BofA issues delivery notices on 4.8 tonne of gold delayed by 8 days indicating they are on the fence on buying vs selling

BofA's gold stack shrinks to 136 tonne

In a post last week I mentioned that gold deliveries were running behind trend.

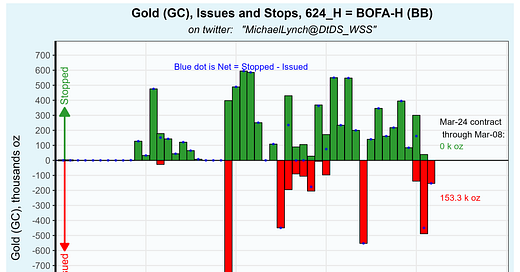

On Friday’s Issues and Stops report it was revealed that BofA was the cause of deliveries being below trend as BofA issued delivery notices for 1,533 contracts or 153,300 oz or 4.8 tonne of gold. Usually banks and large players who are short on first notice day issue delivery notices within a day or two. It appears that BofA was short on first notice day but elected to delay issuing delivery notices for 8 biz days.

Disclaimer on that … 1,903 net new contracts were written over the prior 5 days so I can’t say conclusively that BofA didn’t initiate their 1,553 short position before first notice day (and not thereafter). However, typically new shorts issue delivery notices soon after shorting so it is my judgement that BofA’s short was initiated before first notice day.

So why did BofA delay delivery? I suspect they were hedging their bet … they delayed delivery so they had the option of closing the position and keeping their gold.

In the past I’ve pointed the finger at shorts delaying delivery notices because they don’t have metal to deliver. That is certainly not the case for BofA.

Reviewing BofA’s track record of their buying and selling … they were a huge accumulator of gold between December 2022 through mid January 2024 when they have switched to mostly selling. Since mid January they have issued delivery notices on 780,100 oz of gold (including Friday’s sale).

Back to the 8 day delay … I interpret that to mean that BofA isn’t committed to dumping gold, but they are on the fence. By that I mean they had a short position and delayed issuing deliver notices to keep the option to close the short (by initiating a long position) instead of selling physical.

I don’t think that is wild speculation, however to go into wild speculative territory, perhaps they are observing the recent gold rally and considering the possibility this is the start of the moon shot and therefore delayed settlement. The fact they eventually did issue delivery notices on 4.8 tonne would mean they don’t think the moon shot is imminent.

On the other side of BofA’s issuance of delivery notices were mostly JP Morgan customer accounts who stopped 1,106 of the total 1,567 delivery notices. Cumulative issues and stops so far is shown below. BofA’s behavior during the last couple of months has made these plots more interesting than usual:

Gold’s surge in open interest continues to tacking on 27,192 more contracts. Typically there is about a 5% increase in OI during this portion of the roll cycle, but this surge is obviously anomalous as the 7 day increase is about 30%:

Friday’s one day increase of 27,192 is one of the highest in recent years:

++++++++++++++++++ Silver

The March silver contract tacked on 44 net new contracts which is a decent upward drift:

At this point 49% of registered has transferred:

+++++++++++++ Silver Vaults

Another truckload arrived at the Asahi vault and moved straight to registered. That is almost certainly the HSBC “customer” metal soon to be delivered. See previous post for the HSBC discussion.

In addition 393 koz arrived at Brinks and moved to eligible and 66 koz departed Brinks:

+++++++++++++ Gold Vaults

The gold drain continues as 55.4 koz departed the vault split between Asahi and Brinks’ vaults. Plus 10.1 koz transferred from registered to eligible at JP Morgan’s vault:

Thanks for generously sharing your research. This is 1st day on your ss.

I've been a student of PMs 40 years and never knew how much idk until getting involved w PMTwit. Delighted to learn more at the feet of the sev masters sharing.

Question: As Im unable to interpret the data you report, can you kindly add a sentence or 2 to your postings to summarize its sigificance and key takeaway?

Eg I assume functionally bk BofA does not own all said gold but reps customer accounts (USG, FRB, BIS, hedgefunds?) Excludes derivatives.

If you have a published a book that explains how it can be used to forecast PM movements -- I'm happy to buy it.

Personally, given the early look at COT data FRB UST etc presumable receive, and its scrutiny by experts like GS, BA, JPM-C, yourself, Butler, MaCleod, Coleman, Vince etc, input into CRAY computers w nextgen AI models -- I assume its analysis is hyper efficient leaving me to wonder how you or any of the usual suspects gain any advantage but that's an aside to my original question: "what does it mean" to an active investor but not a day or cmdty trader?

Many thanks.

You have to have at least 2 cups in a shell game!