Non-bullion bank silver buyers swarm the March contract as a net 17.5 million oz transfers from bullion banks

Just like gold ... that's the explanation for this market

February 28, 2025 11:30 AM

Despite the price plunge yesterday, a modest 6,183 contracts closed on the March silver contract’s last day before first notice. That is not far off of a typical last day’s closing. Often a price plunge has a significant impact on contracts closing in the last day. This resiliency of longs standing for delivery could signal that this is a new type of buyer less impacted by a price hit.

A near record 15,691 contracts stood for delivery (78.5 million oz). That is the second highest in comex history, only bested by the epic July, 2020 contract when 16,834 stood for delivery. It is almost a doubling of the most recent active month:

Looking at the issues and stops report, 17.5 million oz transferred from bullion banks to non-bullion banks and that is one of the largest in comex history. This is the same trend as occurred in Gold on the February contract. I suppose one needs a deep analysis of comex data to observe this, but this fact has not been discussed much amongst gold and silver commentators. It is the customer account, non-bullion bank, surge in demand that is driving the market. That includes the movement of metal from London to comex vaults.

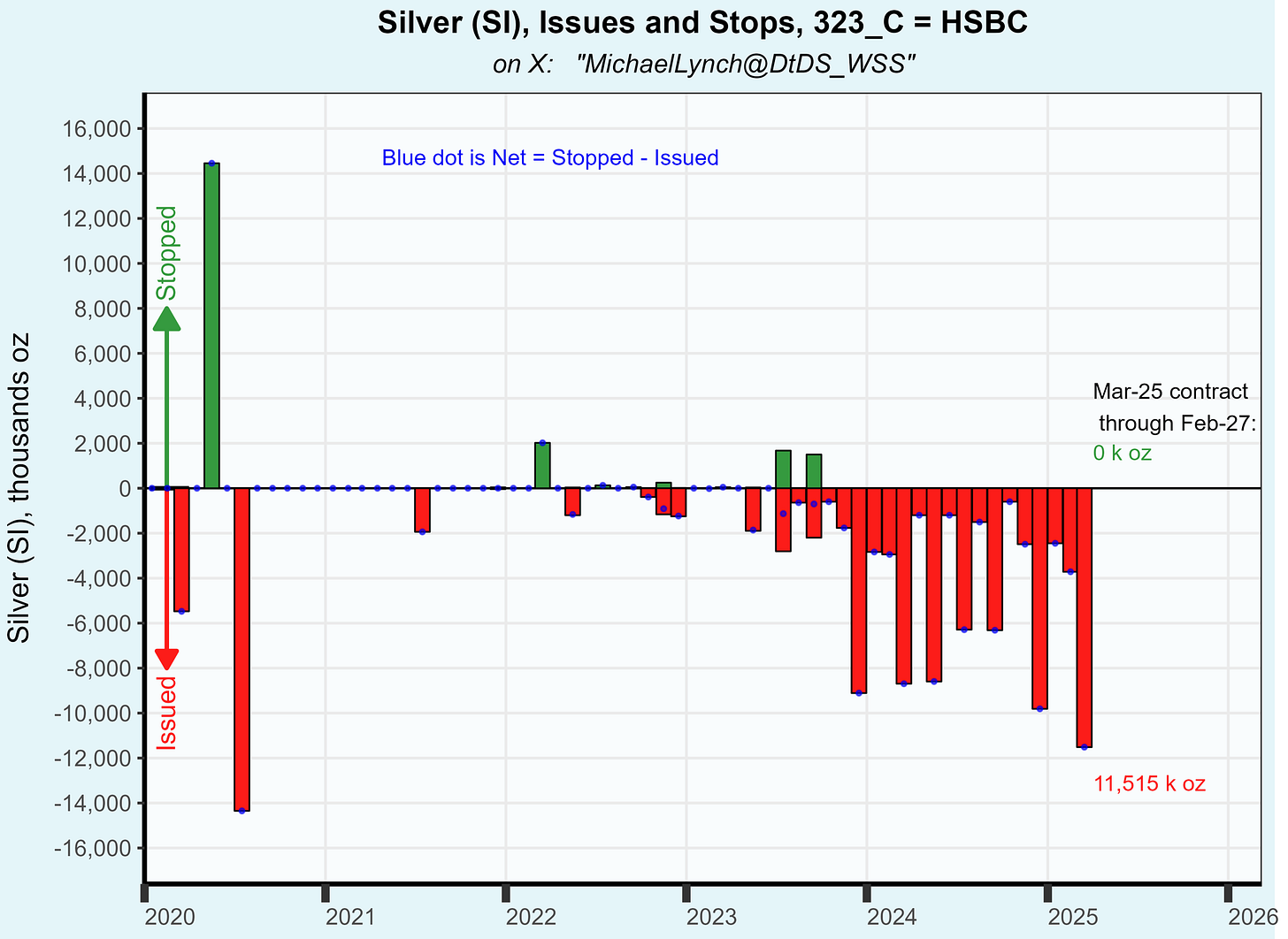

First day issues and stops are plotted below:

JP Morgan’s house account was the big short as they issued 5,590 delivery notices (27.95 million oz). That is a tie with their prior record sell on the July, 2020 contract. Notice the July, 2020 contract keeps coming up in this discussion. That’s not a rhyme … but an exact repeat of history.

JP Morgan’s sale accounts for 58% of the total first day delivery notices so the silver market was heavily influenced by The House of Morgan’s selling.

That HSBC “customer” account I’ve often discussed was the next biggest seller at 2,303 contracts (11.5 million oz).

The top 2 sellers accounted for 82% of the silver sold. And … I’d suggest, both of those entities primary goal may be to suppress price. If you’ve been following my thread, you know I’ve advanced the idea that this HSBC account may be a front to suppress prices via “The Differential Lag Theory”:

https://substack.com/home/post/p-144515700

That HSBC account has now dumped 80 million oz at comex since Dec, 2023. Yesterday’s sale was the largest since July, 2020 (there’s that date again). During that stretch, not one oz of silver has been bought. The differential lag theory rides.

The biggest buyer was JP Morgan customer accounts at 4,316 contracts followed by BMO Capital (Bank of Montreal) at 1,949. Despite BMO being a large buyer, this contract is one of the largest net transfers of silver from bullion banks to non-bullion banks in history.

Going back to JP Morgan’s sale … that 5,950 contracts (29.8 million oz) exceeded my guess which was based on silver moved into registered at JP Morgan’s vault over the last week (14.7 million oz). However, this tidies up a loose end. Back in Aug 24/25 2023 there was a large move of 14.3 million oz into registered at JP Morgan’s vault. Days later JP Morgan issued delivery notices on 5 million oz leaving an unexplained 9.7 million oz lingering in registered.

In fact, to explain the presence of 29.8 million oz I need to sum ALL the silver additions into JP Morgan’s registered vault from then until now. Apparently that unsold silver from August 2023 was just sold. My guess is that JP Morgan, once again, sold all or most of its silver at comex.

As I mentioned in yesterday’s post, last time that happened a sharp rally ensued.

+++++++++++++++++++++ Gold

I’ll cover gold later, but for now … the March gold contract busted the record for contracts standing for delivery:

Thank you

Great work, Thank you!