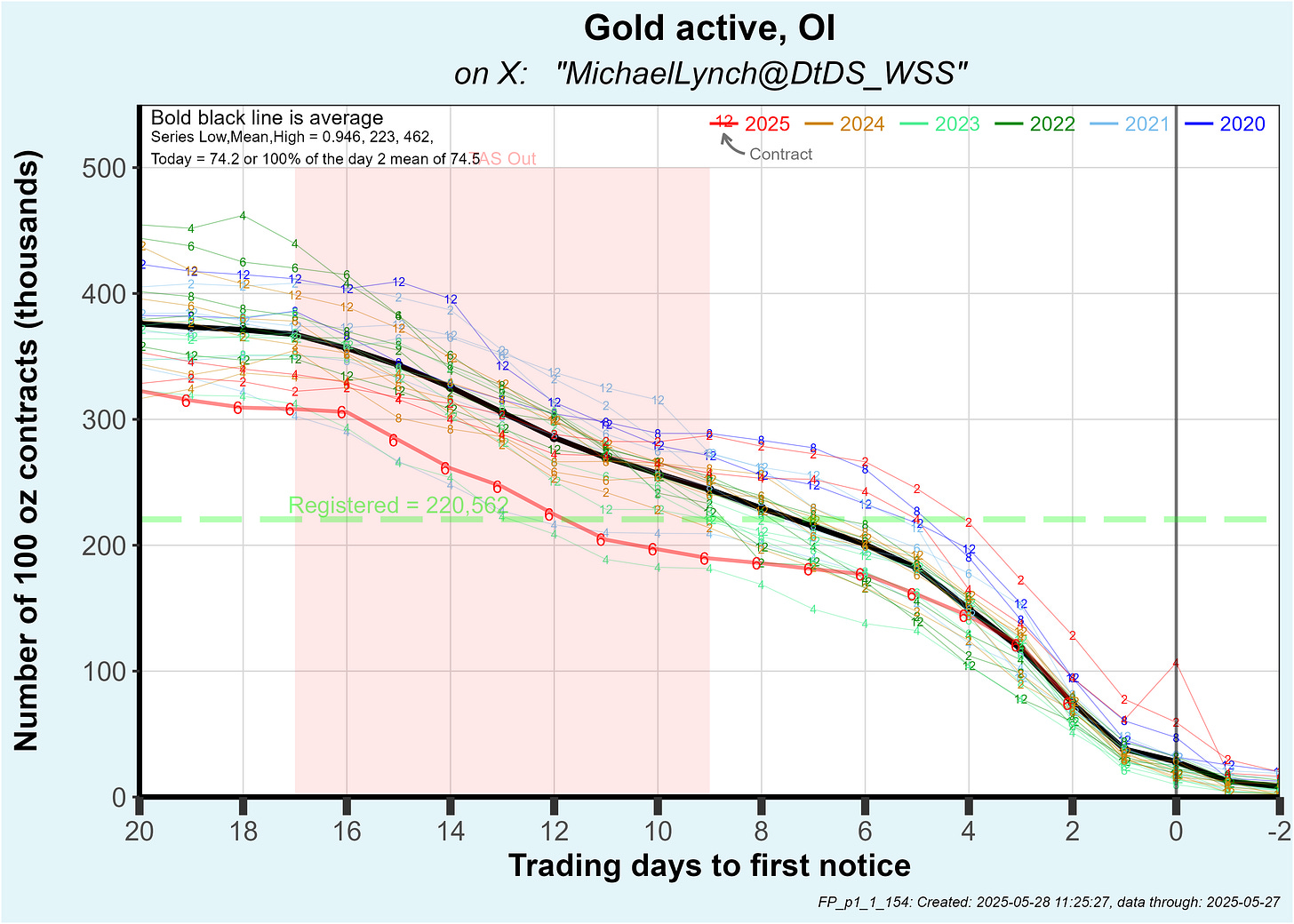

After all this optimistic data, the upcoming June contract, an active month, is NOT inspiring superlatives. With 2 days to first notice, open interest is merely average at 72,244 contracts. This is in stark contrast to the prior 2 contracts (Feb & Apr) which were the top 2 in comex history at the 2 day to go mark.

If you’ve followed my earlier posts, I’ve discussed that the 2025 surge in physical was driven by the “plebs” … ordinary folks, at least ordinary in comparison to bullion banks. These are America’s ultra wealthy or family offices.

The reason gold flowed from London to comex vaults was principally to meet new demand as comex physical deliveries exploded as you see on the plot above.

Some banks along with the “plebs” snapped up physical gold causing the increased demand. Gold moved from London principally to meet this demand and not to dodge potential tariffs. There may have been a few yahoo’s who believe what they read in major media and moved gold from London to comex because of the possibility of tariffs but that was NOT the primary driver. The tariff crap was a good red herring. The last headline the cabal wants to read in the WSJ was the smart money is binge buying gold.

Here’s the data … on the plot below the black line is the monthly net buy (or sell) by non-bullion banks affectionately called the “plebs”. You can see the huge spike in the February contract where they snapped up a net 2.2 million oz on that contract alone. That was about 4 times greater than any other contract. Keep in mind that a lot of those positions were created in the calendar month of January. And that is coincident with the surge of gold moving to comex vaults.

March and April contracts remained strong bringing the 3 month surge to about 3.2 million oz.

Note also there has been a drop in net buys to zero on this May contract (last point on the plot). It appears the buying binge from the plebs has ceased.

When corroborated to the non-spectacular open interest on the June contract (mentioned above), it appears the buying surge is over. That said, I’ll get a direct read on who is buying and selling on the issues and stops report on first notice day later this week.

+++++++++++++++ SILVER

Silver deliveries on the May contract stand at 14,898 (74.5 million oz) with one day to last notice. That is the third highest ever eclipsed only by the post-QE infinity contract of July 2020 and the most recent active month contract of March 2025. See the plot below:

Unlike the June gold contract, the June silver contract is looking hot. June is an inactive month and OI stands at 2,525 with 2 days to first notice. That is the second highest OI ever at this point and about double the average. OI was far above average earlier in the contract as you can see below. That could indicate that the demand peak is in the past.

Also unlike gold … non-banks continue to be large net buyers adding a net 17 million oz on the May contract (compared to gold’s zero net).

For silver, the indication is that non-bank demand remains strong, but again, I’ll get a direct read on first notice day later this week. Tune in then …

Hi Michael - I really enjoyed this article and especially because of the strong references to data not just opinion. I’m a newbie to futures contracts so a lot of the real pleb-style meaning of these charts goes over my head. I would love it if you could add more sentences after the data to explain in simple language what the data is telling us and what it means for future demand and supply and especially price. Thanks so much!!