Non-bank gold buyers emerge driving January contract deliveries into record territory

The plebs are coming!

Jan 23, 2025 12:15

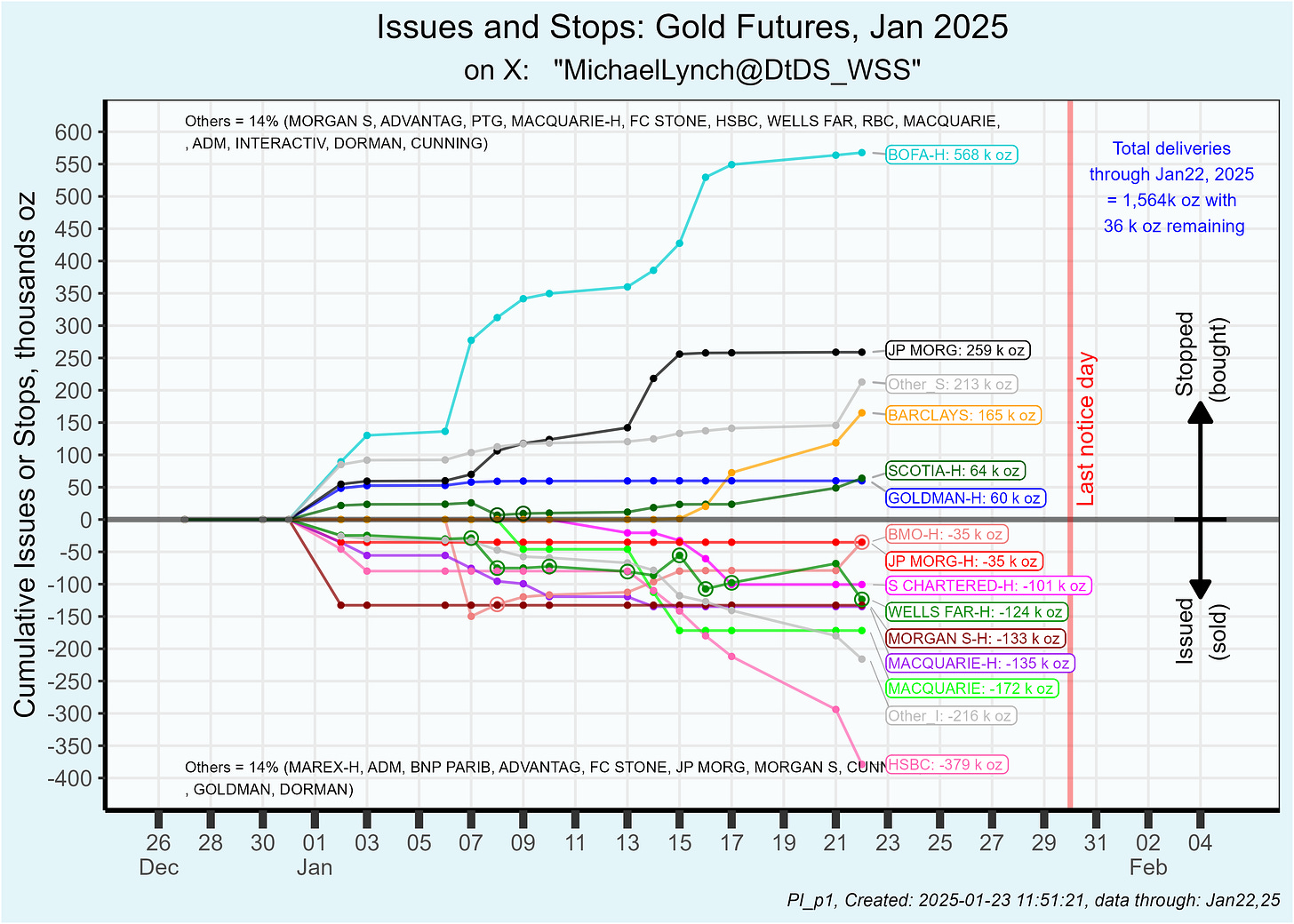

Deliveries on the January gold contract have blown past all prior inactive contracts since (at least) 2009. Deliveries now stand at 15,642 contracts (48.7 tonne) and are nearly as high as recent active month contracts. Furthermore, there are 6 trading days left on the contract and recent activity remains sizzling hot.

Most of the Jaunary contract rush has occured after first notice day. The cumulative net new contracts (since first notice day) plot is going exponential. The current cumulative net new total is 12,500. Yesterday’s (Jan 22) action had 1,766 new contracts. The rush for physical may, in fact, be on.

Recent activity is being driven by less familiar customer accounts. And furthermore, those specific customer accounts have not been active recently so this could signal a change in posture.

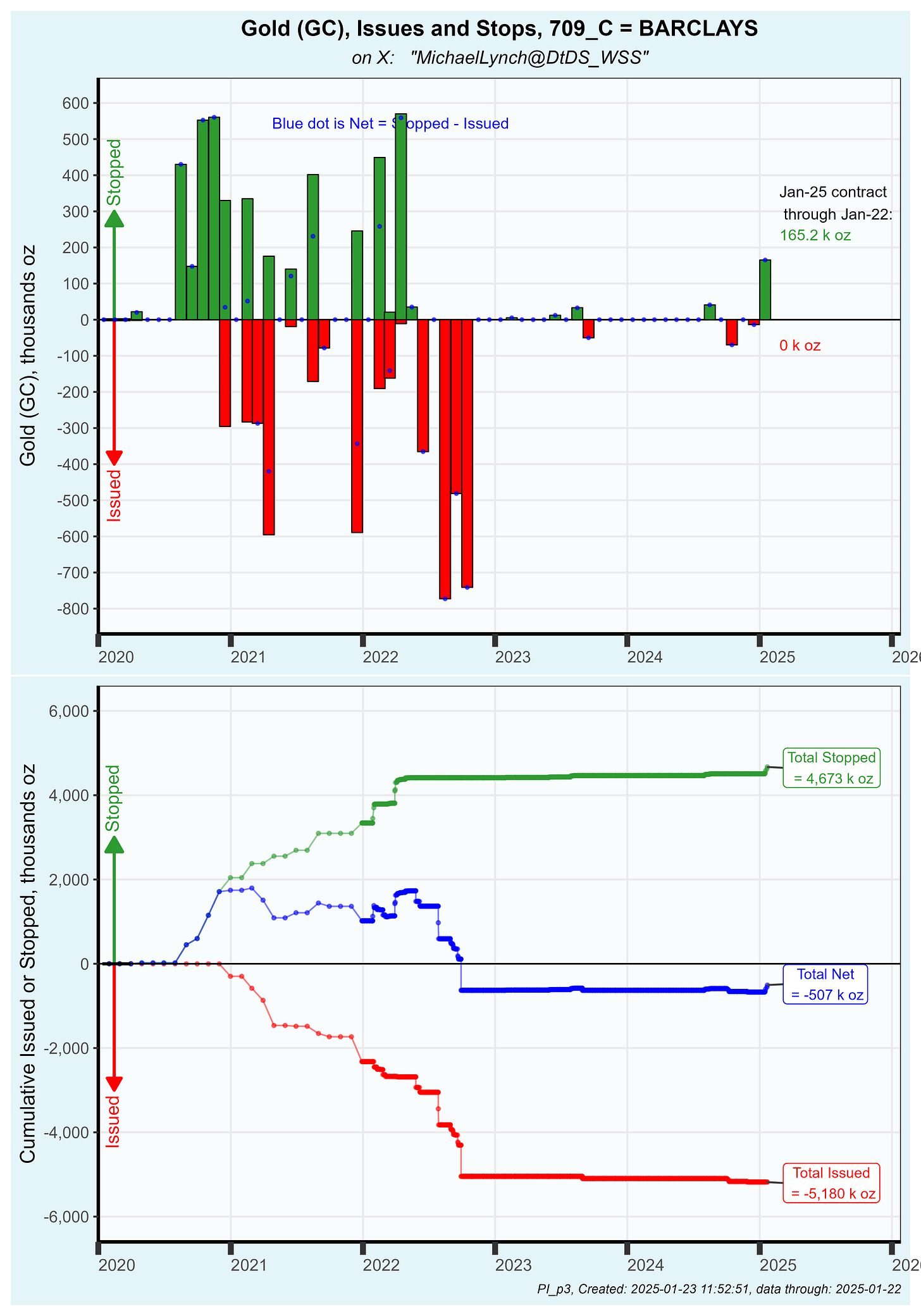

As an example, today’s report for yesterday’s trading had big buys by Morgan Stanley customers (643 contracts) and Barclays customers (465 contracts).

Earlier in the contract BofA was asserting it’s dominance and they remain the top buyer at 568,000 oz. JP Morgan customers have also been busy, which is not unusual, buying 259,000 oz. JP Morgan customers have only sold 17,100 oz, so buys outnumber sells by a factor of 15.

The biggest seller is … drum roll … HSBC customer accounts.

If you haven’t read my piece on “The Differential Lag Theory”, I suggest you catch up on that.

Examining the plebs … Barclays customer accounts haven’t bought this much gold since early 2022. Looking at their history below, they accumulated about a 1.5 million oz position over several months in late 2020, then flipped metal for about a year and a half, then sold it down. Is this the start of a seven figure oz repeat?

Not as dramatic is Morgan Stanley customers who have been net sellers for over a year. Perhaps the 86,600 oz gold buy so far on the January contract is a change in direction:

Looking at BofA … January’s haul is the largest buy for them in over 2 years. Although looking back, it seems that BofA has a standar buy of about 500,000 to 600,000 oz when they are buying. See the plot below.

BofA’s cumulative net has been treading water for about a year. Perhaps this is a change of direction.

At this hour (1:00 PM) volume is high, so there may be another surge in contracts on tomorrows report.

I’ll catch up on silver, the EFP debate, the vault changes and other topics in the coming days. I’ve been busy recently so I have to remember how to type.

It'd be quite revealing if someone knew who has stopped the majority of those BAC contracts.

Hang Seng Boys are selling for USD cuz they need the reserves cuz Russia needs USD's.

Admittedly an over simplification. But I'm an over simplified human.

Hope your absence has resulted in quality of life advances.

Glad you are back!! Real people buying (finally) is music to my ears. Hope the trend continues.