Physical metal mania spreads to silver as over 10 million oz has been bought since first notice day pushing the February contract into record territory

And the March gold contract OI is 5 times typical. Hear that London?

February 11, 2025 1:00 PM

The rush for gold at comex continues and the mania has now spread to silver. First gold.

+++++++++++++++++++++ Gold

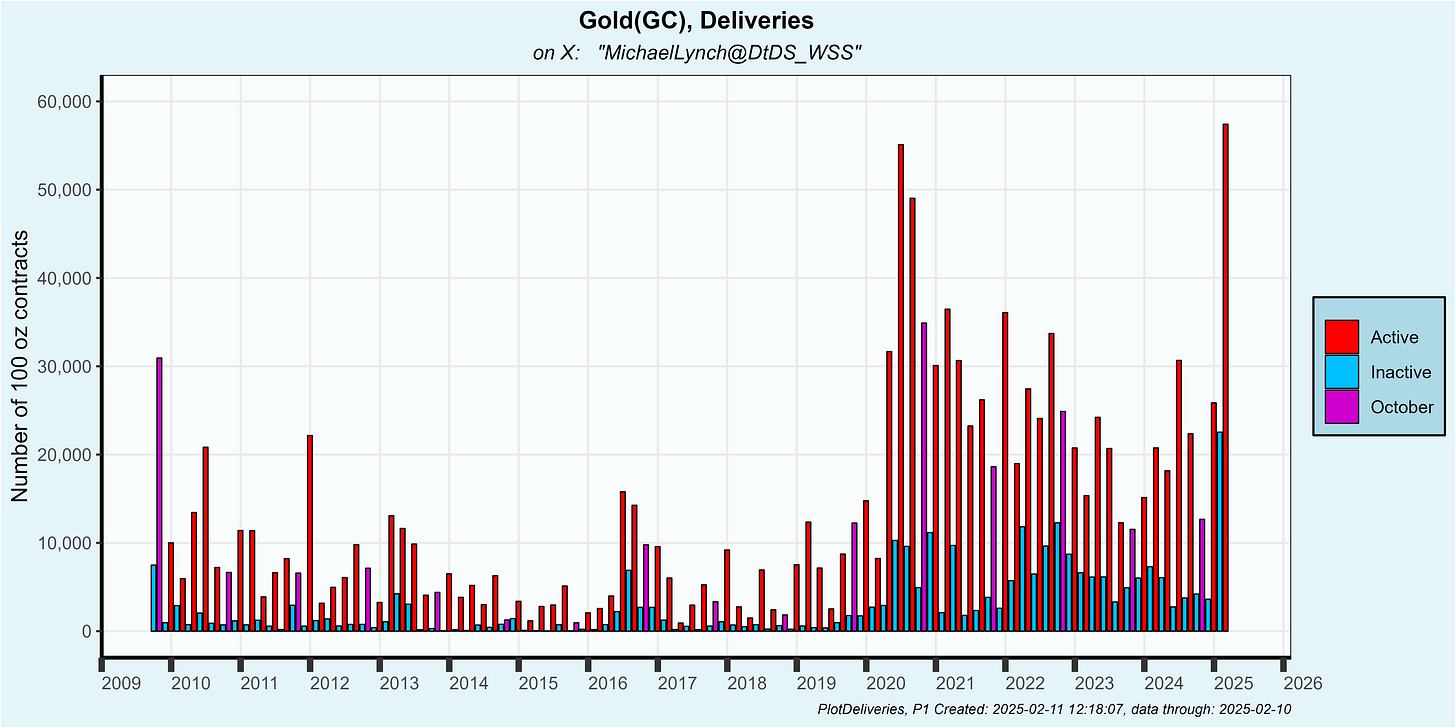

The number of contracts settled with physical on the February contract is at an all time high of 57,412 (5,741,200 oz or 179 tonne). That tops the post QE infinity mania during 2020 as you can see below:

Furthermore, as of this morning open interest remains 5,559. Unless those contracts vanish, you can add about 10% more to that record number of deliveries.

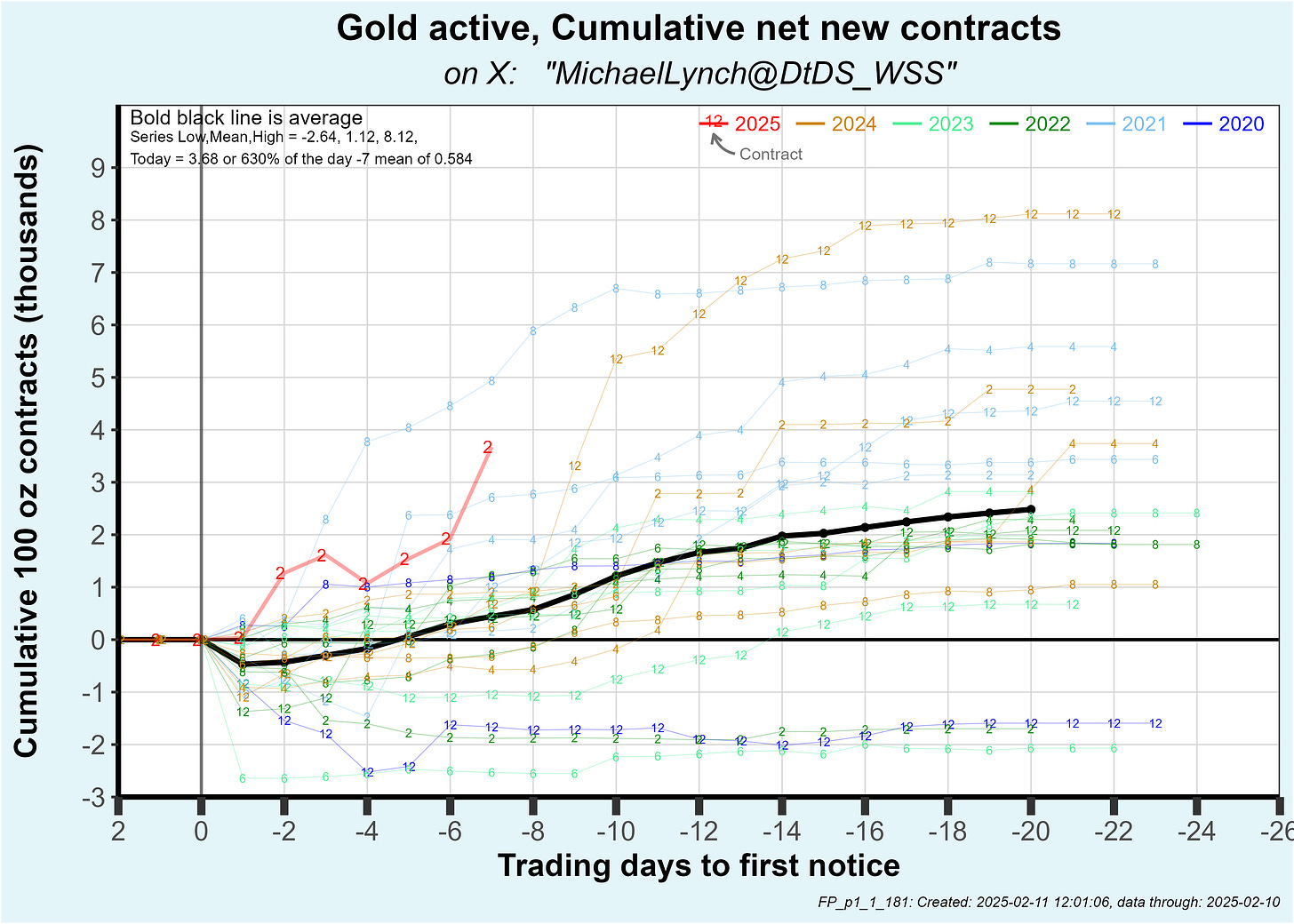

And vanishing seems highly unlikely. I’ll remind you the contract continues trading for another 2-1/2 to 3 weeks. New contracts are being written at one of the highest rates on record. Since first notice day an additional net 3,580 contracts have been written which is one of the highest pace of adds:

I have pointed out that this market is being driven by customer accounts, the “plebs”, and not bullion banks. And those little guys are just fine with inactive contracts. Looking ahead to the upcoming inactive contract of March … at least it’s supposed to be “inactive” … open interest is astronomical at 14,726 contracts as you can see below:

That is 5 times typical. As a reminder, usually inactive contract OI doesn’t plunge into first notice day as these players usually want metal and do not roll their position. Hear that London?

Comex vault adds have been averaging 536,000 oz per day (10 day average) with as much as 1.3 million on a single day:

++++++++++++++ Silver

The February silver contract is an inactive month, so there hasn’t been the same detonation as gold. Regardless, the amount of contracts delivered so far at 3,627 is the highest inactive contract in comex’s history as you can see below:

This February inactive contract is exceeding recent active month contracts. YOu can see that on the above plot. During 2023, active month contracts were delivering as low as 2,708 contracts for the entire contract.

Furthermore … it’s early. New contracts are being snapped up at 7 times the average pace and more than 3 times the highest previous pace as you can see below. Since first notice day more than 10 million oz has been snapped up. Hear that London? Buy another fork lift.

The active contract of March will set the tone for silver. At 12 days to first notice, OI is running 20,000 contracts over typical:

Vault adds are averaging 2.32 million oz PER DAY (last 10 days) with single day adds of 5.43 million oz.

Get your popcorn. Unless you don’t have gold and/or silver.

The financial masses remain generally oblivious as to what’s soon to transpire. I may have missed the Bitcoin Train departure, but I’m on the Silver Train we’ll before it leaves the station

"hear that London? " If I'd never heard of Michael Lynch before I would wonder why he is asking this. But I've read M. L. before so I'm pretty sure it's more of a taunt to a certain person. And that makes it funny in my book. 🤣 Great report Michael 👍