Open interest drops to typical levels for the December gold and silver contracts with one day to first notice

Nov 26, 2025 1:00 PM

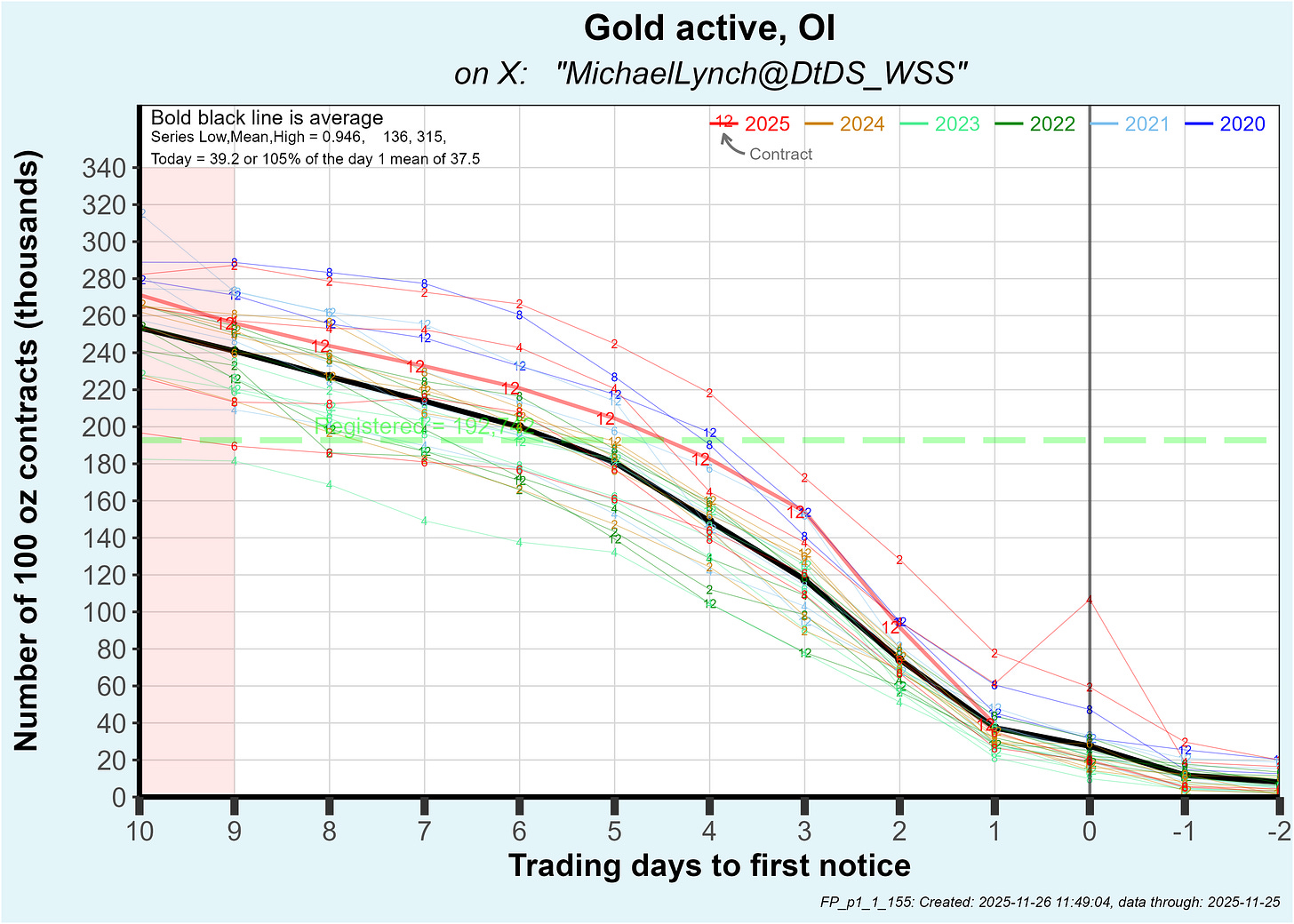

An oversized decline in open interest of 52,441 contracts dropped the December GOLD contract’s OI to 39,197. That is only slightly above the 5 year mean of 37,500 contracts with one day to first notice:

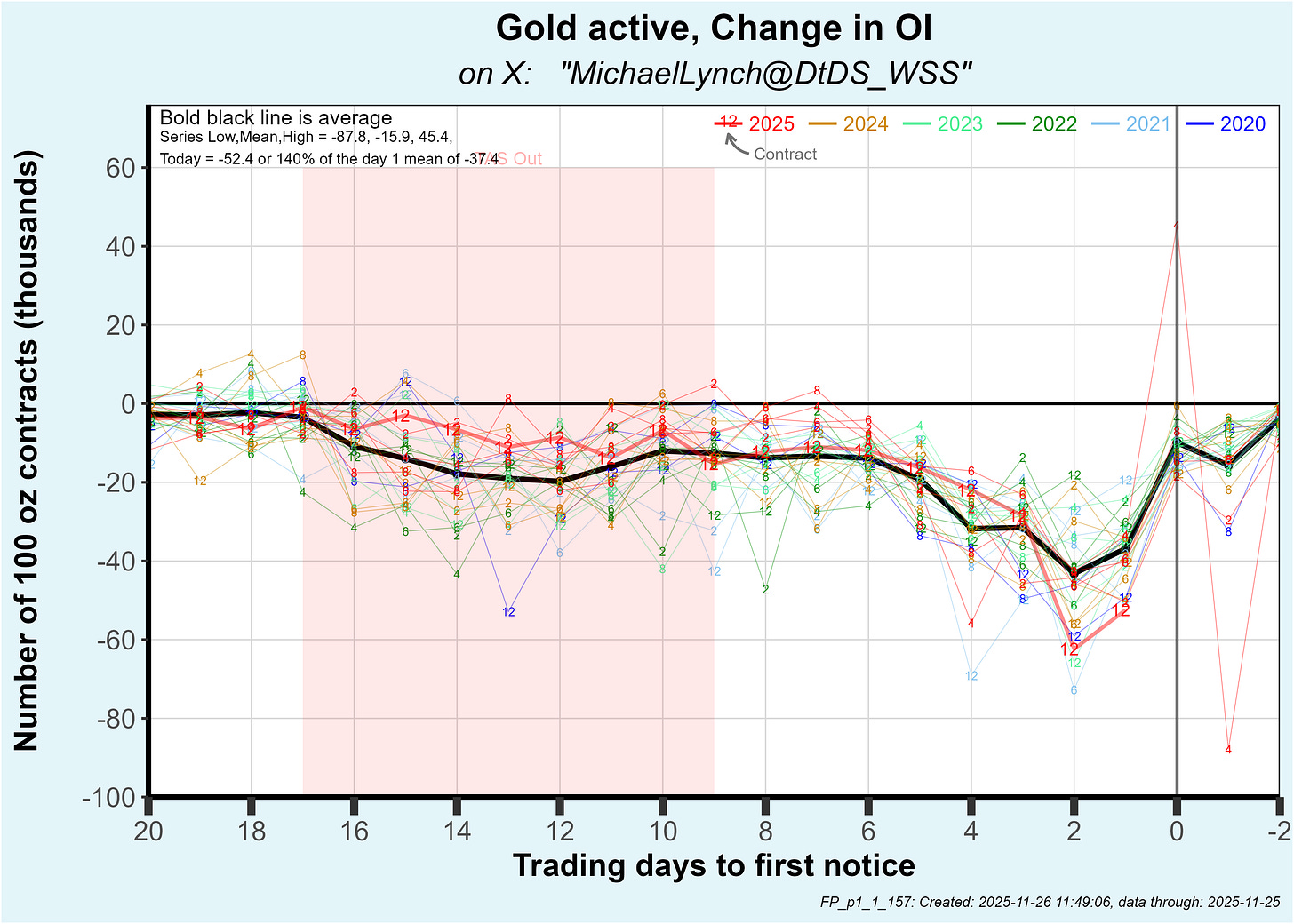

That decline of 52,441 was the largest decline ever for the 2nd to last day of trading and 140% more than the average decline of 37,400.

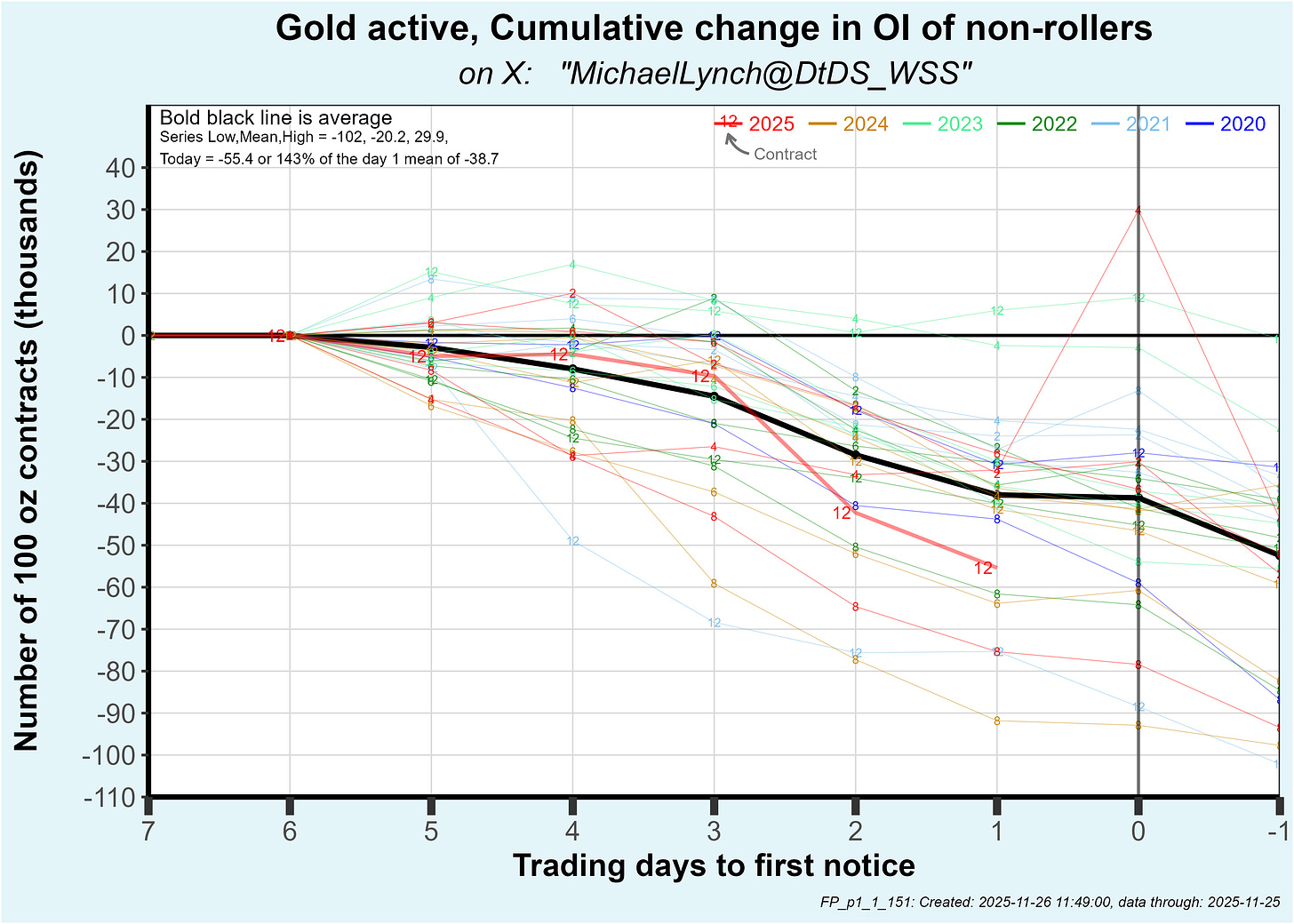

While 52,441 contracts closed on the December contract, only 39,388 opened on the February contract (the next active month). That implies 13,053 contracts closed without rolling. I call that number the “non-rollers” and track the cumulative non-rollers over the last 6 days before first notice. The last 2 days have had more than average non-rollers:

Who would be holding a position so close to first notice and then close as volume and liquidity vanish? Certainly not a hedger. I’d surmise they are mostly bankers who have the discretion to buy metal (as a long) or sell metal (as a short). If that is true, the plot above is an quantitative indicator of banker activity in the run up to first notice … and the last 2 days have seen much more bullion banker impact.

Does this mean that December physical deliveries are doomed for normalcy? Not so. Two contracts earlier this year (Feb and Aug) had more than 15,000 contracts created after first notice day and subsequently delivered so trading during the delivery period is becoming a greater fraction of physical transactions.

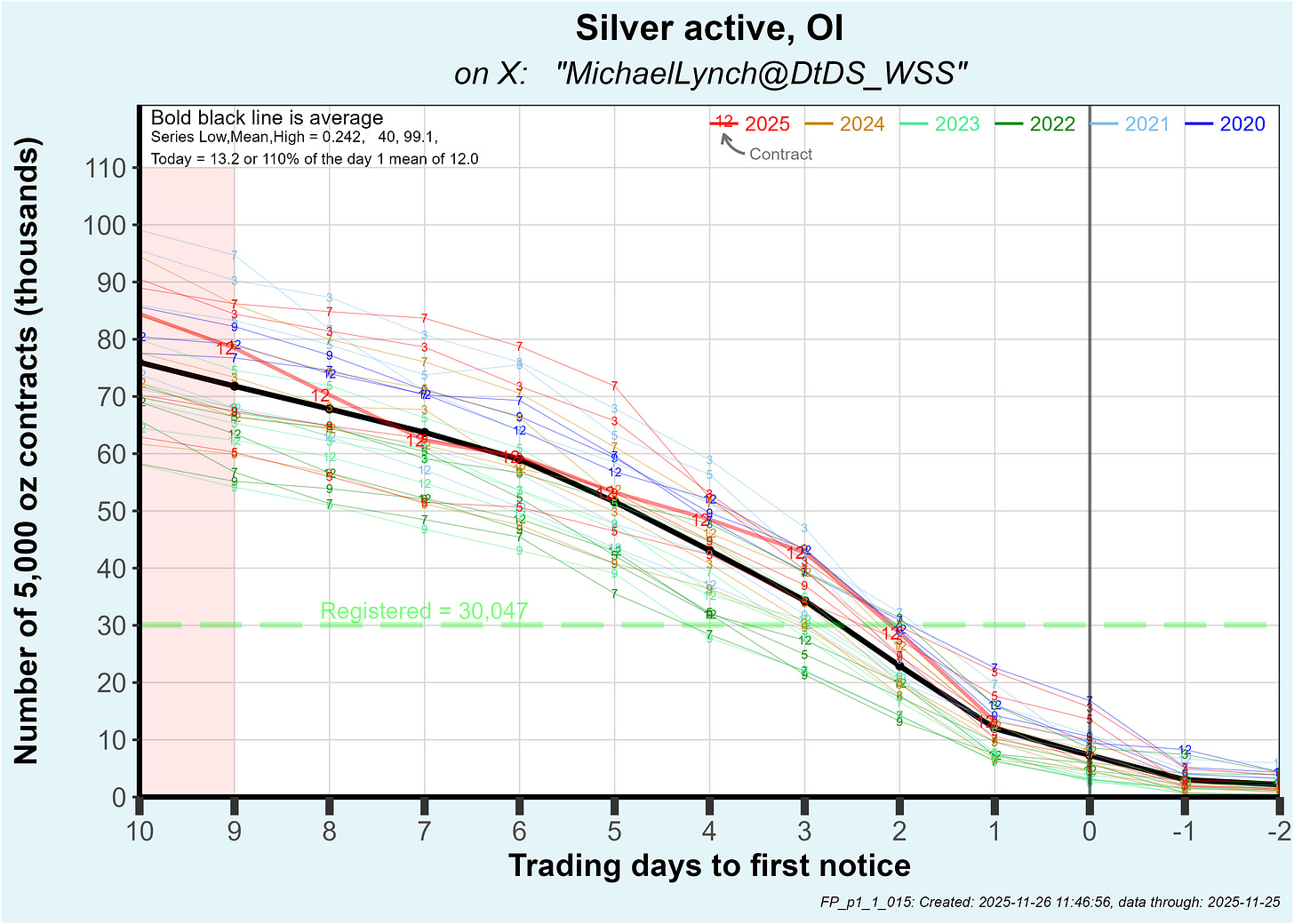

Moving on to silver … similar to gold an oversized roll (into the March contract) knocked December open interest down by 15,424 to 13,219 with one day to first notice. The average at 1 day to first notice is 12,000 so, at the moment, it appears that December deliveries aren’t headed to anything spectacular.

Tune in tomorrow and I'‘ll dissect the players who bought and sold.

Thanks for your recent discussion of what took place on March 28. In this article you wrote: “Tune in tomorrow and I'll dissect the players who bought and sold.“ Did I miss that somehow?

Hi Michael. First of all, thank you so much for all the information and analysis that you have published over the past years. I have been reading most if not all of your work since the beginning of the Wall Street Silver subReddit. About three years ago in the comment section of your post

https://www.reddit.com/r/Wallstreetsilver/s/TiwcJcE34X

you had written: <<I'll [post] 24/7 when the "to 'da moon" moment is on the brink.>>

That had always reassured me, but recently I have been assuming that things have changed for you. Do you need any help maintaining your scripts and/or publishing your graphs? I had always found them an invaluable resource and would love to see lots of updates to them. For example, you used to plot information on PSLV as I recall, and I’m pretty sure I noticed a week or so ago on a day when silver (futures) were significantly down that PSLV was actually up on the day and I was curious to see updates of your relevant graphs.

Anyhow, could you share with us your current intentions for the future? You’ve done so much for the community and you can certainly move on to other things or just focus on your relationships and/or simply enjoying life. It would be a shame for us, however, for your collected data to get lost, though I’m sure that certain large entities would not shed a tear. Thanks again.