BofA does another last minute bail out of a naked short to the tune of 2.1 tonne of gold.

Plus some games at the silver "market" too

+++++++++++++++ Gold

It appears that BofA once again bailed out a naked short during the waning hours of the March gold contract this time for 674 contracts or 67,400 oz or 2.1 tonne of gold.

This isn’t BofA’s first naked short bail out. In fact, their web site has graphics advertising this service:

OK, I know humor doesn’t always translate around the globe … BofA doesn’t advertise bail outs on their web site. That pic above is my lame attempt at humor.

In yesterday’s post I speculated that either BofA or Citi would do a bail out of up to 676 contracts. I based that guess on the signature of the open interest trend where that number of contracts had been open and undelivered for 8 business days.

Here’s what happened … some player initiated a short on March 14 after the $140/oz run up in gold prices. The position was not settled by buying a long contract or delivering gold for 8 days. You can speculate on the motive of this trade … either hoping for a price pull back or attempting to arrest the sharp rally.

In the naked short bail out scenario, the short didn’t have metal to deliver and then transferred their short to BofA by paying BofA the notional amount in fiat plus, no doubt, a premium to incentivize BofA to do the deal. BofA ends up with the short position, a pile of cash and then promptly issued delivery notices as seen on last night’s Issues and Stops report.

And, FYI … JP Morgan customers held the long side of that trade.

As much as I’d like to crow that I’m predicting the behind the scenes activity from my remote hideout high in the Appalachian mountains, there is one other possible scenario. There is a chance that BofA had initiated this position on March 14 and then chose to delay issuing delivery notices. BofA has plenty of gold in the vaults, so that wouldn’t be a naked short position.

In the past BofA has issued delivery notices as soon as possible … either on first notice day or (if during the delivery period) the day the short position was created. Most banks operate the same. Why would BofA delay delivery this time? It is possible BofA is on the fence about parting with metal and kept the short open to give an option to either deliver metal or close without delivery.

In fact, it appeared BofA did that same thing earlier in this March contract. They issued delivery notices on 153,000 oz 8 days into the delivery period. That too could have been hedging on relinquishing gold:

I wrote about that possibility at that time:

https://econanalytics.substack.com/p/bofa-issues-delivery-notices-on-48

The net of all of this is either:

Some unknown player did a naked short on 2.1 tonne of gold, couldn’t escape the position and paid BofA to settle their short. That would be an indicator of tight physical supply and/or false market dynamics.

Or … BofA, who had been on a gold buying binge for 7 months, switched their posture in January, and are now relinquishing gold reluctantly. If BofA is on the fence about relinquishing gold, they are one step closer to return to buying gold. Since they are a major player, that swing in strategy could move the market.

On the upcoming April gold contract, an active month, … there’s been a lot of midnight dealing over the last 2 days as 2,100 contracts closed in the dark of the night. That is between 1.7% and 2.3% of open interest for each day which is much higher than usual:

EFP remained elevated at about double the typical value:

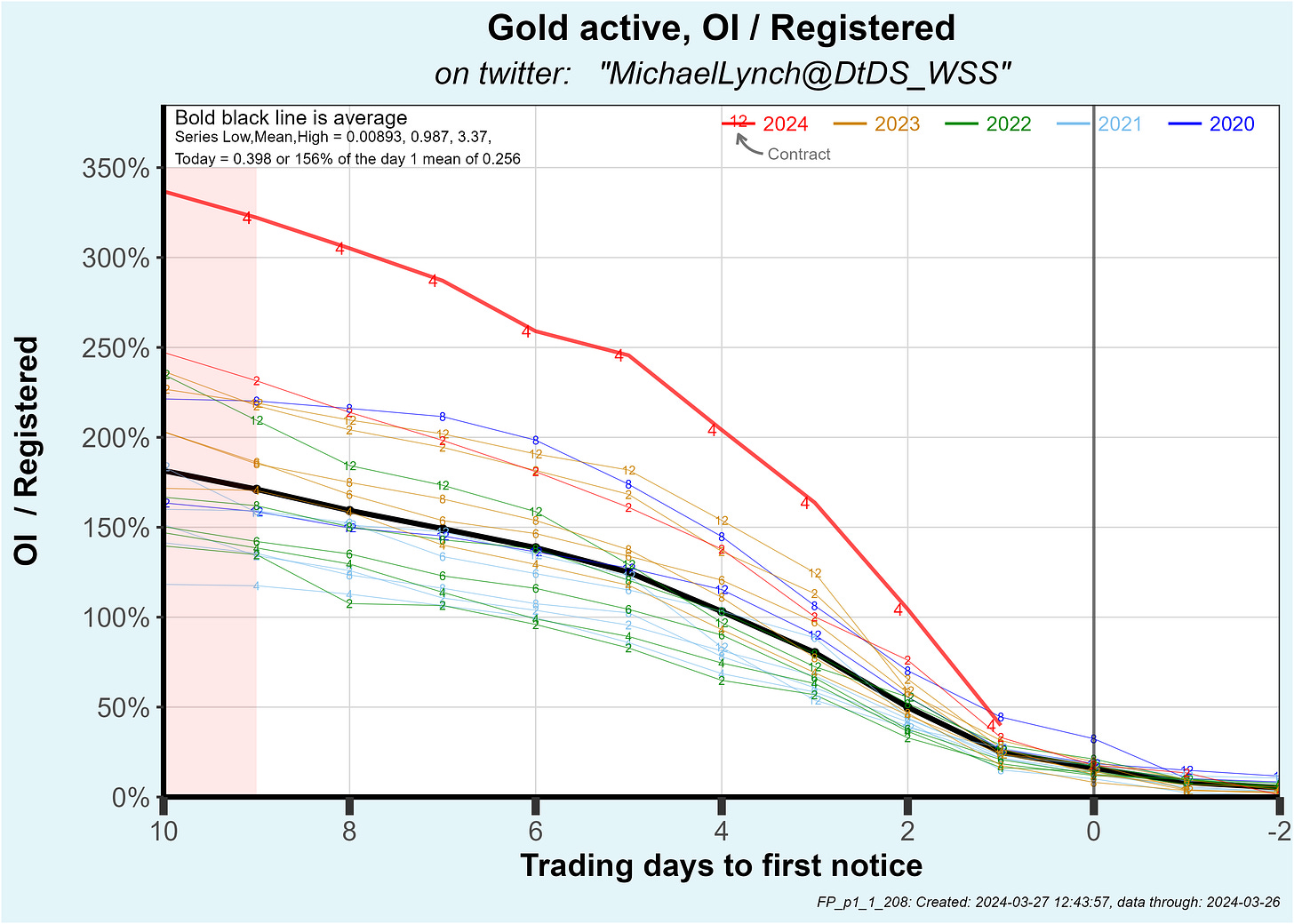

The net of those shenanigans dropped OI substantially down to 30,818 contracts with one day to first notice:

OI is now 40% of registered with 1 day to first notice, the highest since August 2020. The April contract will probably end up being on of the larger fractional drains on registered gold over the last several years:

+++++++++++++++ Silver

The inactive month of April had OI fall by 336:

Considering the period before deliveries commence, that is the largest one day reduction in OI over my 3-1/2 year data set as you can see below.

So go figure … a sudden huge rush to the exits of both shorts and longs OR did a short panic close by enticing longs to settle?

Open interest stands at 550 contracts or 2.8 million oz with one day to first notice.

Just another interesting day at the comex charade. The vault report prints in 2 hours … so no update about the vaults at this time.

I like the humor!

It looks like Gold is going to move to the upside over the next few weeks based on your report. It almost has to before the typical summer doldrums. Curious on how you feel about the data regarding Silver. Any chance of a spike considering the charades that appear to be at extremes in the metal? Thanks for providing your insights.