HSBC continues shorting the May silver contract which incriminates them as the desperate short on the bizarre June contract.

Better than a soap opera

++++++++++++++ Silver

Yesterday on the May contract, HSBC issued delivery notices on 59 contracts. Since there were 174 net new contracts written earlier that day there’s a chance that those were newly written contracts. In that scenario that would indicate HSBC continues to activity short silver. (FYI, sometimes I know they are new contracts but, in this case, I’m not certain since OI at the day’s open was 86.)

What’s the significance of that? The bizarre activity on the upcoming June contract continues with a short seemingly pulling out all the stops to continue shorting yet not stand for delivery. Well who could that be? Any guesses?

IF HSBC continues to short the May contract, that increases the odds that HSBC is the party responsible for the bizarre activity on the June contract. I don’t know that, but it seems logical. HSBC has been the dominant short for 6 months now, I’d surmise they will be the dom short on the June contract too.

Volume on the June contract yesterday continues running hot. Yesterday it was about double the typical volume and today’s prelim (not yet posted) is 1,400 or 5 times the average. Here is the data through yesterday:

I’ve recently penned pieces on how much of that June contract volume has resulted in new contracts. Had those contracts not been settled off exchange, the June contract OI would be into blowout territory. A battle rages on the June contract.

If HSBC is, in fact, that desperate party on the June contract … perhaps the HSBC worldwide manipulation gig via my “Differential Lag Theory” is nearly up.

https://econanalytics.substack.com/p/is-hsbc-depressing-comex-price-while

I know I’m stacking conjecture on top of theories. But if this is correct … it is the biggest story happening in precious metals right now, and could signal an upcoming shift in market dynamics.

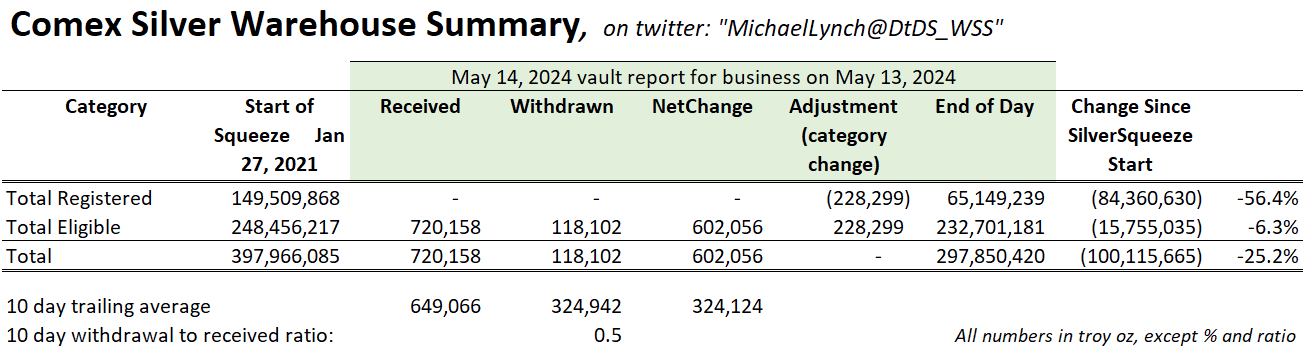

+++++++++++++ Silver Vaults

I mentioned HSBC issuing 59 delivery notices. Those 59 pair precisely with a 296,786 oz move from eligible to registered at MTB’s vault (average 1,006.1 oz per bar). And that metal arrived at MTB’s vault last Thursday.

So the story continues … HSBC is by far the dominant short and continues to settle positions only by moving metal from outside comex vaults into registered for delivery. Silver prices would likely be far higher without HSBC’s vast selling of silver.

Otherwise a truckload (600 koz) arrived at CNT and 118 koz arrived at Loomis. Those gains were somewhat offset by 118 koz withdrawn mostly at Delaware:

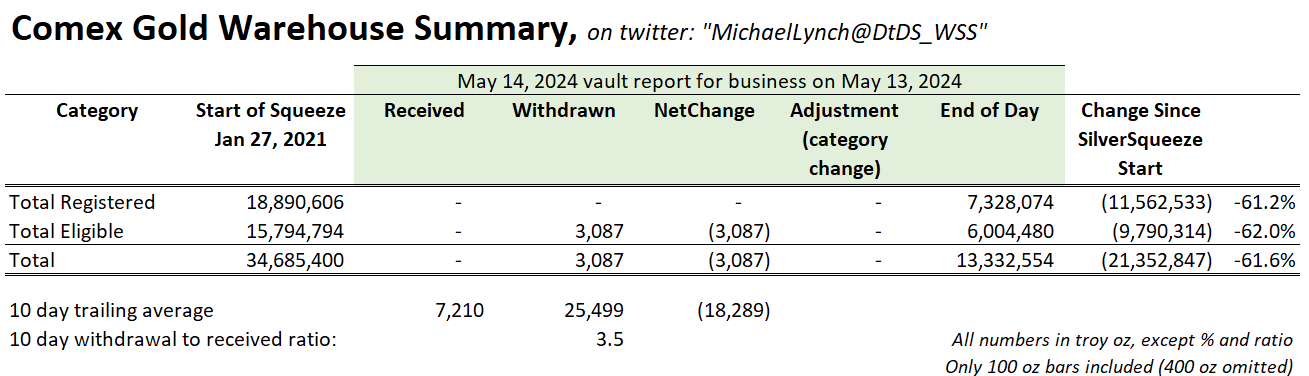

+++++++++ Gold Vaults

Modest moves:

As always your work is very interesting to follow. Thank you and have a great day.

Interesting article series, I wonder how long they can keep this up - end of June?