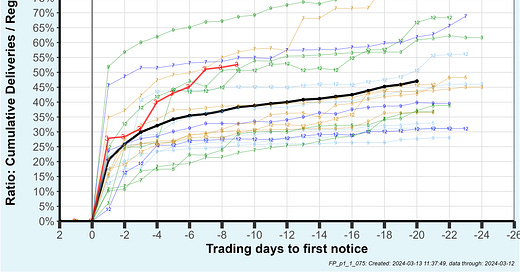

Silver transferred on the March contract is now 53% of registered more than the average of 38%

+++++++++++++ Silver

53% of registered has flipped ownership so far on the March contract. Current open interest is another 3% of registered.

++++++++++++++ Gold

On Tuesday (March 2) the March gold contract which is currently in the delivery period tacked on 513 net new contracts. Delivery notices were issued for 510 contracts. Wells Fargo’s house account issued 476 of those and JP Morgan customers stopped 501 of those.

Wells Fargo often flips metal during the delivery period …

The March contract, an inactive month, now has deliveries of about 6% of registered:

And almost half of that has been net new contracts bought during the delivery period:

Total OI has rolled over after a huge surge:

+++++++++++++++++ Silver Vaults

For activity on Friday (March 8), 2.4 million oz transferred from registered to eligible at Asahi’s vault. That is on top of a 2.9 million oz transfer out of registered on March 6 for a total of 5.3 million oz. If I assume those 2 moves are the same party AND both tranches are from metal bought this calendar year, the owner could only be one of two entities … BofA’s house account or JP Morgan customers. Those are the only parties who have bought that volume this calendar year.

The seller of that metal was HSBC customers who have sold 13.8 million oz so far this calendar year.

Note the saw tooth shape at Asahi’s vault as metal is now being moved to registered, sold and then moved out.

For vault activity on Monday March 11, one truckload arrived at each of Asahi, CNT and HSBC’s vaults for a total addition of 1.78 million oz. That was somewhat offset by a withdrawal of 307 koz mostly at CNT.

The numbers to the oz:

+++++++++++++++++ Gold Vaults

For activity on Friday March 8, 148 koz was withdrawn all at HSBC’s vault. That is a 2.8% reduction at HSBC. In addition 14.4 koz transferred from registered to eligible at Asahi’s vault.

That brings the total net gold withdrawn this calendar year to 2.15 million oz or a 13.5% decline.

Vault activity on Monday was minimal with 2.3 koz withdrawn mostly at MTB’s vault:

>53% of registered has flipped ownership so far on the March contract.

Unless 53% of silver leaves Registered and the vault, then it's just a shell game moving the pieces back and forth. Activity full of sound and fury, signifying nothing.

Spot silver outpreformed both silver & gold stocks, and gold today. There has been recent activity in the junior silver exploration space since gold made that new all time high end of February. A bunch of junior stocks are up 50% to 100% on normal volume inside a few trading days. I think today's silver rally caught the sector off guard. Like it wasn't part of the plan because silver is up over 3% and SILJ was sub 3%. Normally I'd expect SILJ to be up something like 4 to 5 percent on a big candle like silver had today making multi week highs.

The SGR chart looks great and has finnaly started moving down and away from the 90 level which I've been waiting for. Silver has a lot of catching up to do. We can go take out 26 and we're still going to be way behind.

While I don't want to celebrate too early its likely we get a $6 move in silver in a vertical line straight up to 28 from 22. We had two vertical six dollar moves from 18 to 24 in Q3 2022 and second from 20 to 26 in Q1 2023.

Smart money is slowly accumulating the equities. Gold 200 day moving average will breach $2000 soon perhaps this time next week it's currently at $1990 and climbing.

While everyone is distracted in clown world (crypto/tech bubble) speculators and insiders are gearing up for what I hope is going to be a precious metals super cycle.

Silver should have never imploded first trading day of December through end of February. I suspect that accomplished taking entire options strike stacks for the leaps expiring this January that just passed.

CPI prints are diapointing as rigged as they are and we have to unwind 3 months of selling on top of repricing for fill-in-the- blank.