The HSBC "customer" account silver sales are now 22.3 million oz over the last 4 contracts.

And gold metrics are looking stressed as the vault drains

++++++++++++ Silver

After the record number of contracts closing during the delivery period last Friday, all of those contracts have been bought back and then some. The cumulative net new contracts are running at the highest pace in at least 3-1/2 years:

Deliveries so far are 41% of registered and OI at the start of Thursday was another 5% of registered.

Today’s volume as of 3:30 PM is 185 so there is a chance for additional new contracts.

HSBC issued 98 delivery notices yesterday driving their silver sold this contract to 7.4 million oz. That drives their last 4 contract cumulative to 22.3 million oz.

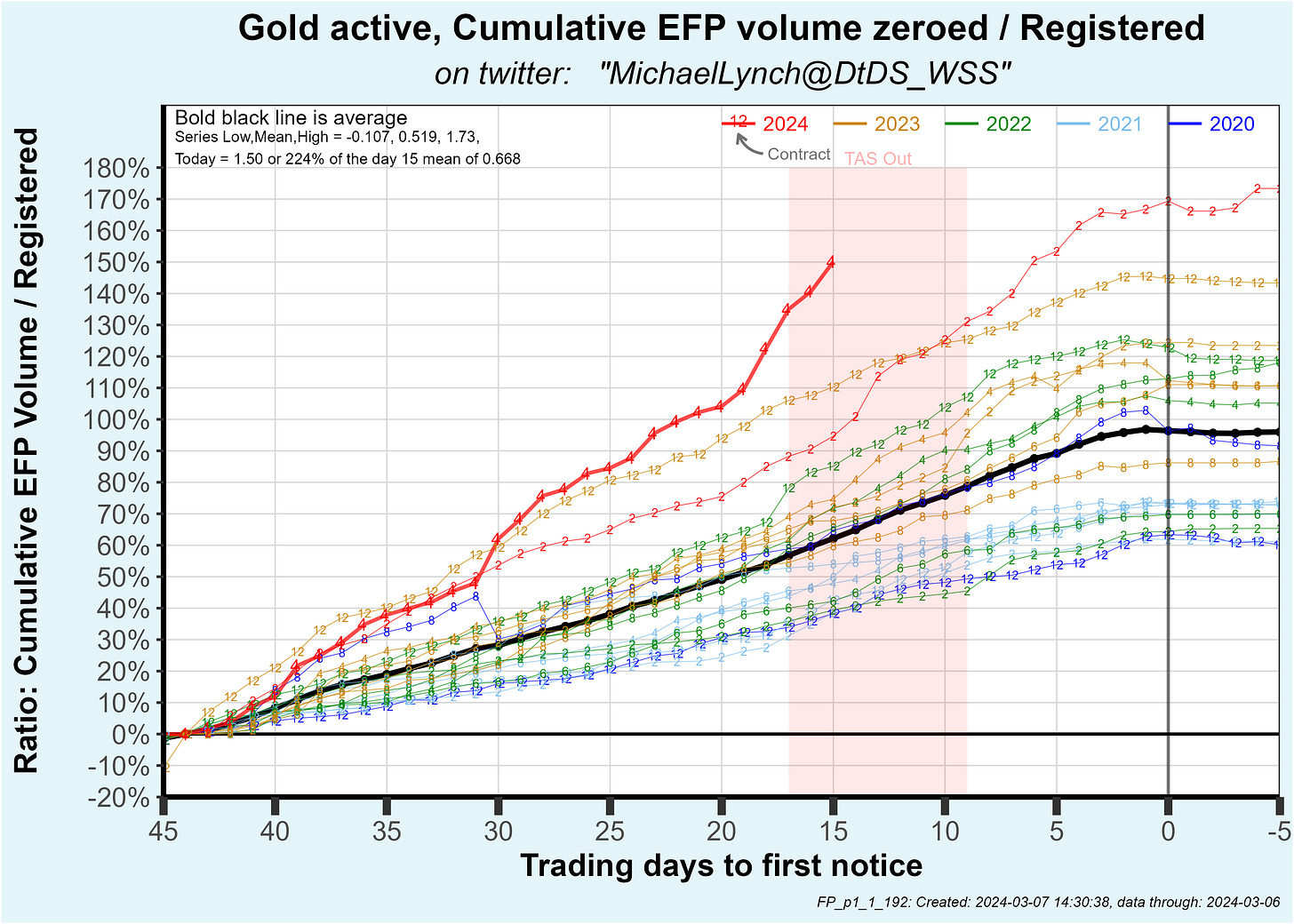

++++++++++++++ Gold

For the March gold contract OI relative to registered is running higher than usual at about 2.5%. Typically at this point in the contract life, OI is much less.

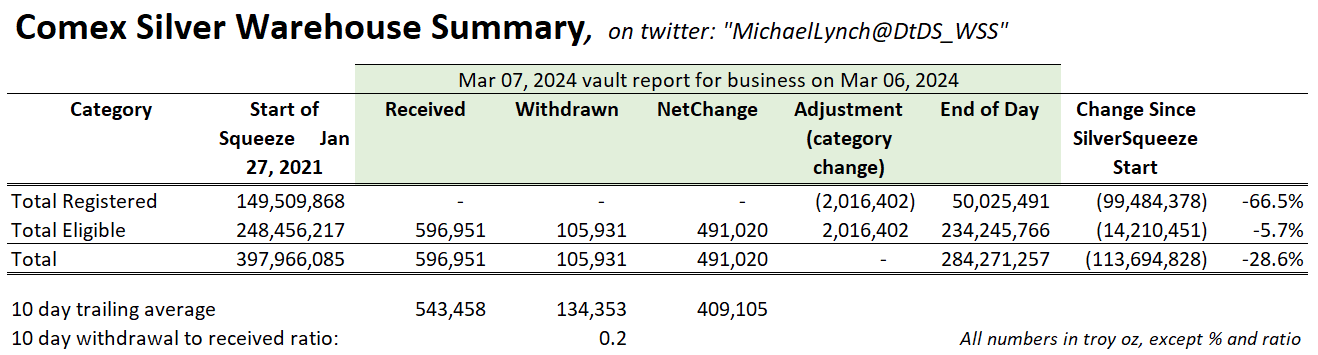

If you’ve followed my thread over the last year or more, you know that the silver vault drain resulted in stress in physical deliveries. For silver, metrics as shown above for silver became stressed as the vault drained.

I usually describe gold as the cabal’s “franchise” meaning that inventories seemed to be managed to prevent delivery stress. However with the gold vault drain, that could be changing.

Yesterday’s total EFP volume continued at a high pace at 7,531 contracts settled in London. That is 3 of the last 4 days being far over average:

The cumulative EFP volume is one of the highest over the last 3-1/2 years. I suspect EFP volume is often associated with closing arb positions which is benign OR private settlements between bankers. You can decide which one is running hot.

As the gold vaults drain many metrics relative to registered are being pushed far into unusual territory. The same EFP data above relative to registered:

Most importantly is the total OI relative to registered now running over 6:

And look at the upcoming active contract of April relative to registered. The roll is about to start, however OI relative to registered is headed north.

+++++++++++++++ Silver Vaults

2.9 million oz transferred from registered to eligible at Asahi’s vault. That is almost certainly metal sold by that HSBC customer account. As I mentioned above, that HSBC account has sold 7.4 million oz this contract period. IF this 2.9 million oz is associated with March settlements, there are only 3 potential players who have bought that much silver in March … HSBC’s house account (3.0 million oz), BofA’s house account (4.45 million oz) or JP Morgan customers (11.4 million oz).

That move out of registered was somewhat offset by 890 koz moving into registered at MTB’s vault … which has also been used by HSBC customer accounts.

In addition, one truckload moved into the vault at Brinks.

+++++++++++++++ Gold Vaults

No activity:

How are you able to gauge which customer is selling and buying, or are you implying a hypothesis?