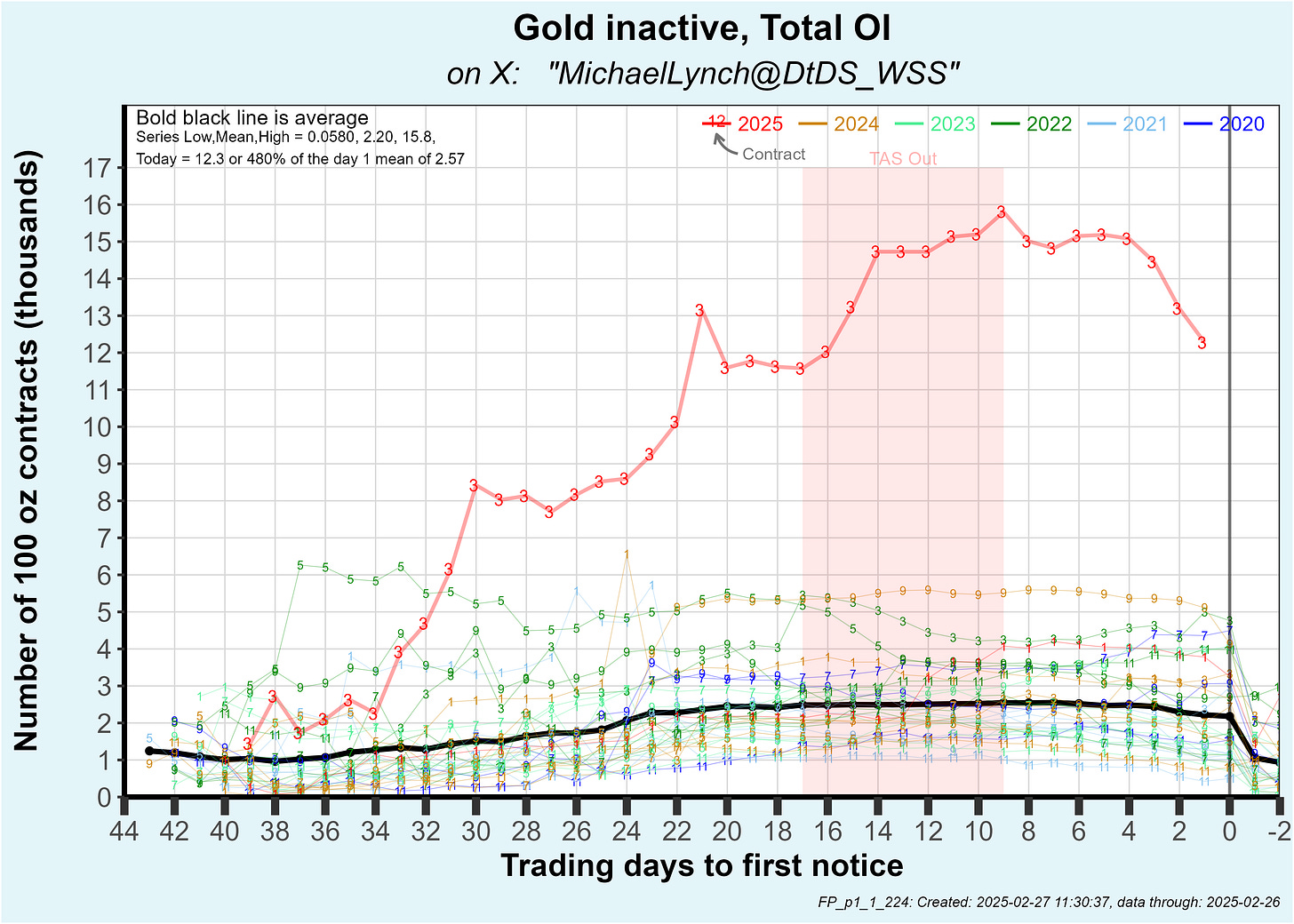

The March silver contract is set for disruption as open interest is as high as the epic July, 2020 contract

The House of Morgan may be the big short

February 27, 2025 10:20 AM

Tomorrow we will see if silver is following in gold’s path with record physical demand. With one day to first notice, it is looking strong. Open interest with one day to FND is nearly the same as the infamous contract of July, 2020. That was the one that busted JP Morgan’s nuts and resulted in a silver price spike. It could be Déjà vu all over again.

Preparations are in progress for a huge transfer. On Thursday and Friday of last week there were huge moves at the vaults from eligible to the registered category. FYI, metal must be in registered to issue a delivery notice, so these moves right in front of first notice day typically mean the metal will be sold. First notice day on the March contract is tomorrow (Feb 28).

One of the moves was 7.4 million oz at Asahi’s vault into registered. That almost certainly means that the HSBC “customer” account will issue delivery notices for that. If you’re following my thread, you know that backstory.

The second move (also on Thursday and Friday) was 14.3 million oz at JP Morgan’s vault. If that is metal to be sold by a single party, it will be one of the top 15 shorts of all time.

The big question is … who’s the big seller? Recall that JP Morgan only operates the vault. They, and others, store metal there. A vault move that size at JP Morgan’s vault indicates either BofA’s house account, JP Morgan customer(s) or JP Morgan’s house account will be a huge seller.

BofA has been buying on the February contract as recently as 2 weeks ago … so I’d downgrade the chance they are the seller.

JP Morgan’s customer account activity is (of course) amalgamated so I never have a read on any one specific player. The fact this move occurred on back to back days means it is likely a single party. That would be an enormous sale for a single customer. So, I’ll downgrade that chance.

That leaves JP Morgan’s house account. If they are the seller, that is a bullish signal.

Why? Recall that on July 31, 2020 the House of Morgan moved 30 million oz into registered and immediately issued delivery notices on the July, 2020 contract. It was immediately apparent that it was JP Morgan’s house account who had been containing a stong silver price rally in the weeks before when silver jumped from $19 to $24. After that was apparent, silver blasted to $29.

Furthermore, JP Morgan had spent their stack. They were gelded and out of the game.

So what’s going on? It’s possible they recharged their stack over the years and, once again, tried to defend a rally.

Speaking of the vaults … below is my chart of the vault totals by category. The current total silver of 398.2 million oz is set to eclipse the all time high set in Feb 2, 2021 of 399.8 million oz:

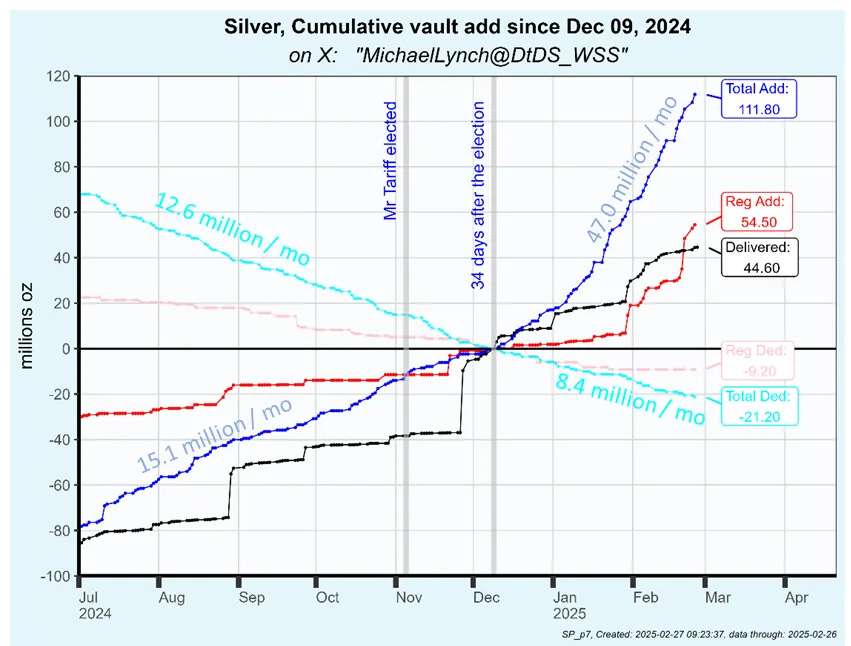

The plot above shows the net total but not the additions and withdrawals. I took a closer look at the vault data, analyzing silver additions and withdrawals separately along with the metal delivered. See that in the plot below.

I’m tracking the cumulative change for each category (adds, deductions and delivered). I zeroed the meter at Dec 9. Why then? That is the pivot date where vault activity changed … although this is most apparent on the gold plot. See this tweet for that:

https://x.com/DtDS_WSS/status/1893028806350245959

There was a change in silver vault trends on Dec 9, but the big pivot for silver lagged about a month as you can see on the plot.

The plot reveals:

The rate of silver additions was 15.1 million oz per month before Dec 9. In the last 2 months it has averaged 47.0 million oz per month.

The rate of silver removal has slightly declined from 12.6 million oz per month before Dec 9 to 8.4 million oz per month since Dec 9.

The run up in the vault total is due not just to vault additions but also reduced withdrawals.

Since Dec 9, 111.8 million oz has been added and 21.2 million withdrawn.

Focusing on registered silver … the amount of metal in registered is regulated by shorts or potential shorts. They move metal to registered if they intend to sell it. And some players apparently keep metal in registered to create the appearance of supply.

Since Dec 9, 54.5 million oz has been added to registered and 9.2 oz was withdrawn for a net change of 45.3 million oz. During that period 44.6 million oz has been delivered.

That seems like a pair, however there hasn’t been an active month contract go into first notice since Dec 9. That fun starts tomorrow when the March contract has FND.

If I assume the 9.2 million oz moved out of registered was part of the 44.6 million oz bought since Dec 9, that would leave 35.4 million oz that is in registered and has transacted since Dec 9. How much of that metal going to be resold?

As of yesterday’s report registered stands at 121.8 million oz. Deducting the 35.4 million oz means 86.4 million oz is now in registered and had not been transacted since Dec 9.

As seen on the first plot above, with one day to first notice, open interest is 21,874 contracts (109 million oz). Let’s say 6,000 contracts close on the last day (the average is 5,000). That would leave 15,874 contracts standing for delivery or 79 million oz (about the same as July, 2020). In that case, nearly all of comex registered would have flipped ownership since Dec 9.

Now is a good time to ask oneself … what is this new breed of buyers (post Dec 9) planning for their silver? Do these buyers have a different objective? Are they going to just flip silver, or hold it? If they are holders, this is a market ready to explode.

++++++++++++++++ Gold

If I had a flair for drama, which I don’t, I’d leave you with that. But let’s look at the count down plot for gold.

OI on the March contract has sold down a little the last few days … not typical for an inactive contract. However, OI is still much higher any other contract in comex history:

If the new breed of buyer is anything to do with the Treasury and if they are trying to buy back, or cover leases on the 8,100 tonnes they have sold... they will be the stickiest long in the market. That metal will be gone for good.

Thanks Ditch!