The physical gold rush continues although activity is driven by banks.

Silver ... record activity is driven by customer accounts.

May 8, 2025 10:07 AM

++++++++++++++ Gold

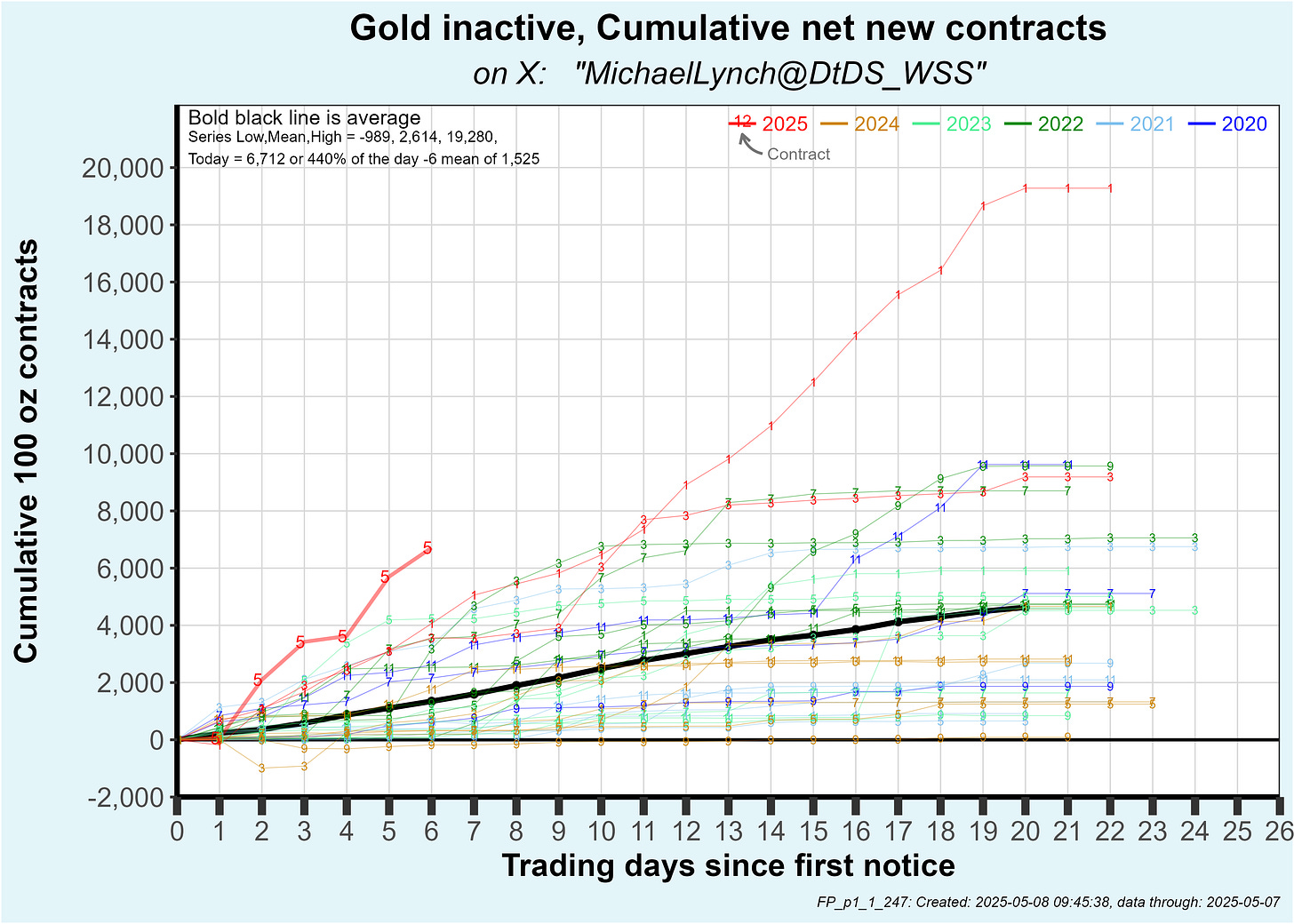

The May gold contract sizzles as the run on physical continues. The number of contracts written since first notice day are running higher than any other contract in comex history. Over the 6 days since first notice, 6,712 new contracts have been written … far above the mean of 1,525 and far above the previous high of 4,150. See the plot of cumulative net new contracts below:

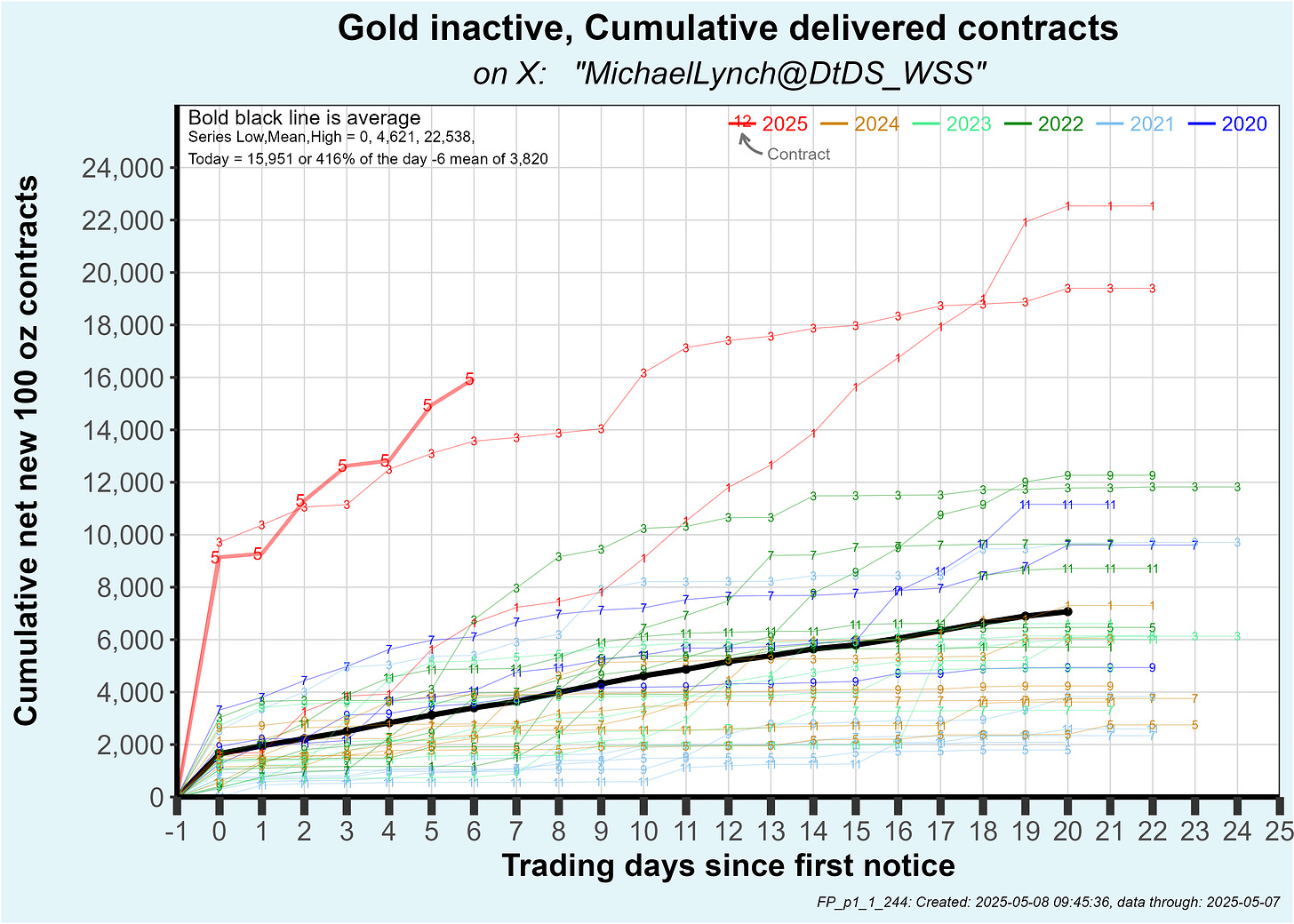

Recall from my previous post that the May contract had the second highest number of contracts standing for delivery at 9,306. The net of all that activity is that cumulative deliveries are now nearly 16,000 … well into record territory topping the record set on the previous inactive March contract. See the horse race below:

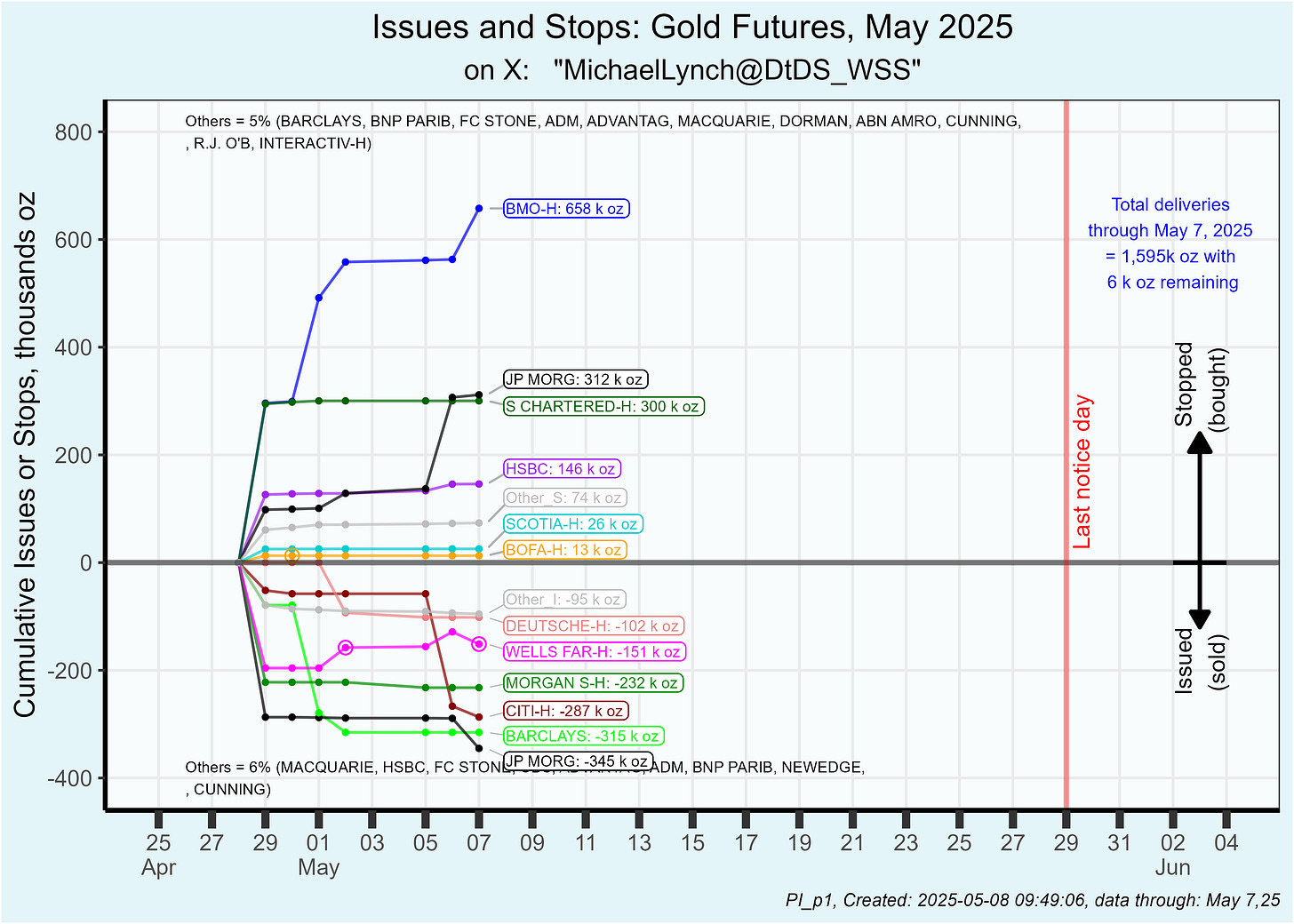

Who is driving this activity? See the plot below of cumulative issues and stops by account. Note that house accounts are indicated by a “-H” after the name.

Notice that nearly all activity is bank house accounts plus JP Morgan customer accounts. It appears that comex customer accounts have accumulated their stack and have now stood down. That isn’t a bullish signal. Many banks tend to flip metal on a month to month basis and therefore their buying activity isn’t net demand over a sustained period.

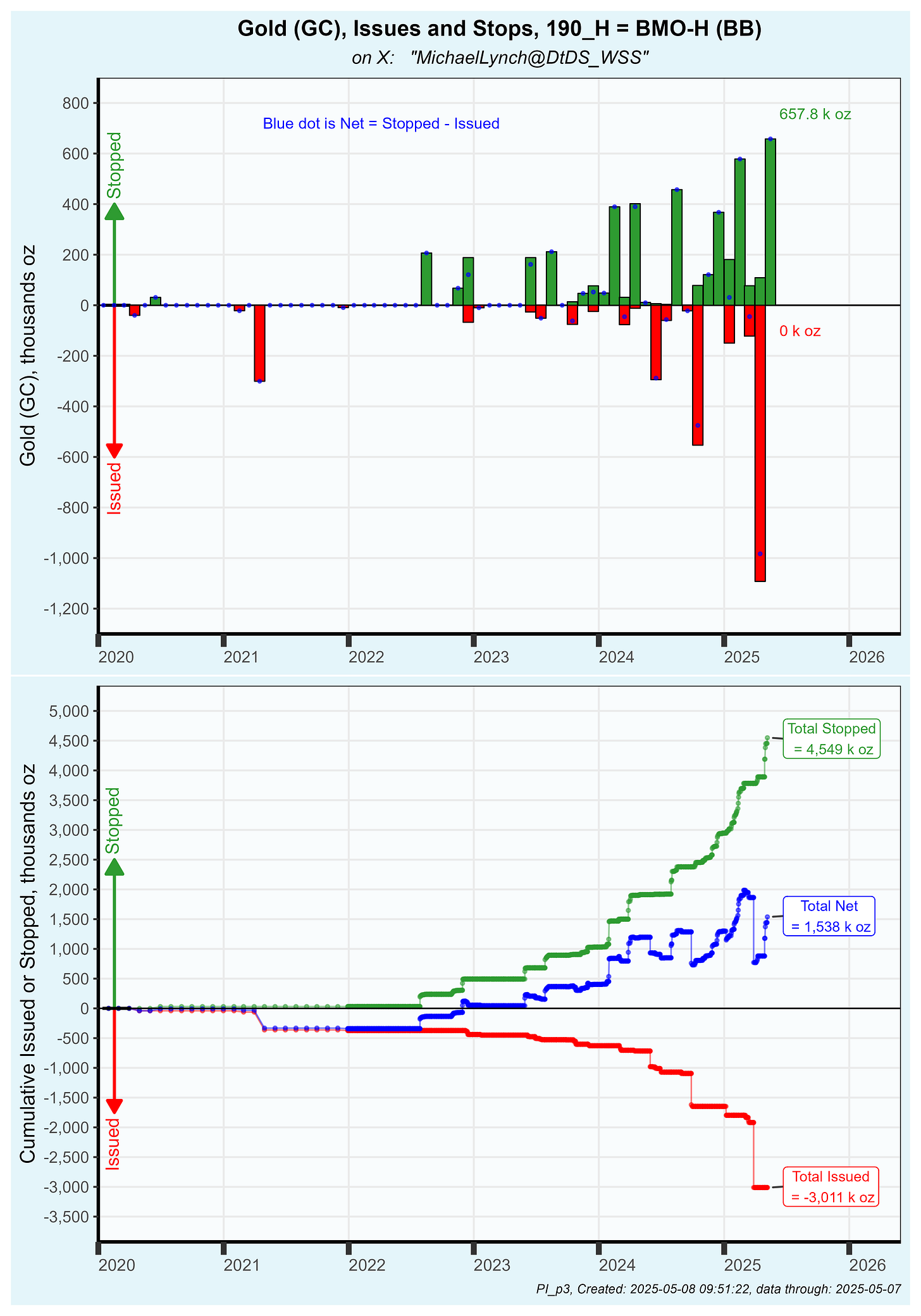

The Bank of Montreal has been the biggest buyer at 658,000 oz (20.5 tonne) and they serve as a good example of a trader. Notice on the plot below that large purchases are often sold soon thereafter:

++++++++++++++++ Silver

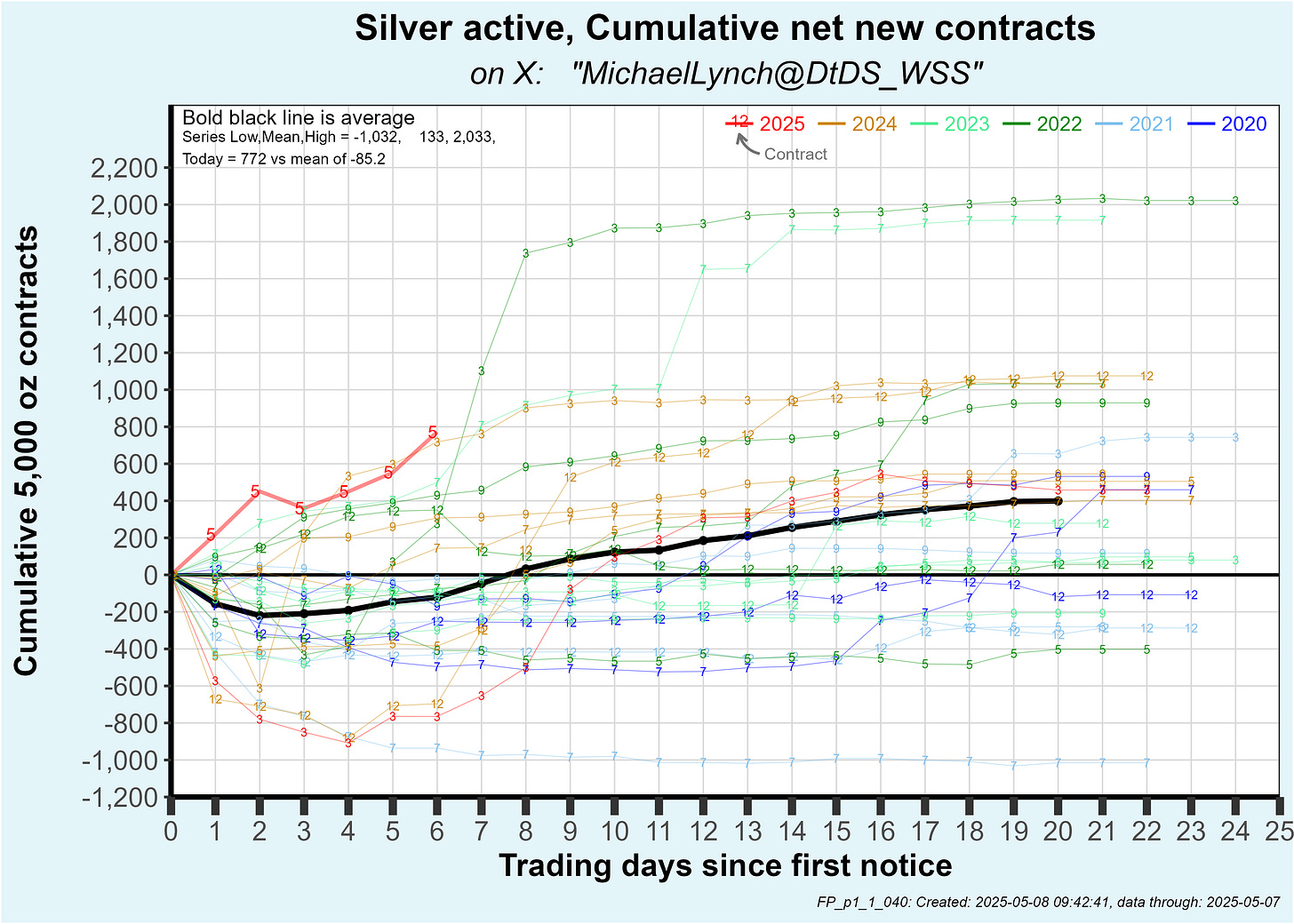

The May contract is an active month and the story is similar to gold. Net new contracts are running at a record pace … although just barely. But hey, a record is a record:

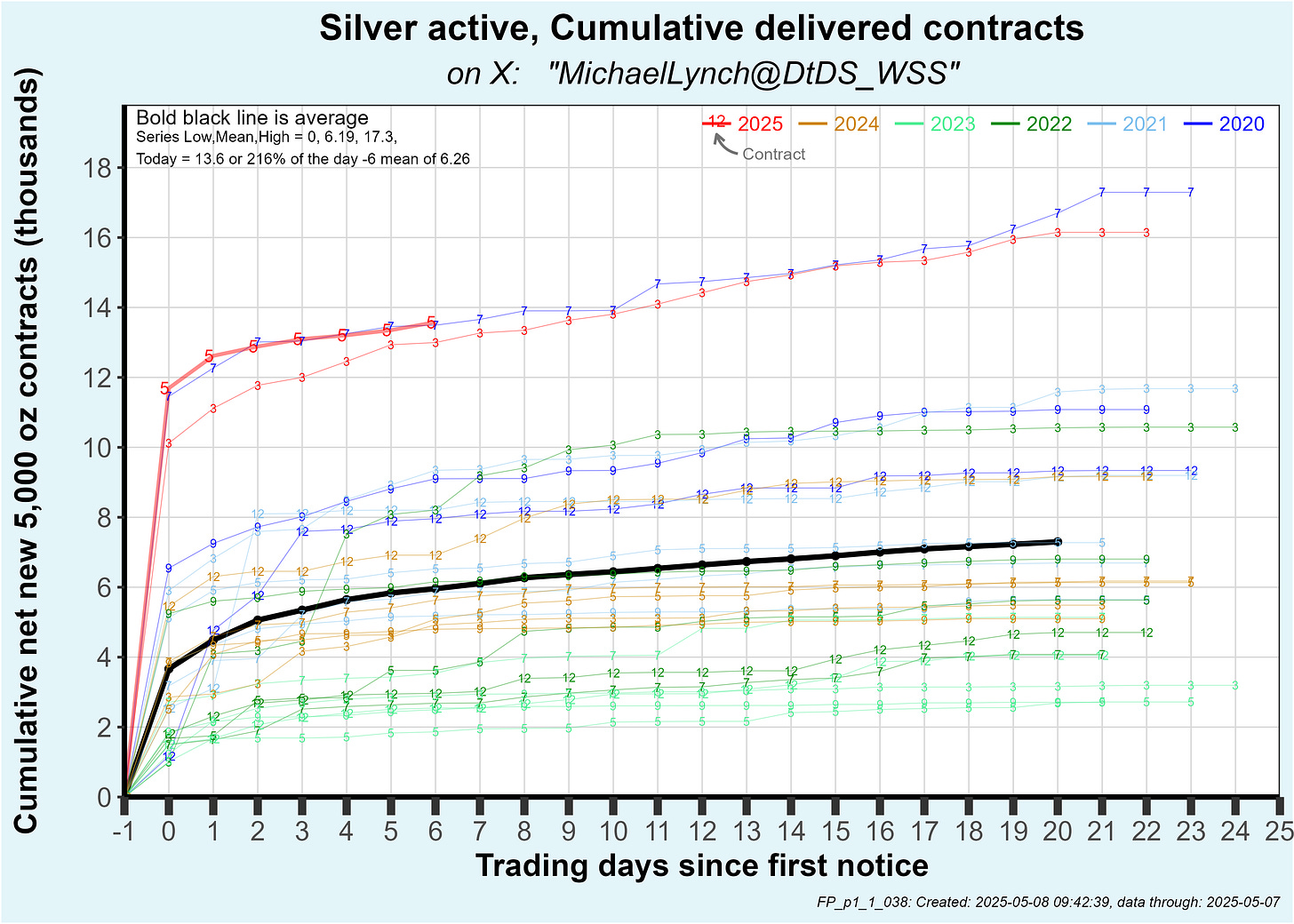

The cumulative delivered contracts also stand at (also just barely) a record 13,581. See the plot below. The two other contracts at this stratospheric level were the epic July 2020 contract driven by QE infinity and and the previous active contract of March.

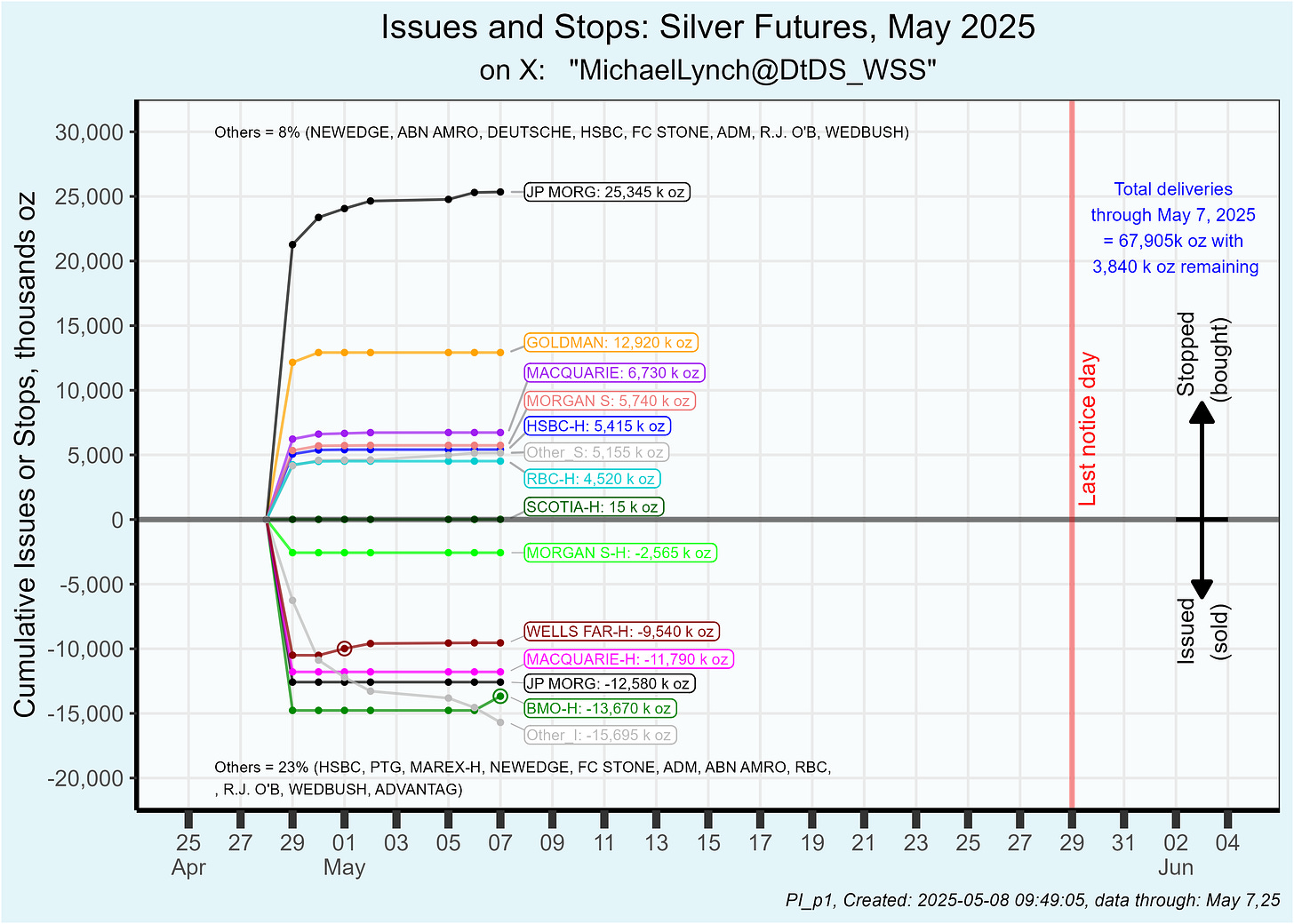

Silver buying has been driven by JP Morgan customer accounts at 25.3 million oz and Goldman customers at 12.9 million oz as you can see on the plot below. BMO has been the largest seller although you can see they reversed direction and bought some silver yesterday … again, BMO is a trader.

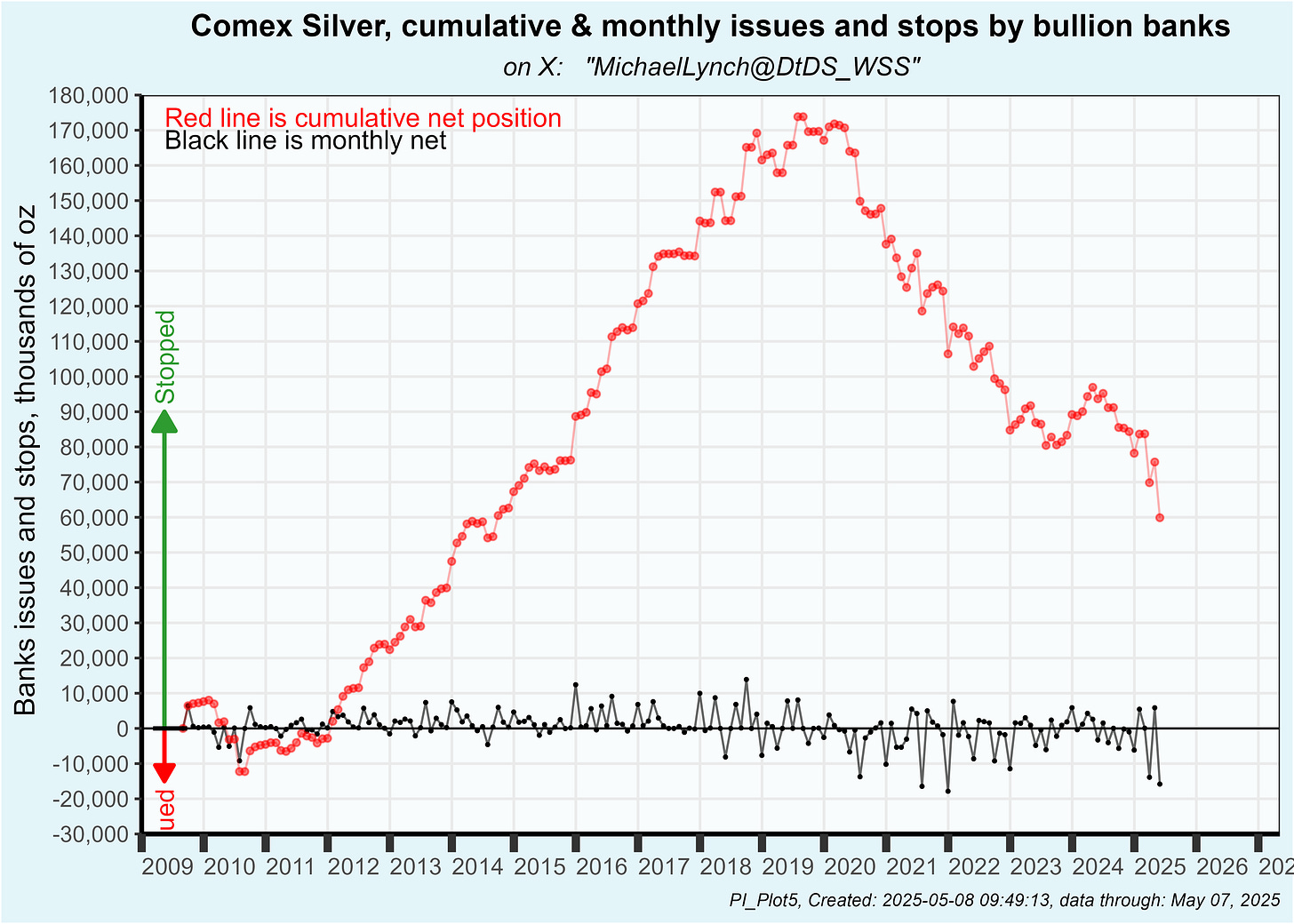

On the May contract a net 15.8 million oz (3,165 contracts) has transferred from banks to non-banks, the third highest net sale by banks in history for a specific contract. Banks have sold a net 110 million oz since QE infinity. See the plot below:

Why would banks be sellers after QE infinity? Money printing is a sell signal?

I hear that the COMEX will need to be Basel 3 compliant by July. Which is two months from now.

"Lit fuses, crisscrossed in the night." JW

"Lit fuses crisscrossed in the night." JW

Dear God,

Are you flicking giant matches at our planet? Please stop. Thank you, er, Amen.

Stunning report as usual. Always a great read, provided one suffers no heart issues. Agree with the other comments; BASEL III is relevant. And though we've raced by past milestones, the timer on this doomsday device is counting down. Which wire to cut?! The gold one? The silver?

Your two closing sentences, rhetorical questions, or literal as well. Why sell silver after QE to Infinity (and beyond)? Maybe to hold gold down, delaying the Great Keynesian Fiat Explosion. Buying time with cold hard cash?