The HSBC "customer" account moves 3.1 million oz of silver into the vaults to expand their cumulative 48.7 million oz market dump.

So what's 50 million oz do at the tip of the spear? The Differential Lag theory in action?

Sept 11, 2024 4:30 PM

+++++++++++++++ Silver

That HSBC “customer” account I’ve written much about appears to be continuing to dump silver. On 5 of the last 6 business days, a truckload (+/- 600,000 oz) has moved into Asahi’s vault. And on the remaining day 129,000 oz moved into the vault. That 6 day total is 3.1 million oz averaging 516,000 oz per day. All of that went to eligible and not yet into registered.

Scrolling further back in time … on 18 of the last 40 biz days (starting July 17 through today’s report) a truckload or more has moved into Asahi’s vault. The 40 day total is 11.5 million oz averaging 288,000 oz per day. The 516,000 oz per day rate over the last 6 days is therefore further acceleration.

And FYI … I don’t believe anyone else chooses to vault at Asahi, so I’m comfortable linking all moves into eligible or registered to this HSBC “customer” account.

Asahi’s vault opened in early 2023. It is a rare occasion for new comex vaults to open. With the benefit of subsequent activity, it seems to have opened specifically for this one HSBC “customer” account. Furthermore, I’d add that it is odd that an HSBC customer wouldn’t vault at HSBC. Not sure if this switcheroo was meant to be a decoy … but it doesn’t take Sherlock Holmes to track these huge vault moves to names on the issues and stops report, especially when they happen on the same day for the same volume.

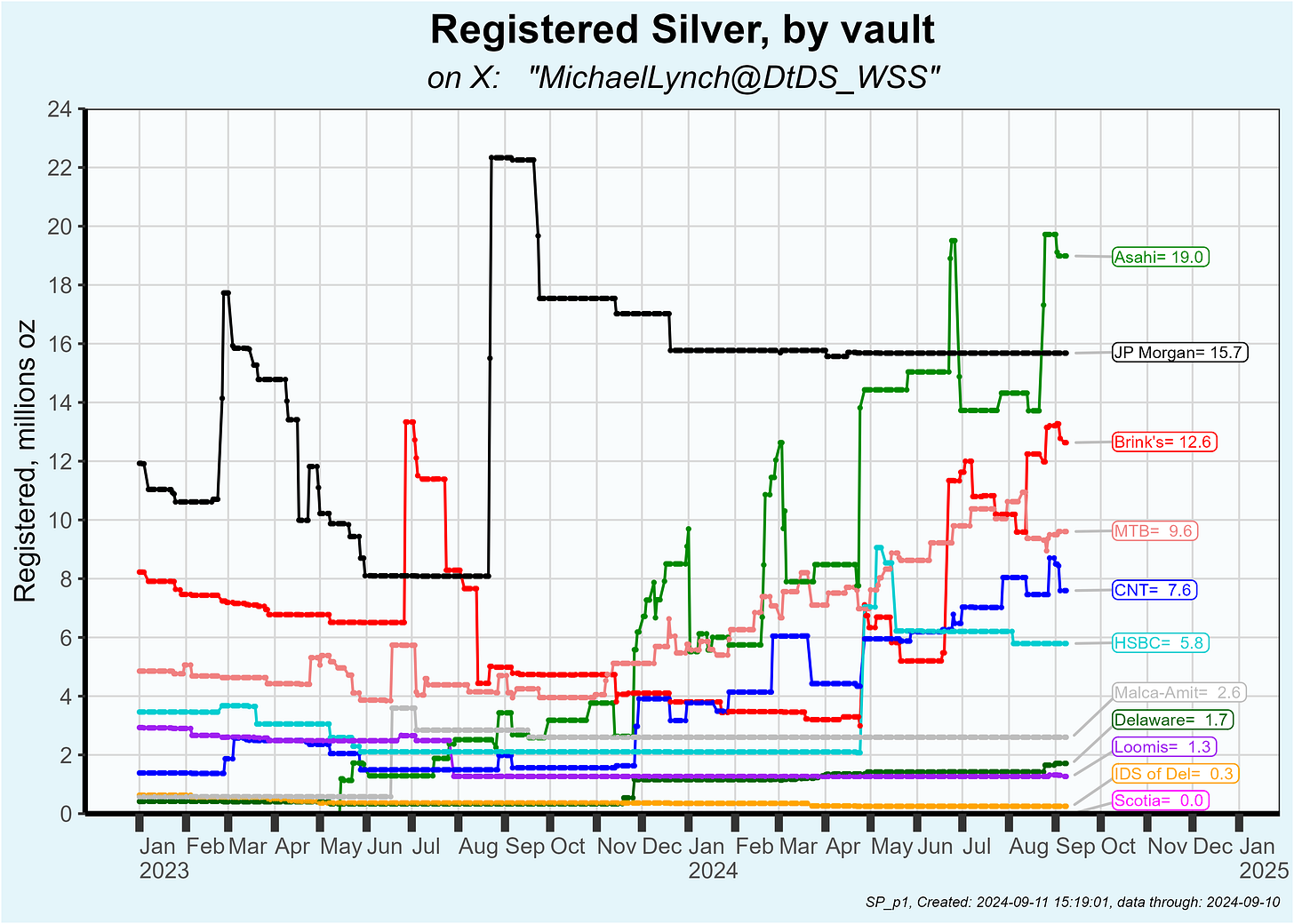

Based on total metal in the vault, Asahi’s vault now ranks #4 of the 10 comex vaults behind, JP Morgan, Brinks and Loomis:

Based on metal in registered, Asahi’s vault now ranks #1 recently eclipsing JP Morgan’s vault and now having 20% more.

Much of the metal in Asahi’s registered is not owned by that HSBC “customer” but is metal previously sold by that customer and not yet moved out of the vault.

The sales surge by this “customer” account started in Dec of last year. Since then delivery notices were issued by the “customer” on 48.690 million oz. Looking back from the inception of Asahi’s vault (May 2023) 48.171 million oz was moved into registered. The reason the numbers don’t match exactly is that on some occasions that HSBC “customer” issued delivery notices from MTB’s vault.

A total of 56.743 million oz was moved into Asahi’s vault and the inference is that the HSBC “customer” may have about 8.6 million oz in Asahi’s vault (56.743 less 48.171 already moved to registered).

It appears that the “customer” has it’s supply worked out and that has NOT always been the case. There was one occasion where I documented BofA bailing out the “customer” late in the delivery period when they didn’t have silver to deliver.

Plus, a peek at this month’s issues and stops shows that the HSBC “customer” issued all of their delivery notices on day 1 and that is a signal of a short who has metal ready to deliver.

Once again, the “customer” was the biggest seller at comex silver:

What is that remaining 8.6 million oz slated for? Not the contract currently in the delivery period (Sept). It is likely for later contracts. How do I know that? At this morning’s open, OI on the Sept contract was 67 (335,000 oz) so the “customer’s” stack isn’t meant for the Sept delivery period.

The net of all this is … the HSBC “customer” dump will continue. In fact, it may accelerate. If you missed my earlier piece on the significance of that …

It’s going to be epic