Trading volume on comex silver is nearly double the average as open interest continues to surge upward

+++++++++++++ Silver

Yesterday (Wednesday April 3) 80 new contracts (400 koz) were written on the April contract which is now in the delivery period. That’s more than typical, but not a rush for physical:

There hasn’t been much to learn from delivery notices lately. BofA has stopped a total of 11 delivery notices, essentially zero, so BofA has stood down on this contract.

There is 1 million oz waiting on delivery and the HSBC “customer” hasn’t issued delivery notices since first notice day. I suspect they are holding much of that remaining short position.

Open interest of all contracts jumped by 4,556 yesterday after an increase of 5,070 the day before. Comex’s raw report:

Total OI is the highest since July 2021 at this point in the roll cycle:

Most of the increase (3,579) went into the July contract as traders skipped the upcoming active month contract of May. The May contract will start rolling to July soon so traders are initiating positions on the July contract.

Total volume over the last 2 days has been nearly double the mean:

I define a “flip” as volume that doesn’t result in a net new contract. It’s a measure of how much churn is occurring. Numerically it is just the trade volume less the absolute value of the change in OI.

Yesterday 115% of open interest flipped compared to the mean of 66% as you can see below. There’s a lot of traders opening and closing positions over the last 2 days as silver has spiked.

++++++++++++ Gold

After 5 days of delivery notices, Bullion banks still have not sold any gold on the April contract. The only asterisk on that statement is a 75 contract sale by Wells Fargo’s house account. Wells routinely flips metal during the delivery period and they have stopped 283 contracts, part of which was before and part after the 75 contract sale. So, Wells is just flipping metal during the delivery period as normal.

Look for Scotia to sell some of the 204 koz they bought earlier on this contract.

Similar to silver, BofA has just nibbled on gold buying only 24 contracts … essentially zero. Looking back at BofA’s gold and silver activity since 2021, there are 4 months where they were absent from buying or selling both gold and silver … Sept, Oct, Nov 2021 and May 2022. So this stand down by BofA isn’t unprecedented.

Cumulative issues and stops:

+++++++++++++ Silver Vaults

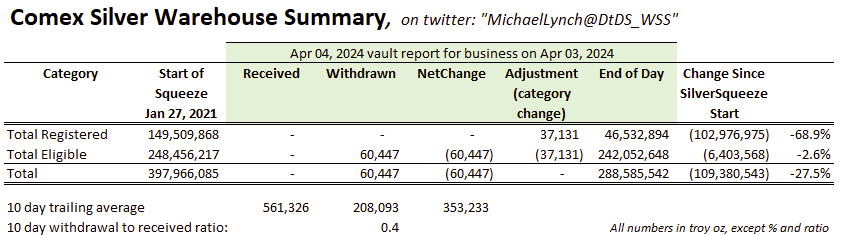

60 koz was withdrawn at CNT and 37 koz transferred into registered at Delaware:

+++++++++++++ Gold Vaults

No movement at the gold vaults:

Impressive analysis, thanks.

Hope you post short note on effect, long and short, of Crimex increased margin requirement today for PM.

A more modest subscription option, or 1-time "donation" option would be appreciated for us somewhat casual readers. It is interesting data, and worthy of support.